We don’t use many exclamation points when writing about startup funding. But the 2021 North American annual tallies require at least a few.

In short: It was a really big year for funding! Really, really big!! It was record-setting big, and not by a small margin!!!

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

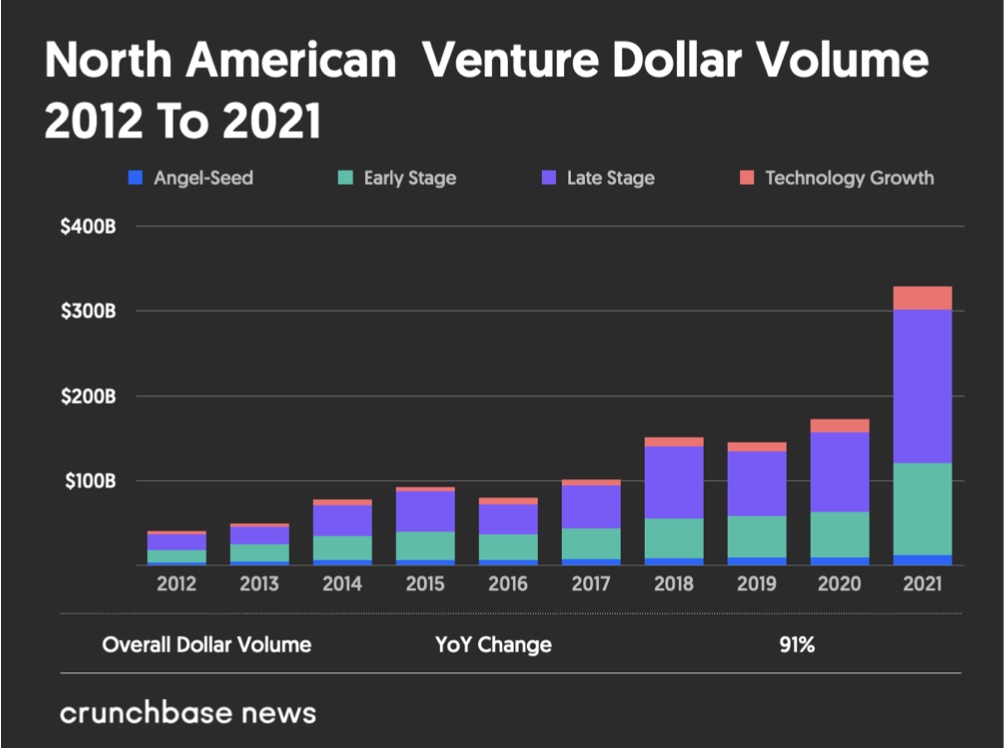

Over the course of 12 months in 2021, investors put $329.5 billion (!!) into startup investments across all stages, per Crunchbase data. That’s an increase of 92 percent from 2020 levels, which were themselves record-setting.

The year ended on an up note too, with fourth-quarter investment totalling $88.9 billion across stages, making it both the spendiest quarter of the year and the highest in the history of the Crunchbase dataset.

Table of contents

North America overall

Overall venture investment nearly doubled year over year in 2021, capping off roughly a decade of mostly steady increases in funding. For perspective, here are the annual funding totals, color-coded by stage, for the past 10 years:

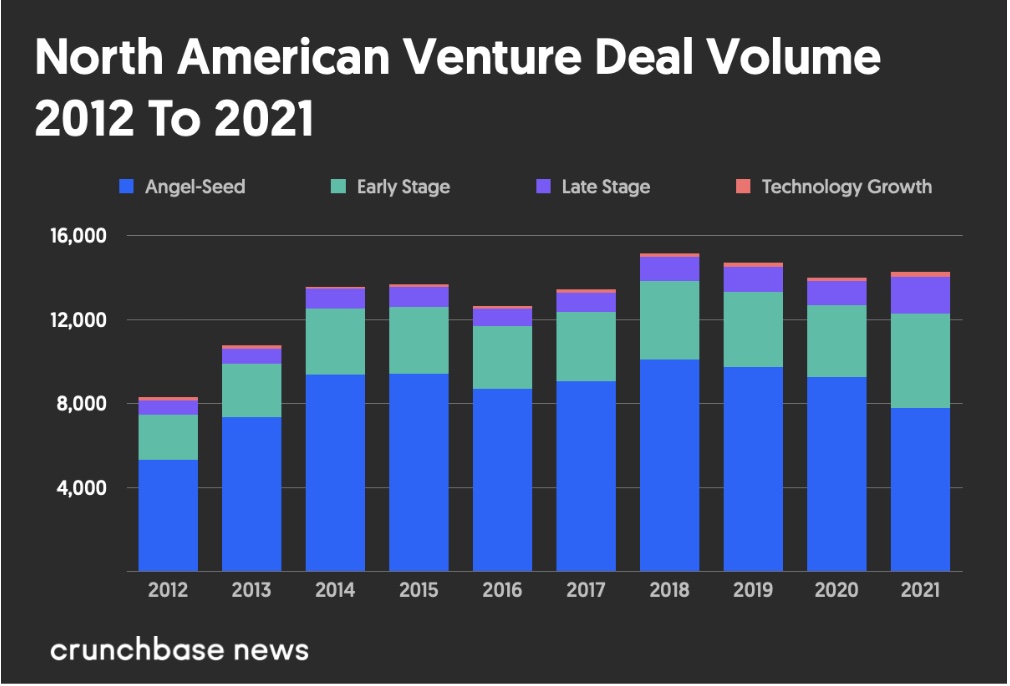

In case you were wondering, the surge in investment was driven by bigger deals, not more of them. The number of completed rounds in 2021 was roughly flat with those of 2020. As illustrated in the chart below, deal count has stayed reasonably stable in the past few years, even as funding totals skyrocketed:

The fourth quarter also blew past prior benchmarks, as funding soared. Every stage of investment, from seed through technology growth, was up in 2021. Supergiant rounds proliferated, and more new unicorns were minted than ever before as companies in a broad array of industries crossed the $1 billion valuation mark.

It was also a strong year for exits, as marquee names tapped the IPO market, large M&A deals accumulated, and more companies took the rocky but increasingly popular SPAC route to market.

Below, we look at the tallies by stage, highlight some of the largest funding recipients, and take a look at the top exits driving returns.

Late-stage funding

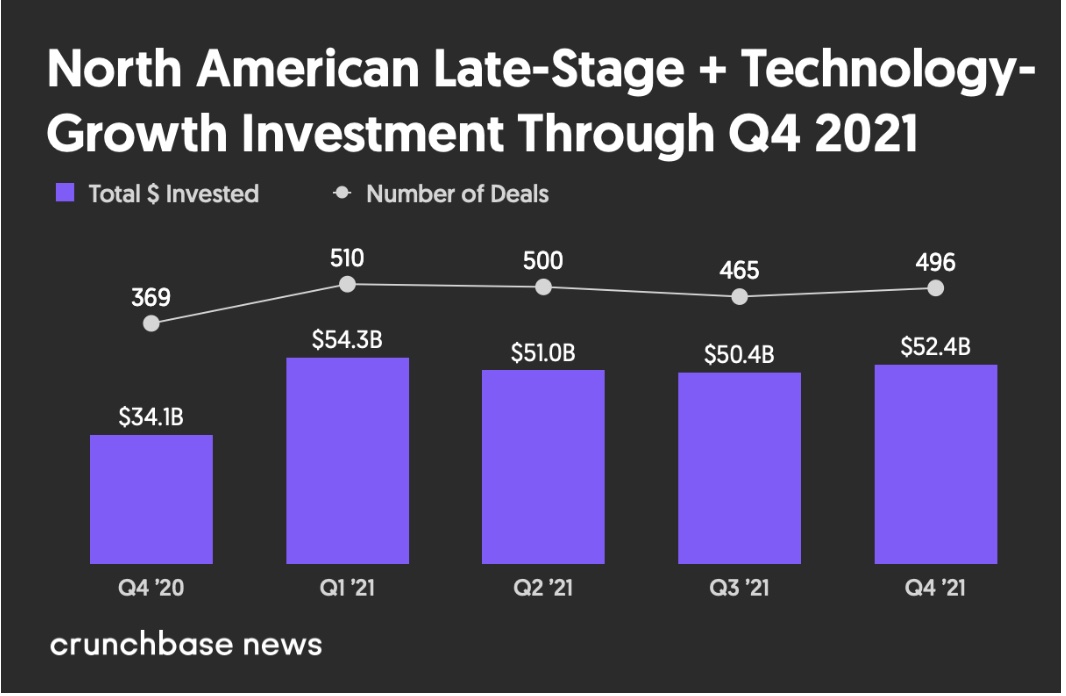

Late stage accounts for the largest share of venture dollars across any stage, so we’ll start there.

An astounding $208 billion went into late-stage and technology-growth investment rounds in 2021. That’s up 91 percent from the 2020 tally of $109 billion and the highest total we’ve seen to date.

Round counts ticked up as well, with nearly 1,971 known late-state and tech-growth deals in 2021, up nearly 50 percent from the prior year. In the chart below, we lay out funding totals and round counts for the past five quarters.

The fourth quarter boasted the second-highest funding tally of 2021. This was driven by a concentration of the kind of giant startup funding rounds that once raised eyebrows but now are a seemingly everyday occurrence. Some of the largest funding recipients included:

- Lacework, a provider of automated cloud security, raised $1.3 billion in its Series D round;

- Devoted Health, provider of health care plans for seniors, picked up $1.15 billion in Series D funding;

- Thrasio, an aggregator of consumer brands that sell on Amazon, raised $1 billion in Series D funding; and

- Airtable, a workflow management platform, raised $735 million in Series F funding.

Rounds in the multiples of hundreds of millions, meanwhile, were pretty commonplace. For late-stage venture rounds (Series C and beyond), Crunchbase tallied at least 29 financings of $300 million and up in Q4.

Early-stage funding

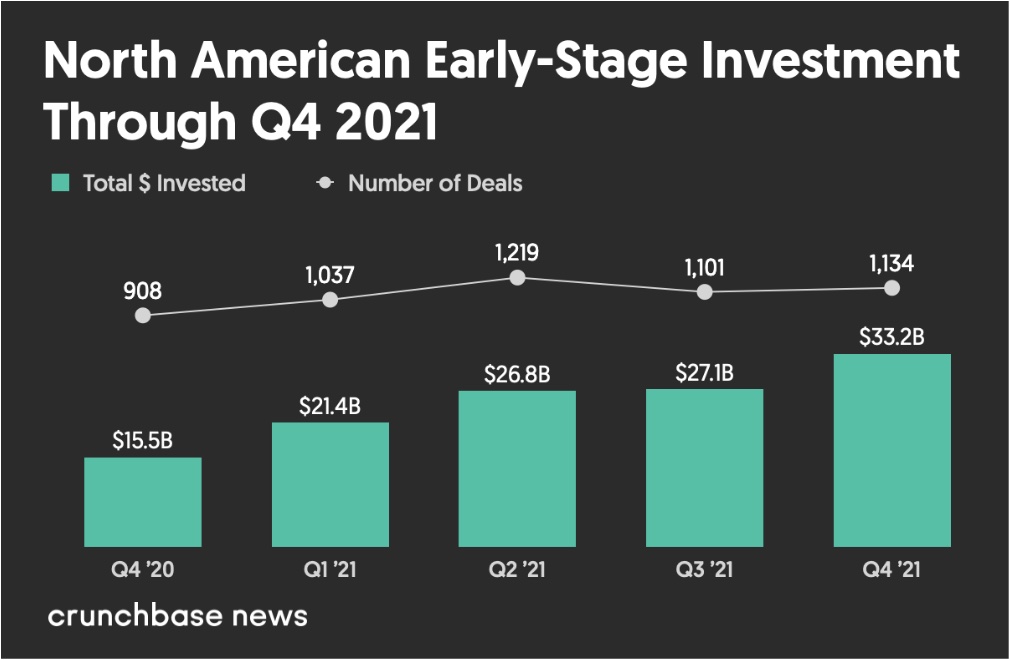

Early-stage funding was also on a tear in 2021.

For the full year, investors put $108.5 billion into early-stage (Series A and B) deals. That’s just over double the 2020 total of $53.8 billion and, once again, a record-setting tally.

The fourth quarter ended on a high note as well, with $33.2 billion going into early-stage rounds—the highest quarterly tally for the year. Below, we compare early-stage funding and round counts for the past five calendar quarters:

As usual, a few ultralarge funding rounds played a big role in pushing up the totals. Some of the largest investments for Q4 include:

- Commonwealth Fusion, a Cambridge, Massachusetts-based startup working on building the first commercial fusion power plant, raised $1.8 billion in a Series B round;

- Sierra Space, a Colorado-based developer of space transportation systems with a vision for enabling space habitats, raised $1.4 billion in a Series A financing;

- Forte, a San Francisco-based provider of tools for game publishers to integrate blockchain technology, raised $725 million in Series B funding; and

- MoonPay, a Miami-based company developing payments infrastructure for crypto, raised $555 million in a Series A funding round.

Seed-stage funding

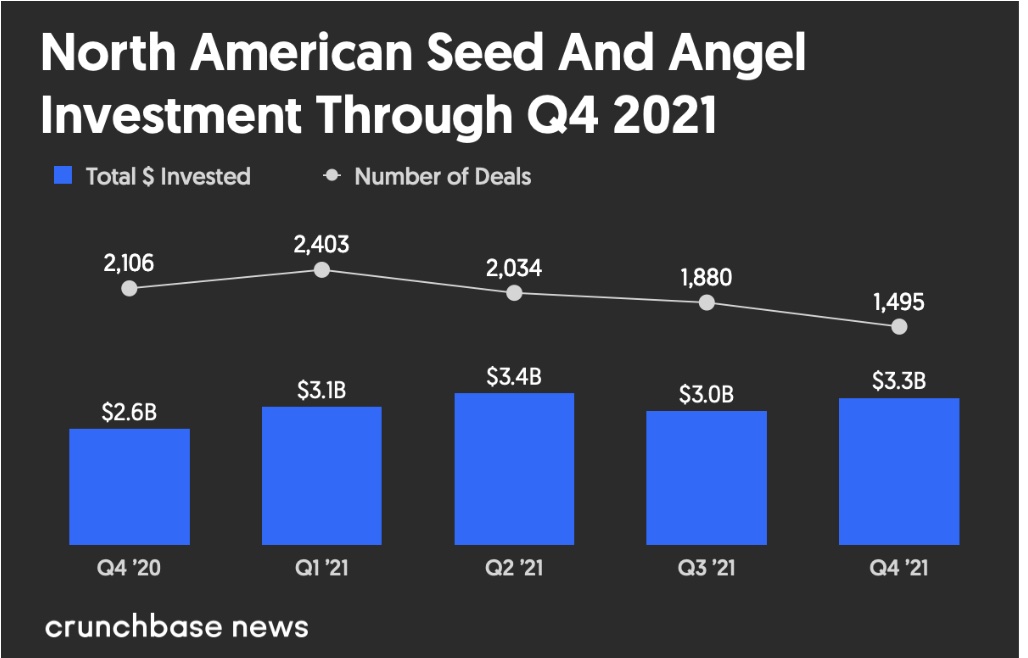

Seed and angel funding scaled new heights too.

For all of 2021, investors put $12.8 billion into seed-stage deals. That’s an increase of 35 percent over 2020, which saw a total of $9.5 billion in seed investment.

The fourth quarter was also a standout period for seed, with $3.3 billion in reported financing, per Crunchbase data. That’s up about 10 percent from Q3 and up 27 percent from year-ago levels. We chart out funding and deal count for the past five quarters below:

The tallies for the just-ended quarter are particularly remarkable given that seed stage deals are often first recorded in the Crunchbase dataset weeks or months after they close. That means reported Q4 totals are likely to rise over time.

Also noteworthy: Reported investment totals grew even as round counts declined. While some of that may be attributable to reporting delays, it’s also clear that the average size of seed deals continues to rise.

Exits

Investors weren’t just putting money into startups in 2021. They were also getting returns back amid a robust environment for both public offerings and big-ticket acquisitions.

While aftermarket performance was choppy for some, particularly for companies that took the SPAC route to market, others managed to sustain valuations in the tens of billions.

Public offerings

For venture-backed public offerings, the biggest debut came in November from electric vehicle manufacturer Rivian. The Michigan company raised around $12 billion in the largest IPO of the year, garnering an early market cap exceeding Ford and General Motors. Though shares have fallen sharply from their highs, the company was still recently valued above $70 billion.

Other big debuts in 2021 include:

- Coinbase, the cryptocurrency marketplace, went public via direct listing in April. Recent share prices are far off their highs, but the company still has a market cap around $60 billion;

- UiPath, a provider of enterprise process automation software, raised $1.3 billion in its April IPO. Shares are far off their highs, with the company’s recent market cap around $21 billion;

- Robinhood, the zero-fee stock and crypto trading platform, raised $2.1 billion in its July IPO. Shares have shed more than half their value since the company’s debut, leaving its current market cap around $13 billion; and

- Roblox, the popular gaming platform, went public in March via direct listing. Shares are still up from the initial offer price, with the company recently valued around $52 billion.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

In Q4, venture-backed companies continued to make a steady stream of market debuts. In addition to the quarter’s headline IPO event—Rivian—other big offerings included:

- HashiCorp, a provider of enterprise cloud automation software, raised $1.2 billion in its December IPO and secured a recent market cap around $14 billion;

- Aurora, provider of autonomous vehicle technology, went public in November after completing a reverse merger with a special-purpose acquisition company. It was recently valued around $11 billion; and

- Embark, a developer of technology for self-driving trucks, also completed its SPAC merger in November, securing a recent market cap around $3 billion.

M&A

Acquirers also kept busy in 2021. Although disclosed prices for the biggest M&A deals were still a small fraction of the largest public offering valuations, the numbers still added up.

The fourth quarter closed out the year with a number of sizeable acquisitions of venture-backed companies, including:

- Truebill, an AI-enabled personal finance app, sold to Rocket Companies in a transaction valued at $1.275 billion;

- SimpleNexus, provider of an online platform for the home purchasing and loan process, sold to banking software provider nCino in a $1.2 billion deal; and

- Ecobee, a provider of WiFi-enabled smart thermostats, sold to Generac Holdings in a transaction valued at up to $770 million.

For the full year, we can add in some other big deals, including:

- Auth0, an identity management platform, sold to Okta in a stock transaction valued at around $6.5 billion;

- Divvy, a platform that helps businesses manage payments and subscriptions, sold to Bill.com in a $2.5 billion deal;

- Iora Health, a patient care platform, sold to primary care provider One Medical in a deal valued at around $2.1 billion; and

- Turbonomic, a developer of tools that optimize application performance, sold to IBM in a transaction reportedly valued at between $1.5 billion and $2 billion.

The big picture

For a few years now, the big question in venture capital has been: How long can things run ultra-hot before they overheat?

Certainly investments have been scaling ever-higher heights for a longer duration than this author anticipated.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Of course, the ascent hasn’t been entirely smooth. We’ve seen a few rocky developments this year, in particular the underperformance of so many funded companies that took the SPAC route to public markets. We’ve also seen poor aftermarket performance for Robinhood and some others that took the IPO or direct listing path. Additionally, the recent rout in crypto prices in recent days doesn’t bode well for the heavily funded space.

But clearly, optimism is still running high, with big bets being placed in recent weeks in sectors from fusion energy to cybersecurity to space transport. Hopefully, it will end well.

Further reading

- Global Venture Funding And Unicorn Creation In 2021 Shattered All Records

- Venture Funding In Asia Shatters Record For Year And Quarter—Thanks In Large Part To China

- Europe’s Unicorn Herd Multiplies As VC Investment More Than Doubled In 2021

- SoftBank, Tiger Still Lead Pack Of Spendiest Startup Investors In The World

- Europe’s Most Active Startup Investors In 2021 Hail From Across The Globe

- Here’s What’s Driving Latin America’s Rank As The World’s Fastest-Growing Region For Venture Funding

Methodology

The data contained in this report comes directly from Crunchbase, and is based on reported data.

Note that data lags are most pronounced at the earliest stages of venture activity, with seed funding amounts increasing significantly after the end of a quarter/year.

All funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Glossary of funding terms

Seed and angel consists of seed, pre-seed and angel rounds. Crunchbase also includes venture rounds of unknown series, equity crowdfunding and convertible notes at $3 million (USD or as-converted USD equivalent) or less.

Early-stage consists of Series A and Series B rounds, as well as other round types. Crunchbase includes venture rounds of unknown series, corporate venture and other rounds above $3 million, and those less than or equal to $15 million.

Late-stage consists of Series C, Series D, Series E and later-lettered venture rounds following the “Series [Letter]” naming convention. Also included are venture rounds of unknown series, corporate venture and other rounds above $15 million.

Technology growth is a private-equity round raised by a company that has previously raised a “venture” round. (So basically, any round from the previously defined stages.)

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of pandemic pet pampering. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/03/Pets-2-300x168.jpg)

67.1K Followers