While the public markets continue to reward growth that comes with a not-too-high burn rate, the private markets remain enamored with growth, full stop.

Subscribe to the Crunchbase Daily

Underscoring that point, zero-fee stock trading service Robinhood is in the news this week for raising more capital at a higher valuation. Indeed, The Information reports that Robinhood is “nearing the close of a funding round from existing investors at a valuation of between $7 billion and $8 billion.” The same article goes on to state that the round could be a mere “prelude to a much bigger round of funding it has discussed with a wider group of investors, which could value the company at over $10 billion.”

So Robinhood is going to raise again, at a higher valuation, about a year after it last raised. And then it might raise again at an even higher valuation.

To understand if this makes any sense, let’s rewind the clock a bit and remind ourselves how Robinhood got to today.

History

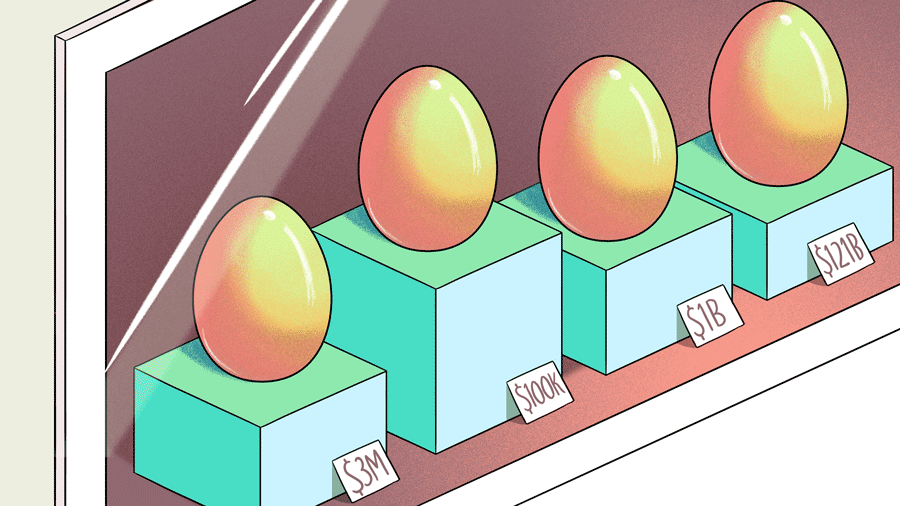

In December 2013, Robinhood raised a $3 million Seed round led by Index, according to Crunchbase data. That was quickly followed up by a September 2014 Series A of $13 million, also led by Index. The company’s Series B landed in May 2015, adding $50 million to Robinhood’s accounts. But the firm was hardly done raising more money.

Indeed, its April 2017 $110 million Series C valued the firm at around $1.3 billion, post-money. Just over a year later, Robinhood snagged $363 million in the form of a Series D that valued it at about $5.6 billion.

Thinking about this as a whole, it’s worth noting that 2016 is the only year Robinhood didn’t raise. That makes news of its possible Series E and its new valuation of up to $8 billion reasonable in terms of pace. Furthermore, it makes another round at a $10 billion valuation somewhat grokkable.

What’s notable for us is that we can now get our hands around what $10 billion in unicorn value looks like, thanks, in part, to Slack.

The Slack Comparison

For example, Slack raised its Series H in August of 2018. That $427 million in capital valued the workplace productivity service in the realm of $7.1 billion. Now, Slack has grown a lot since then, so its worth may have grown.

But in the quarter that included August 2018, its fiscal third of 2018, we know a few things about what Slack was doing at the time in terms of revenue, growth, and profits. Here’s what happened in the Slack’s quarter ending Oct. 31, 2018 per its S-1:

- Top line: $105.6 million in revenue.

- Growth: Revenue up 81 percent year-over-year, and 14.1 percent sequentially.

- Revenue quality: 87 percent gross margins, largely recurring top line.

- Profit: -$47.7 million ($10.5 million of which came in the form of share-based compensation).

Slack was scaling its sales and marketing spend at the time, so its net loss looks pretty steep. But if you are growing over 10 percent sequentially at $100 million quarterly revenue scale, you’ll get a pass from worried investors—especially if you are as well capitalized as Slack was.

Not (Entirely) Alike

All this is to raise some general scale comparisons for the current value of Robinhood. Obviously, differences abound: Slack sells recurring software tools to other companies on a recurring basis; Robinhood drives revenue by selling order information, providing select investment tools, and a subscription service that provides certain advanced features to power users. That makes Robinhood’s revenue, I think, not recurring.

So on a per-dollar revenue basis, Slack is probably more valuable, as it has both high gross margins and revenue recurrence. Continuing with that thought, if Robinhood is as big as Slack today at a $7 billion to $8 billion valuation it might be overpriced given the recurrence discrepancy.

Turning to Robinhood at $10 billion, let’s say for a moment that Slack is worth that much now. We don’t know how its direct listing will go, but it seems unlikely that a company with as much growth inside of it won’t see valuation appreciation in the time since its last raise. So, if Slack is worth $10 billion, what numbers would power that valuation?

Its most recent quarter will include revenue of around $134 million, up 66 percent, and losses of around $38 million, according to ranges provided in its most-recent S-1/A.

Slack is improving its profit margins while still growing quickly. It’s a nice company, really. A bit more unprofitable than expected, but still very good. Can Robinhood in its current form measure up, given that it is shooting for a similar-ish valuation?

Is there some revenue growth at Robinhood that we’re missing? Perhaps! If so, then all this speculation was an exercise in performative conservatism. But at the same time, it’s worth remembering what was worth $7 billion late last year to help us ground ourselves when a new company reaches for a similar price tag.

Now go outside and have fun on the holiday weekend!

(For fun, duck into the last time we ran this exercise.)

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a man sitting on a huge pile o' money. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Giant_Funding-470x352.jpg)

![Illustration of toast with $ toasted in. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Forecast-dollar-sign-300x168.jpg)

67.1K Followers