By Healy Jones

The VC bubble has subsided and last year marked one of the most difficult on record to raise a Series A funding round.

As interest rates climbed and global uncertainty became pervasive, the growth-at-all-cost mindset evaporated and investors pivoted rapidly to favoring startups with strong revenue, capital efficiency and strong gross margins. This left a lot of companies in the wind with 2023 seeing the highest number of startup bankruptcies in a decade.

At Kruze Consulting, we work with more than 800 startups and their founders to help them navigate everything from bookkeeping to getting prepared for funding rounds and due diligence.

At the end of the year, I wanted to find out what separated seed-funded startups that were able to raise a Series A with their peers that folded in 2023.

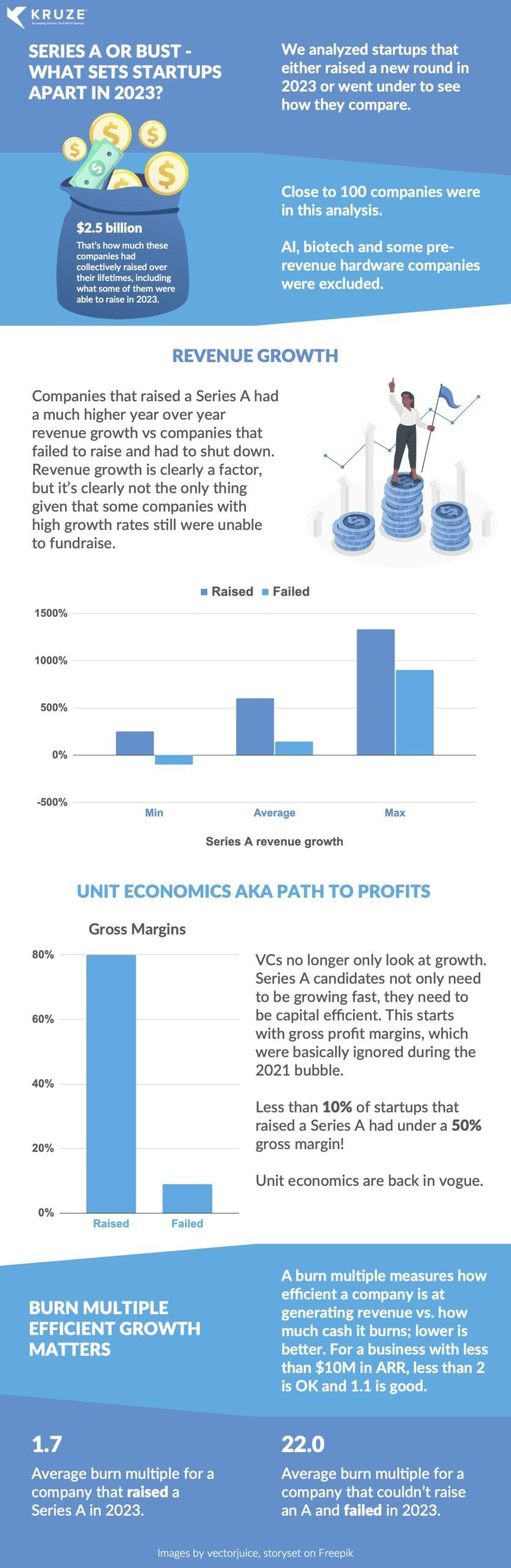

The analysis that I’m about to present looks at data from about 100 seed-funded startups that tried to raise a Series A in 2023 — comparing those that were successful with those that failed and subsequently went under.

AI startups, biotech startups and the like were removed from the analysis. The results reflected the shift in sentiment the ecosystem felt last year and should be seen as the new normal for founders.

So, what were the key metrics that differentiated between these two groups?

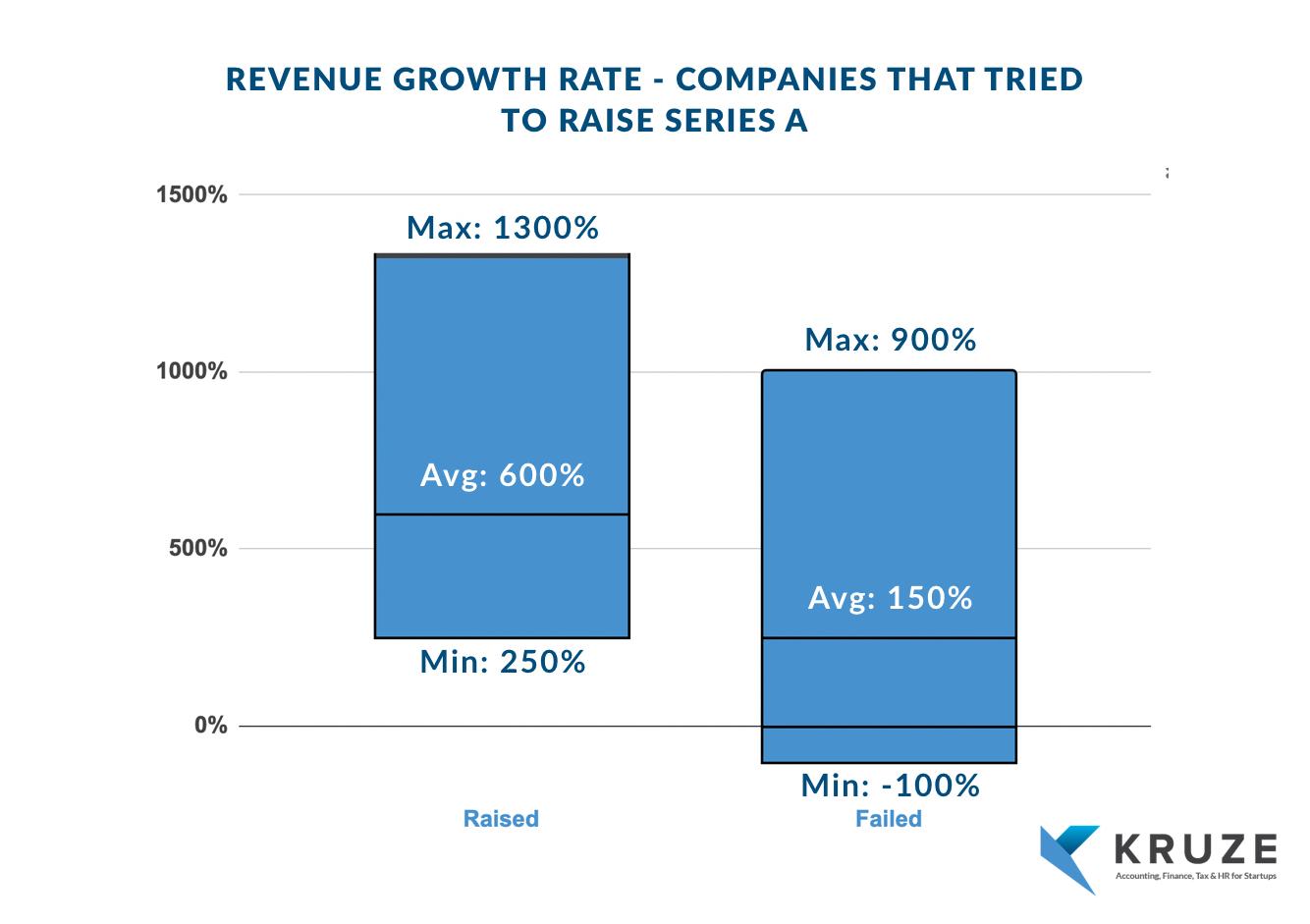

Revenue growth still matters

Revenue growth is, as always, a prominent signal. All of the companies that managed to raise were growing revenue on average at 4x the rate of those that closed shop. However, there were many startups with impressive revenue growth that were still unable to raise a Series A.

Investors value more than revenue growth

To that end, gross margin on that revenue was another clear distinction between companies that raised and those that failed. About 90% of startups raising a Series A in 2023 had an over 50% gross margin, with the average of the successful companies being 80%.

Again, the growth-at-all-cost mindset went by the wayside as investors only deployed capital into businesses that were generating high-margin revenue growth.

And those strong unit economics at the top line flowed through to the bottom line as well, with companies that closed a Series A showcasing an average burn multiple of just over 3x, whereas companies that failed were 10x worse. Only founders who had capital efficiency at the forefront were able to close that next round.

The past year was full of hard-earned lessons for founders and reset the standards for venture-backed startups. It all happened very quickly, and many businesses that didn’t have these metrics at the foundation of the business from the beginning were not able to turn the battleship in time.

Healy Jones is a vice president at Kruze Consulting, where he spends his time advising startups on the intersection of their strategy, financing and projections. Previously, he held finance and marketing roles with several startups, and has been an investor at multiple venture capital funds.

Related reading:

- US Seed Investment Actually Held Up Pretty Well For The Past 2 Years. Here’s What That Means For 2024

- Lower Valuations, Higher Bar: What It’s Like To Raise A Seed Round In 2024

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of blender with random icons and M&A buttons. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/MA_blender-470x352.jpg)

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers