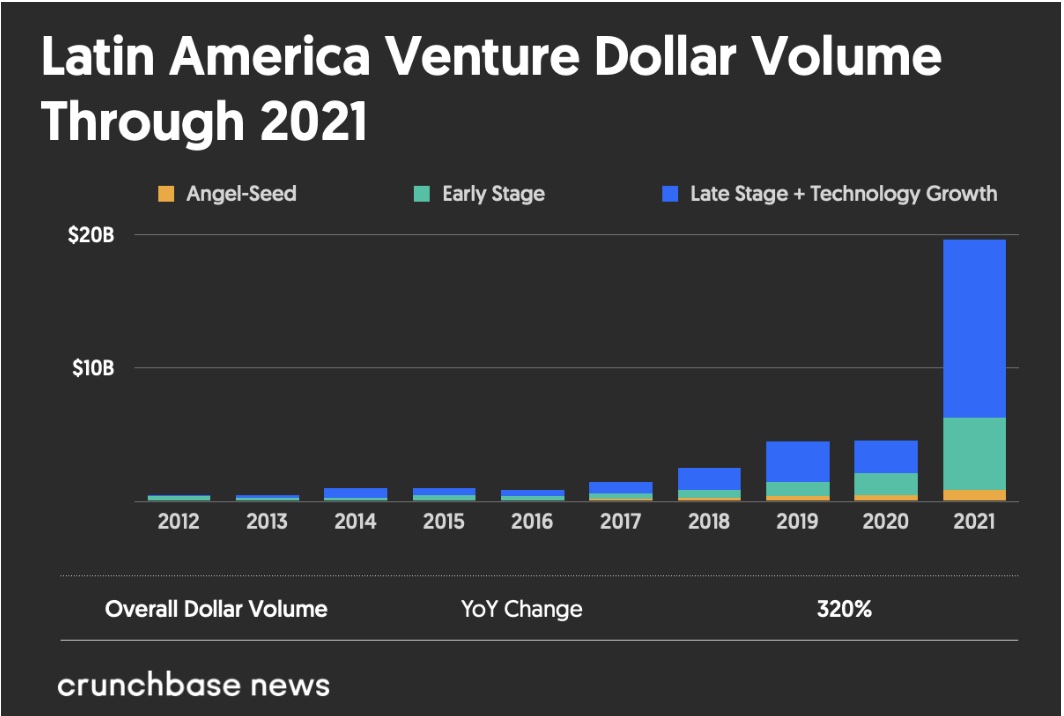

For Latin American startups, 2021 was an extraordinary year on the funding front. Venture and technology growth investors poured an estimated $19.5 billion into the region, per Crunchbase data. That’s more than triple prior year levels, which were themselves record-setting.

By global benchmarks, it was a particularly impressive showing. Latin America was the fastest-growing region in the world for venture funding in 2021, according to Crunchbase data for the six largest geographies.1

We’re not seeing signs of a slowdown either. In just the first two weeks of this year, Latin American startups pulled in over $450 million, according to Crunchbase data. Investors in the region, meanwhile, are optimistic that tallies will keep rising.

“You’re definitely going to keep seeing acceleration,” said Pedro Muller, Latin America-focused seed investor at Prodigio Capital, who points to several factors leading the boom. These include greater participation from foreign investors, a growing pool of experienced startup entrepreneurs, and the huge market opportunity providing services to Latin America’s growing middle class.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Below, we take a closer look at funding to the region, focusing on annual funding totals, latest quarterly numbers, largest rounds and major exits.

A record-breaking year

While venture funding to Latin America has been steadily on the rise for the past decade, investment accelerated dramatically in 2021. We take a look at funding totals, color-coded by stage, in the chart below:

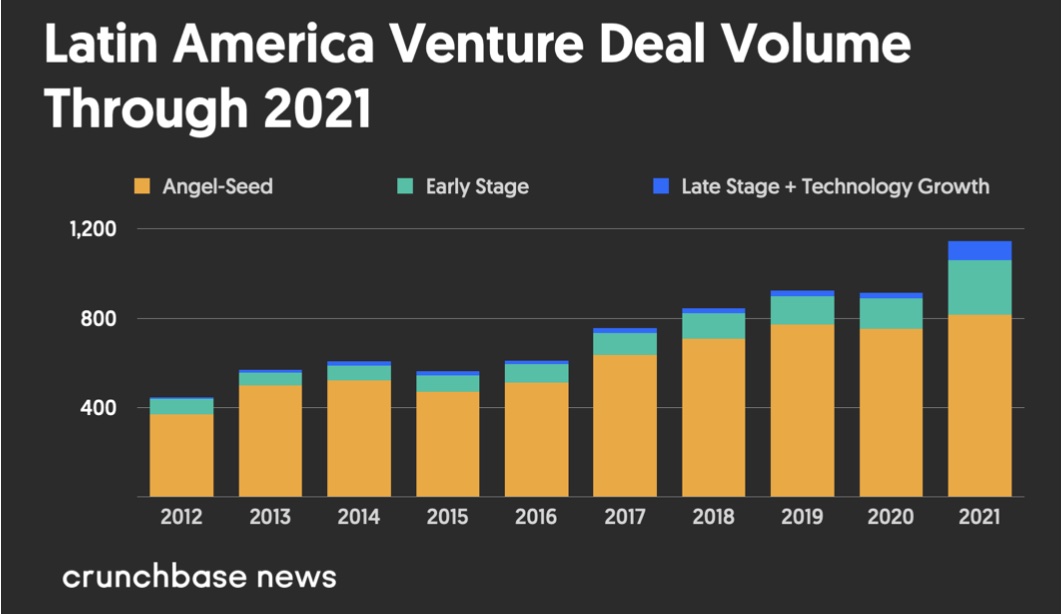

Deal counts were also up in 2021, albeit less dramatically. Below, we look at deal volume, color-coded by stage, for the past 10 years. As you can see, there’s a longtime pattern of steady gains:

Late-stage led

The surge in 2021 funding was largely driven by late-stage rounds. Overall, $13.3 billion went to late-stage deals—more than two-thirds of total funding.

The sharp rise in late-stage was mostly driven by bigger rounds, not more of them. While deal counts were up, the standout trend was the emergence of a steady stream of so-called supergiant funding rounds of $100 million or more.

A handful of ultra-large rounds boosted those totals. Some of the biggest include:

- Nubank, the Brazil-based online challenger bank, raised $750 million in pre-IPO financing in June before carrying out its public offering in December;

- Nuvemshop, a provider of tools for Latin American businesses to set up and manage their online operations, raised $590 million in Series D and E funding rounds in 2021;

- Rappi, a Colombia-based provider of fast delivery services across much of Latin America, raised $500 million in a Series F tranche in July; and

- Loft, a São Paulo-based online marketplace for residential real estate, raised $525 million in Series D funding last year.

As for favored industries, fintech remains the standout, though other sectors also had a big year for dealmaking.

“Fintech has long been the biggest sector of investment for us, but e-commerce has really made a strong comeback,” said Julie Ruvolo, head of venture capital at the Association for Private Capital Investment in Latin America (LAVCA). In addition to vertical marketplaces in sectors like pet food and groceries, the region has also seen a wave of brand aggregators raising big rounds.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

With larger fundraises come higher valuations. Latin America now has at least 27 known unicorns, or private companies with valuations of $1 billion or more, per Crunchbase data. We also saw one of the most anticipated unicorn exits to date as Nubank made its NYSE debut in December, maintaining a recent market cap around $35 billion.

Earlier stages also outperformed

Early- and seed-stage dealmaking was also on a tear.

A whopping $5.5 billion went into early stage (Series A and B) in 2021, up from $1.6 billion in 2020, per Crunchbase data. Year-over-year gains resulted from a combination of rising deal counts and a number of really big early-stage rounds.

On the deal count front, we recorded a total of 242 Series A and B rounds in 2021, up from 136 in 2020. Brazil was the top destination for funded companies, followed by Mexico, Colombia, Chile and Argentia.

A handful of really big early-stage rounds also pushed up the totals. Recipients of the largest Series B rounds for 2021 include payment tech provider EBANX ($430 million), delivery app Daki ($260 million) and crypto exchange Mercado Bitcoin ($200 million). Mexico City-based e-commerce brand aggregator Merama, meanwhile, raised $345 million in Series A and B financing last year.

As early-stage companies graduated to larger rounds, seed and angel investors made sure the supply of fresh startups stayed plentiful. Crunchbase estimated seed funding for the region at around $900 million for 2021–up markedly from an estimated $500 million in seed funding for 2020.2

Valuations are up at the seed stage as well, said Muller, noting that he just saw a pre-product startup in Brazil raising at a $30 million valuation. “That’s something we haven’t seen ever before,” he said.

The case for more growth ahead

Startup founders and investors are by definition big believers in the potential of tech-driven innovation to scale massive new businesses. So, it’s not surprising to hear bullish projections for coming quarters.

But, innate optimism aside, they do make a compelling case for Latin America’s enduring appeal for the venture crowd.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Prodigio’s Muller points to the maturity of talent as a big driver for startup activity. Whether it’s Latin American founders with Silicon Valley ties returning to their native countries to launch startups or alums of regional unicorns setting out on their own ventures, the pipeline of experienced entrepreneurs does look to be expanding.

Muller is also keen on the potential for startups to provide a host of products and services for Latin America’s growing middle class. Consumers in the region, he said, have long been underserved in categories from financial services to infrastructure to commerce.

Valuations reflect a sky’s the limit vibe. Between 2019 and Q3 of 2021, the average early-stage round size roughly tripled, per LAVCA data.

But as Ruvolo observes: “We can’t look at valuations in a vacuum.” The numbers are rising because investors are seeing strong revenue growth and realized potential for really big exits.

Further reading

- Global Venture Funding And Unicorn Creation In 2021 Shattered All Records

- North American Startup Funding Scaled Unprecedented Heights In 2021

- Venture Funding In Asia Shatters Record For Year And Quarter—Thanks In Large Part To China

- Europe’s Unicorn Herd Multiplies As VC Investment More Than Doubled In 2021

- SoftBank, Tiger Still Lead Pack Of Spendiest Startup Investors In The World

- Europe’s Most Active Startup Investors In 2021 Hail From Across The Globe

Methodology

The data contained in this report comes directly from Crunchbase, and is based on reported data. Data reported is as of Jan. 10, 2022.

Note that data lags are most pronounced at the earliest stages of venture activity, with seed funding amounts increasing significantly after the end of a quarter/year.

All funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Illustration: Dom Guzman

Crunchbase tracks funding across six regions globally: North America (U.S. and Canada), Latin America, Asia, Europe, Africa and Australia/South Pacific.↩

Because seed deals commonly get reported late or are not captured in the database, it’s best to view these numbers as broad estimates, likely to be revised over time.↩

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of pandemic pet pampering. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/03/Pets-2-300x168.jpg)

67.1K Followers