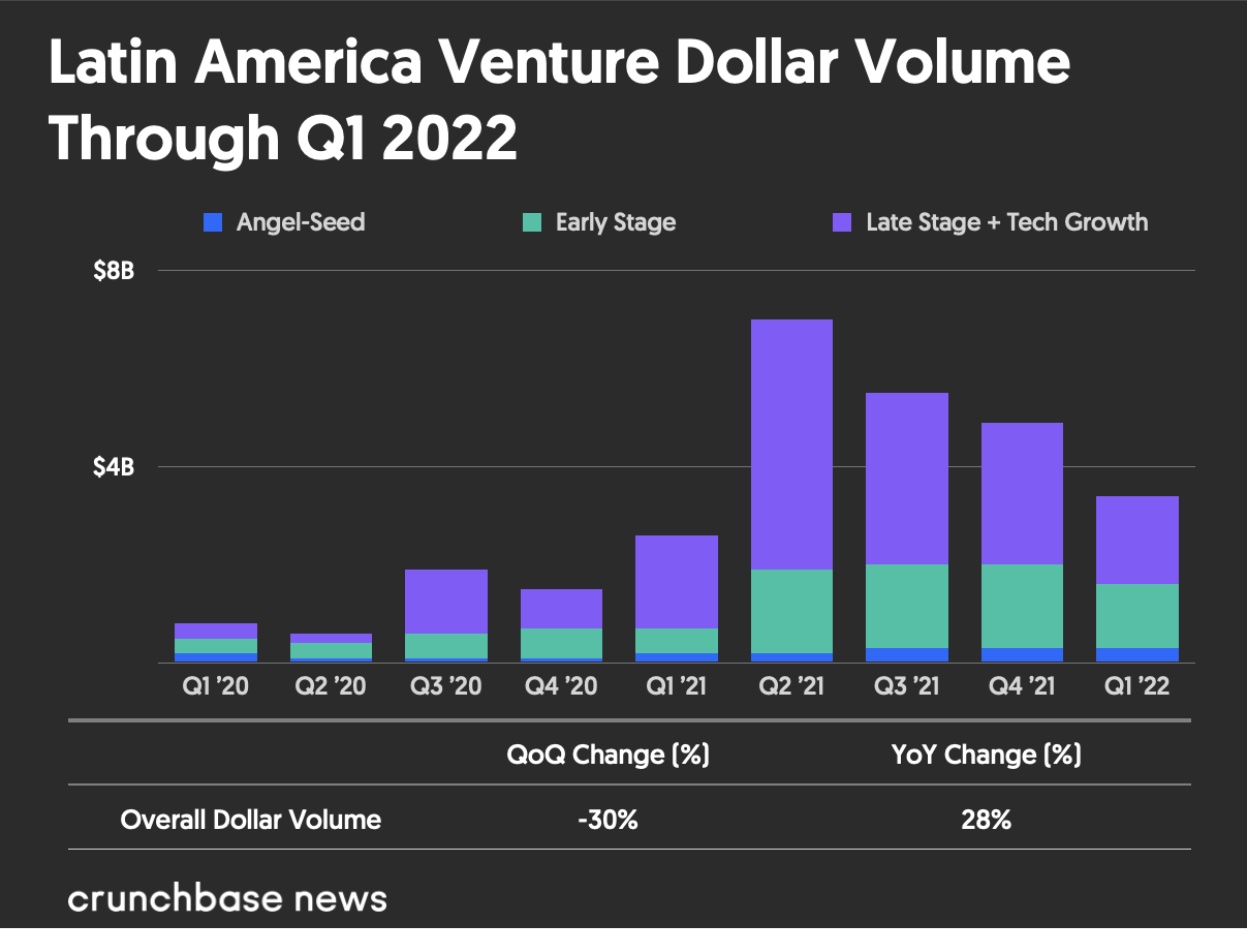

After an unprecedented run-up, venture funding to Latin American startups fell in the first quarter of this year.

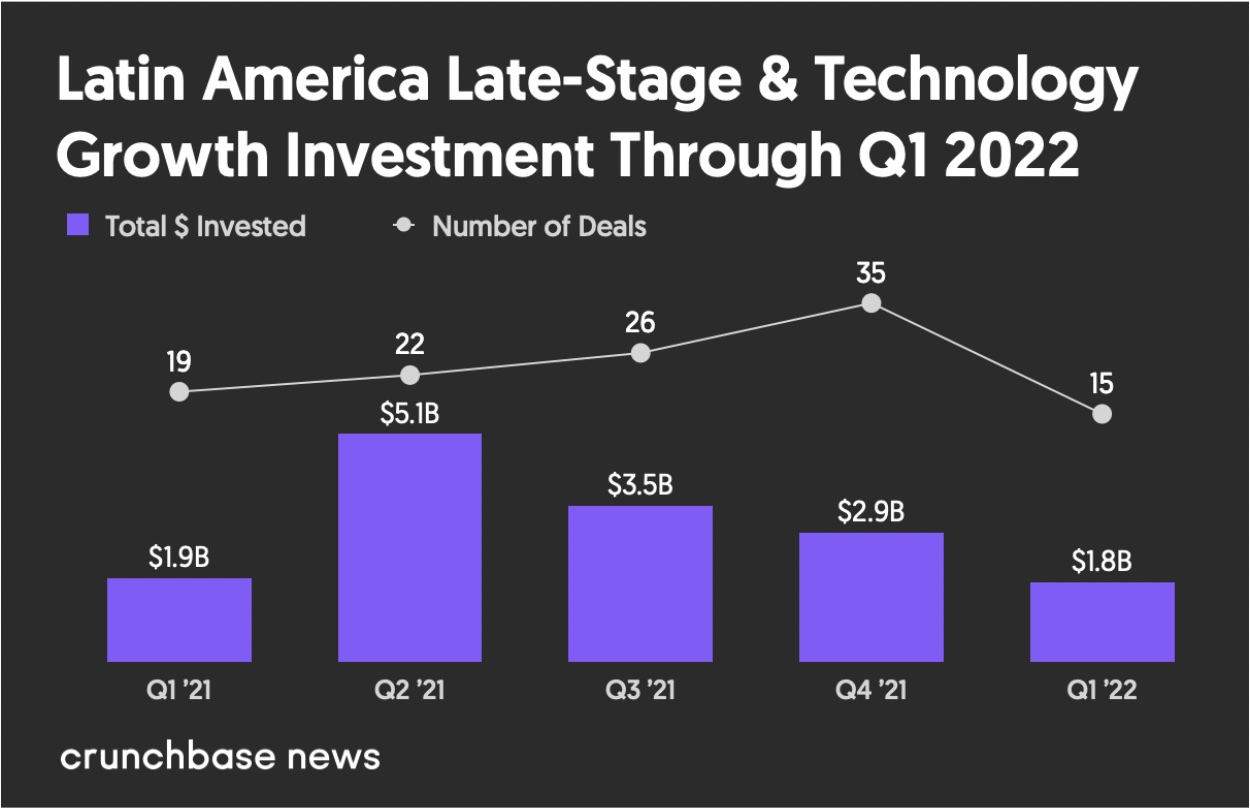

Overall, investors put $3.4 billion into funding rounds in Q1 of 2022—down 30 percent from Q4 2021. Round counts also fell, with later-stage posting the sharpest drop at just 15 reported rounds, down from 35 in Q4.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Nonetheless, by historical standards, the Latin American startup scene is still running hot. Even with the quarter-over-quarter decline, total investment for Q1 is 28 percent higher than the year-ago quarter. For perspective, we lay out funding totals for the past five quarters below:

Late stage fell

What to make of the numbers? Well, first off, it should be emphasized that we are coming off record highs.

Latin America ranked as the fastest-growing region in the world for venture funding in 2021. Over the course of the year, venture and technology-growth investors poured an estimated $19.5 billion into the region, per Crunchbase data. That’s more than triple prior year levels, which were themselves record-setting.

Most of the rising investment went to late-stage rounds, with valuations rising in tandem. Brazil and Mexico alone count 25 unicorns between them, per Crunchbase data, and the region’s population of ultra-high valuation populations grew briskly between 2020 and 2021.

For a broader view, we look at late-stage round counts and investment totals over five quarters below:

To see a Q1 late-stage contraction in Latin America isn’t entirely surprising. Globally, later-stage investment has been on the decline, with Q1 totals down from Q4 highs, and the number of newly minted unicorns lower.

A large portion of Latin America’s late-stage investment comes from firms headquartered overseas. And the region is not insulated from factors impacting other markets, including a weak IPO environment and heightened pressure on lofty private valuations.

Still, we did see some big rounds at late stage in Q1, including a $300 million Series D for Brazil-based digital bank Neon, and a $260 million Series F for Brazilian consumer loan provider Creditas.

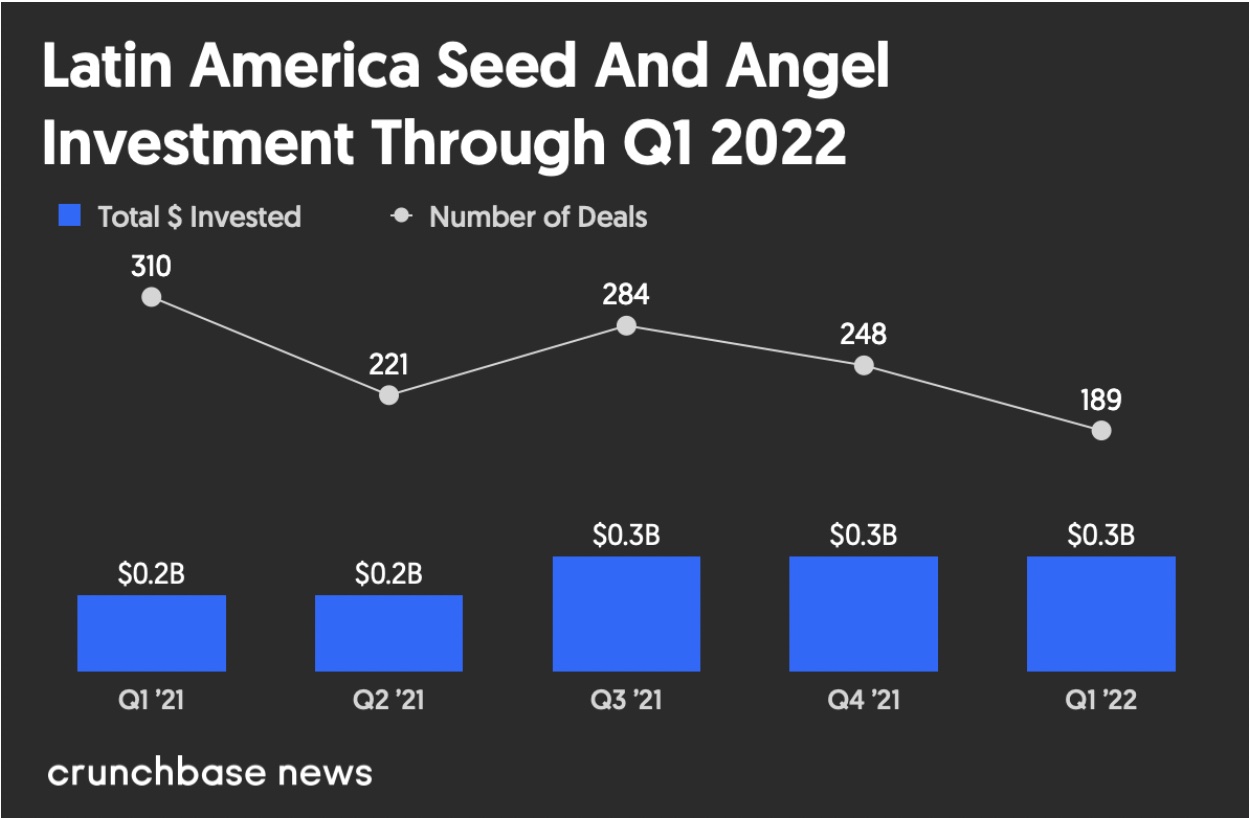

Seed stage grew

While the unicorn scene has cooled some this year, funding at the very earliest stages remains quite robust.

Seed and angel investment held up at around $300 million in Q1—roughly on par with the prior two quarters. For context, we look at reported round counts and investment totals for the past five quarters below:

The numbers match how Wenyi Cai, founder and CEO of Colombia-based startup backer Polymath Ventures, describes the funding scene for the very earliest-stage startups. While unicorn valuation inflation may be a worry at the late stage, seed dealmakers still are busy as ever.

“At pre-seed, seed and Series A, where we’re more familiar, I would say there’s still a lot of strength in the market,” Cai said in an interview. She’s bullish on growth prospects across a range of sectors, including e-commerce logistics, fintech infrastructure and social commerce.

In particular, Cai and other seed-stage investors continue to see tremendous opportunity building services for Latin America’s large and underserved middle class. Mobile-centric platforms are top of mind in the consumer space, with startups scaling up in areas ranging from retail to real estate to fintech.

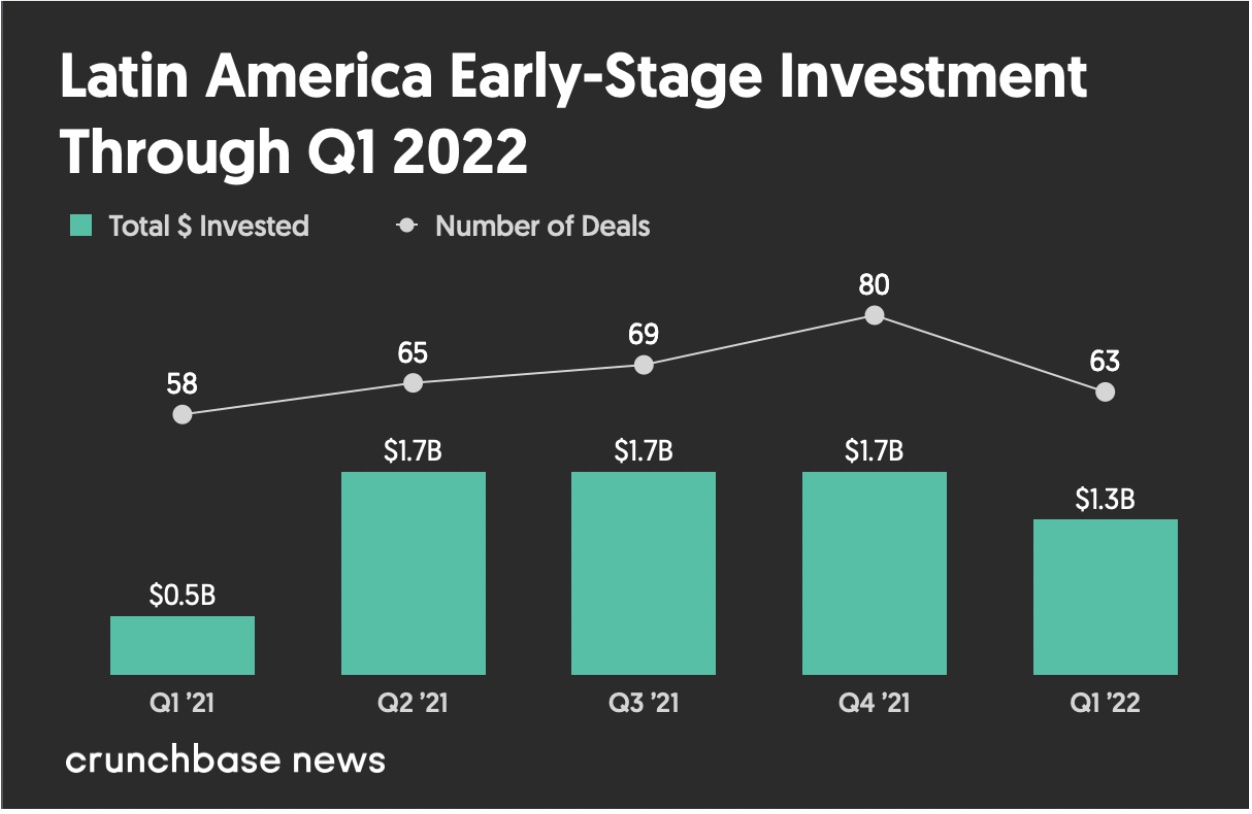

Early stage

Early-stage (Series A and B) funding totals were also down in Q1 relative to the prior three quarters. However, the $1.3 billion invested in the first quarter of 2022 is still 160 percent above the year-ago total, so the notion of decline is somewhat relative.

We map out the ups and downs over the past five quarters below:

While a typical early-stage deal is around $15 million, there were a few examples of much bigger rounds in Q1.

The largest was a $181 million Series B for Colombia-based Tul, a provider of a mobile app that lets users buy hardware and construction products from local merchants. That deal, Cai said, is exemplary of a broader hot trend in venture funding focused on platforms that serve small and independent Latin American businesses.

The next-largest round was a $112 million Series B for Solides, a Brazilian developer of human resources software aimed at increasing productivity and reducing turnover costs.

The road ahead

Overall, the latest numbers out of Latin America probably won’t turn the region’s startup bulls into bears, or vice versa.

Investment totals don’t go up every single quarter, so seeing some pullback isn’t necessarily alarming, particularly when one considers how quickly and dramatically funding scaled up. Seed also looks healthy, indicating there’s continuing appetite to back promising entrepreneurs at the riskiest stage of startup development.

However, as Cai observes, the unicorn herd is likely to see some culling. While those with a history of operating lean should do OK, she says, other high-valuation startups will need to pare back costs to make it through what looks like a tougher late-stage fundraising environment.

Methodology

The data contained in this report comes directly from Crunchbase, and is based on reported data. Data reported is as of April 4, 2022.

Note that data lags are most pronounced at the earliest stages of venture activity, with seed funding amounts increasing significantly after the end of a quarter/year.

Please note that all funding values are given in U.S. dollars unless otherwise noted.

Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Glossary of funding terms

Seed and angel consists of seed, pre-seed and angel rounds. Crunchbase also includes venture rounds of unknown series, equity crowdfunding and convertible notes at $3 million (USD or as-converted USD equivalent) or less.Early stage consists of Series A and Series B rounds, as well as other round types. Crunchbase includes venture rounds of unknown series, corporate venture and other rounds above $3 million, and those less than or equal to $15 million.

Late stage consists of Series C, Series D, Series E and later-lettered venture rounds following the “Series [Letter]” naming convention. Also included are venture rounds of unknown series, corporate venture and other rounds above $15 million.

Technology growth is a private-equity round raised by a company that has previously raised a “venture” round. (So basically, any round from the previously defined stages.)

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of "clicking" on an AI brain {Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/AI_Brain-470x352.jpg)

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers