The rapid deployment of AI across industries in recent months suits the longtime talents of TSVC, a seed investor in deep tech companies where AI coupled with domain expertise has led to breakthroughs.

The firm invests very early in companies with technology that can be challenging to understand. Its investment focus is in deep tech in semiconductor materials and robotics companies, in healthtech companies and also in the data economy, which includes AI.

Founded by Eugene Zhang and Chun Xia in 2010, the firm has built an impressive portfolio of more than 200 companies in its 13 years of operation.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

TSVC’s four general partners have operating experience as well as engineering backgrounds. Alongside the general partners, the firm evaluates companies with the technical knowledge of its 14 venture partners, many of them founders and tech executives with Ph.D.s.

It led the seed round in Zoom in 2011. It also invested early in now public companies Ginkgo Bioworks, Carta, Quanergy and in Zum transportation, a growing private company that rethinks student transportation.

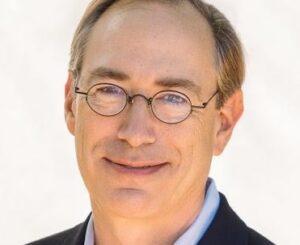

We spoke with TSVC partner Spencer Greene on the firm’s deep tech successes, its approach to investing at seed, and the AI investment boom. Greene joined TSVC in 2020 and leads the firm’s health practice.

For Greene, it’s not enough for a startup’s technology to be innovative today. He wants to know: How will that tech hold up years from now? Can it fight off competitors and copycats?

The majority of the firm’s portfolio companies have an AI component — but that’s not enough.

“I spend more time and energy looking for defensibility than what we used to,” Greene said. “AI needs to be coupled with something else to make it hard enough, because it’s going to be transformative for so many industries.”

Betting on AI

TSVC invests in a startup’s team, product or technology, and then market size.

“I think AI is, for most businesses, table stakes,” said Greene. “AI and some other technologies together have made barriers to entry lower in many situations. That can be a good thing if you’re an early-stage startup — you can attack incumbents who are much larger than you, and you can get to market very quickly. But it can also make it harder to build a sustainable business because you can be vulnerable just as easily to someone else who comes after you.”

In the health care sector, for example, Greene said investors understand that AI will be able to read X-rays and pathology slides better than a doctor. However, once this technology is FDA-approved, it might not be defensible as a technology unless the startup has a unique and large dataset that creates some differentiation.

TSVC applies the same principles to its other sectors, such as the AI and robotic space, where the firm has been active lately. There is a ton of innovation happening in computer vision, Greene said.

The firm’s portfolio companies include:

- Computer vision companies and robotics company Beagle Technology, which prunes grapevines without destroying crops.

- eBots, a precision manufacturing company that uses 3-D vision useful for building smartphones that require many manual assembly steps — a technology that was not possible only a few years ago.

- Automat Solutions, which uses AI to discover alternate materials for the lithium battery market. Automat’s AI engine predicts suitable materials, which are then tested in a lab for the ability to store more energy or charge faster or maintain cooler temperatures. This learning then gets fed back into new predictive models.

- Reema Health, which aims to keep Medicaid patients healthy and out of the hospital — something that would have an enormous impact, according to Greene.

- Preveta, which provides specialty health care coordination, saving on costs — and highlighting TSVC’s interest in startups that tackle inefficiencies in the health care space.

Early Zoom

When TSVC first invested in Zoom, it was not at all clear that the company could succeed in a competitive market for web-conferencing.

TSVC’s Zhang met Zoom founder Eric Yuan through an organization for Chinese tech professionals in the Bay Area. At the time, Zoom was focused on the consumer market, creating a “poor man’s telepresence” via a Facebook plugin.

TSVC wasn’t sure if the consumer approach would work, but Yuan had experience in the sector. He had left online conferencing company Webex — then owned by Cisco — frustrated by what he saw as lack of innovation. Yuan hired a team of engineers who invented a new codec that improved the audio and video quality in conference calls with better compression technology.

The underlying technology was important to its success alongside the intuitive interface that Zoom is known for.

Zhang led TSVC’s investment in Zoom, a seed round of $3 million in 2011 that valued the company at $15 million. Afterward, he noticed that on a flight using Wi-Fi that while his Skype call didn’t hold up, the Zoom call did.

The pre-A stage

The seed market has changed, Greene said. “I hadn’t heard the term pre-A hardly at all until lately, and now I seem to hear it all the time.”

Companies that manage to raise Series A funding are spending a longer time to get there, according to a recent analysis of Crunchbase data.

This has given rise to seed extension rounds, a signal the valuation is flat from a prior funding typically two years ago. And when a company is raising pre-A it reads as there is a little step up in valuation. But overall they are both saying they are not yet ready for a Series A funding.

Still, TSVC has not seen a decline in the number of companies pitching for funding. “We are seeing much more reasonableness on valuations. There was a point in time where it kind of went crazy,” he said.

Initial check size for the firms these days is $500,000 to $1 million with reserves for follow-on funding, according to Greene.

TSVC co-invests in seed rounds that are typically $3 million to $6 million but can be around $2 million as well. The firm’s valuations for seed deals are typically around $10 million, $15 million or, on the higher end, $20 million.

Greene predicts that amid turmoil in the tech world, there are opportunities for very early-stage investors like TSVC. “Some of the layoffs in Big Tech have been pulling back their moonshot projects, and essentially ceding territory back to venture,” he said.

Related Crunchbase Pro query:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration showing AI agents, depicted by robots, performing digital tasks. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Quarterly-agenticAI-470x352.jpg)

![Illustration of IP shopping. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/06/Reopening-470x352.jpg)

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers