It has (nearly) happened!

As the domestic markets came to a close on Thursday, something caught our eye that we wanted to highlight: Snap and Twitter are now (nearly) worth the same amount. It’s been a long time coming, in a sense, and it speaks either well of Twitter or poorly of Snap—or some hybrid of both.

Follow Crunchbase News on Twitter & Facebook

We’re flagging the moment as it’s close enough to count, even though, at the precise moment we took the pertinent screenshots, the firms were merely very close to sharing the same value. If that’s not good enough for you, I am pleased to pass along a note from the local chapter of the Pedants Anonymous: You’re late.

One last pre-note before the data: According to Wolfram Alpha’s handy market capitalization comparison charting feature, we can see that, back in July, the two were quite close in terms of their respective market caps. But it wasn’t until Snap’s recent earnings miss that they wound up mostly in-sync.

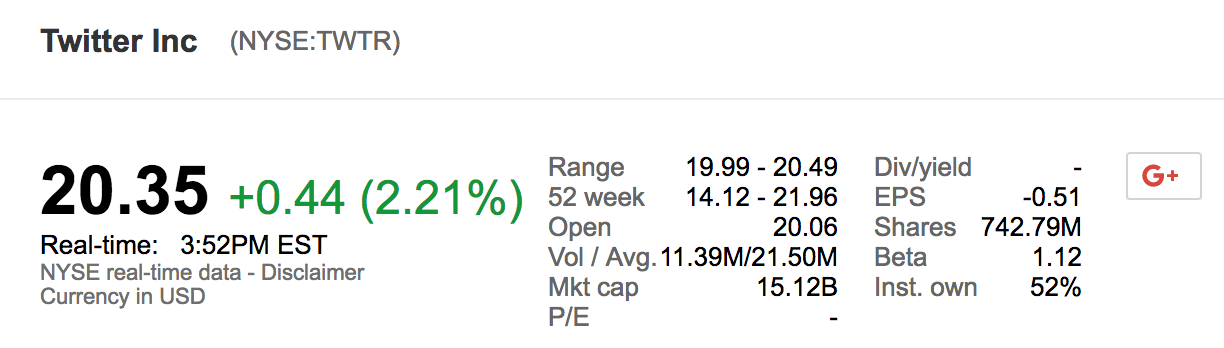

With all that in our pocket, here’s the math per Google Finance:

As you can quickly sum, Snap is worth just about $0.47 more than Twitter, which is quite the turn of affairs.

Before Snap went public, Twitter was in the tank and persistently whacked by investors for slow user growth and a history of GAAP losses. At the time, Snap was quickly expanding its userbase while its revenue exploded. Its losses were, at best, secondary to its growth.

Now Twitter and Snap have traded places. Twitter is showing nearly-surprising signs of life, with growing DAU results and a push for GAAP profits. Snap, in contrast, is far under its IPO price. It has also missed revenue and user growth targets. Both misses have served to make its huge unprofitability less cute and more biting.

Snap is now worth billions less than it was valued at at the time of its mid-2016 Series F. Twitter, in fairness, is also below its IPO price. However, Twitter has rebounded from its lows while Snap is currently mired in its own.

For startups, the lesson is simple enough: Even incredibly quick year-over-year revenue growth is not enough to save you in the real markets. In fewer words: Twitter’s public-market recovery as it heads into GAAP profits isn’t a surprise.

And Snap lost more than twice its revenue last quarter once all the math was done.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a map to an Exit. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Exit-map-470x352.jpg)

![Money - Illustration of a giant piggybank with a woman looking at it. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Big_Piggy_Bank-470x352.jpg)

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers