When SoftBank announced last month it will take a more conservative approach to selecting investments—after recording a $27.7 billion loss on its Vision Fund business segment for its fiscal year—it was another warning shot that the high times of 2021 are over for venture capital.

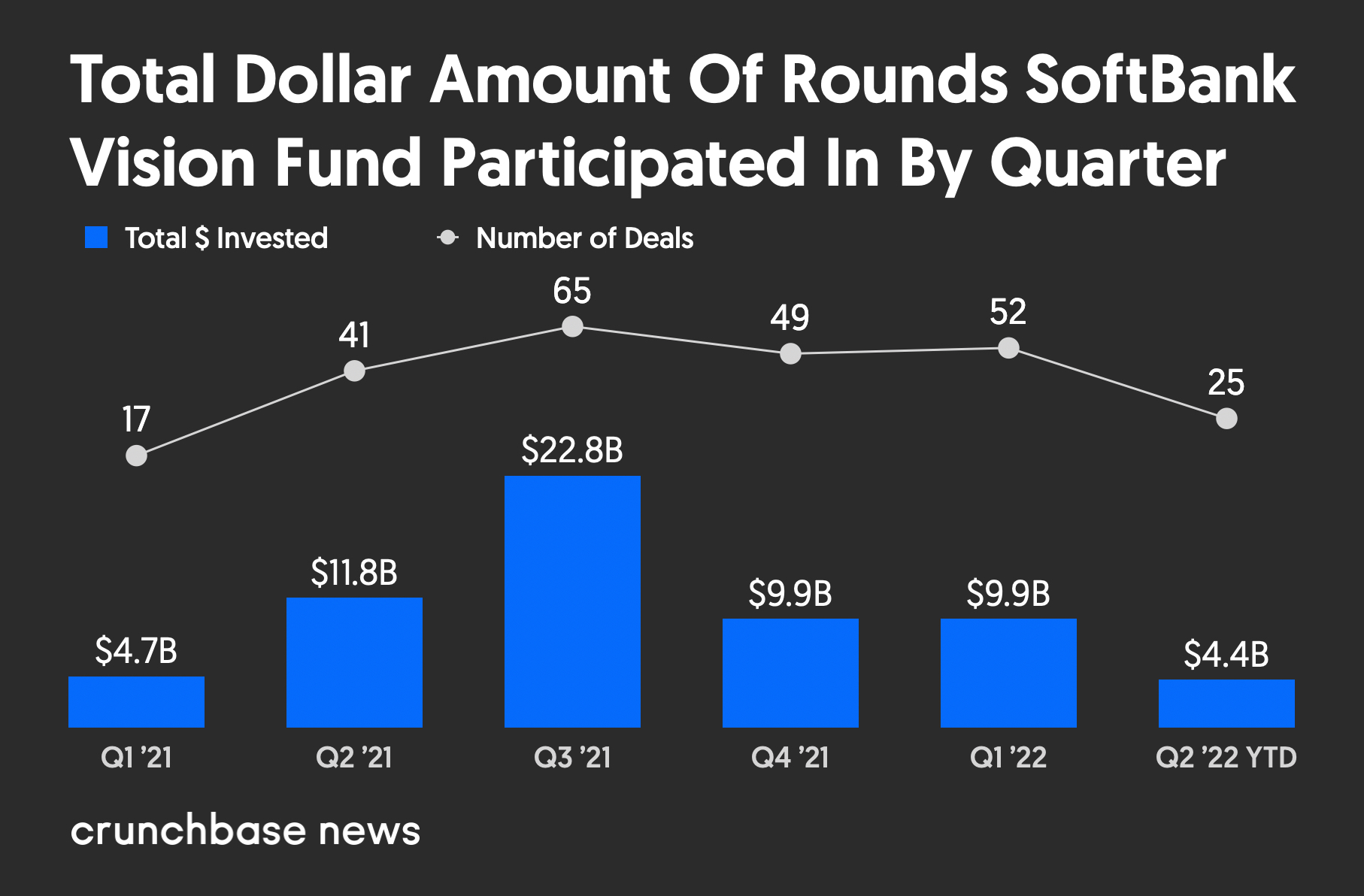

However, the technology conglomerate seemed to be slowing its investing even before the declaration—at least in terms of the size of the rounds it participated in, if not the number, according to Crunchbase data.

After investing in a fund record of 65 deals worth a total of nearly $23 billion in the third quarter of 2021, the SoftBank Vision Fund slowed its pace in the fourth quarter of last year and first quarter of this year, per Crunchbase numbers.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

The total dollar amount of rounds it participated in for those quarters combined was less than that record third quarter, which was the height of the venture market.

In addition, SoftBank seems poised to end the current quarter with its lowest number of deals since the first quarter of 2021. Those deals are also worth significantly less, Crunchbase data shows.

Not going so big

The numbers likely do not come as a shock to anyone following the private market—startups and VCs have reported for months that large, expensive growth rounds are down as valuations continue to fall.

Startups generally are raising smaller late rounds, if they can raise at all.

For SoftBank—which along with firms Tiger Global and Insight Partners helped power the venture market for the last several years—the drop in large round participation is quite noticeable.

According to Crunchbase data, the SoftBank Vision Fund participated in nine rounds of $1 billion or more last calendar year. This included leading or co-leading such rounds for India-based Flipkart, South Korea-based Yanolja and Massachusetts-based Devoted Health.

Through more than five months this year, SoftBank has yet to participate in a round of that size. Thus far, the largest round the company’s fund participated in was $935 million for San Francisco-based logistics company Flexport.

The VC pullback

On May 12, SoftBank Chairman and CEO Masayoshi Son told investors that the company will have stricter investing criteria moving forward and a more defensive posture.

The announcement came as part of the company’s earnings report for the fiscal year ended in March. SoftBank, known for its investments in companies like Nvidia and Uber, has been hurt by the falling markets, especially the underperformance of companies like China-based ride-hailing app Didi, Singapore-based logistics company Grab, and South Korean e-commerce platform Coupang.

Perhaps the best illustration of SoftBank’s mindset shift came in February, when it did not release a promised $1.35 billion to Cruise as part of an agreed upon deal when the autonomous carmaker completed a commercial deployment of vehicles. Instead, General Motors acquired SoftBank’s equity ownership stake in Cruise for $2.1 billion.

SoftBank is far from alone in its pullback. Since the beginning of the year, firms such as Y Combinator, Sequoia Capital and Tiger Global all have either issued warnings publicly or privately about the market.

Related reading:

- Tiger Global’s Startup Business Holds Up Against Bear Market

- As Venture Dollars Slow, Deal Terms Begin Trending Back Toward Investors

- Which Startup Sectors Are The Bulls And Bears In 2022’s Sluggish VC Market?

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Image of multiuse agentic AI/robot North America quarterly[Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/year-of-agentic-ai-quarterly-north-america-470x352.jpg)

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers