Among the world’s largest nations, the U.S. has by far the highest rate of startup investment relative to population. Over the past year, venture investors put nearly $270 billion to work—averaging out to around $800 for every person in the country.

Subscribe to the Crunchbase Daily

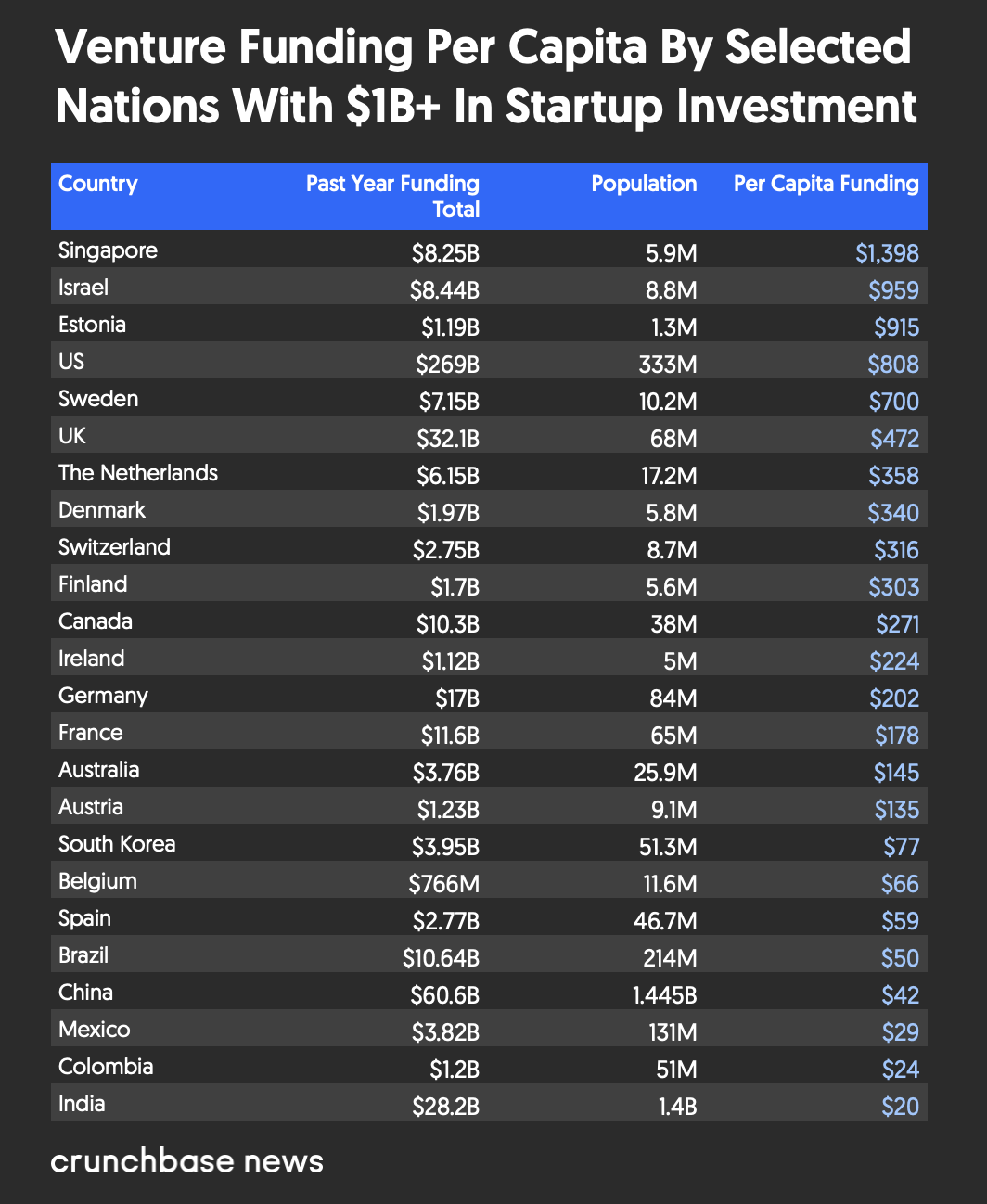

But among all countries, the U.S. ranks fourth in per capita startup investment. The No. 1 and No. 2 slots go to Singapore and Israel, two smaller countries that punch well above their weight class for tech-driven entrepreneurship.

Among mid-sized countries, meanwhile, the U.K. was the standout, with an investment rate that works out to just under $500 per person.

Those are findings from our latest survey of per capita venture capital investment across a sample set of 24 countries that pulled in more than $1 billion in the past 12 months. Among the cohort, investment levels ranged from a high of nearly $1,400 per capita (Singapore) to a low of $20 (India).

In the chart below, we look at how all the countries in the sample set compare:

One takeaway from the exercise is that India and China, two of the largest global venture capital markets, score rather low on the per capita metric. This indicates that while they have flourishing startup economies, they don’t encompass a large share of the population.

Another standout that requires a bit of explanation is the surprisingly high ranking for Estonia. This is pretty much entirely due to Bolt, the multinational ride-hailing, delivery and microbility platform that is headquartered in the capital city of Tallinn and raised nearly $700 million in its last funding round in August.

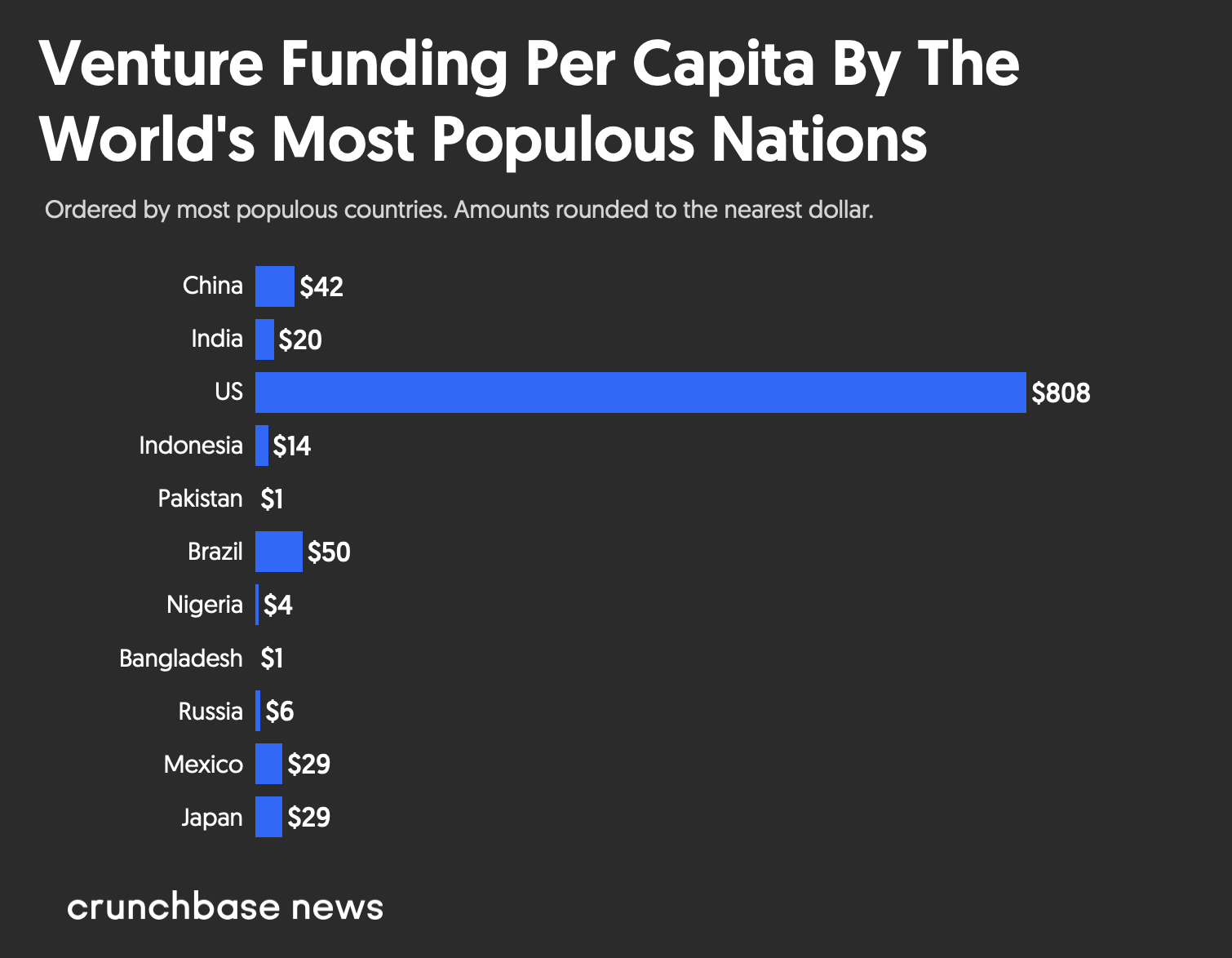

How do the most populous countries compare?

For a second, related exercise, we took a look at how the world’s most populous countries rank in terms of venture funding per capita. This produced the not entirely unexpected result that many very populous countries see only a tiny pittance of venture capital investment.

For a look at how it breaks down, see the chart below:

The tallies may look discouraging for many countries, but there is a bright side. Recent history shows things can turn rather quickly, with countries sometimes seeing venture investment multiply several fold in a few years.

Take Colombia. Between 2010 and 2015, the country attracted just around $150 million in total venture funding, per Crunchbase data. Over the past 12 months, however, Colombian companies pulled in close to $1.2 billion across more than 100 rounds.

A similar story has unfolded in Brazil. Latin America’s most populous nation pulled in less than $2 billion in total venture dollars from 2010 to 2015, per Crunchbase. Now, it’s well over $10 billion in a single 12-month period.

So, when things scale, they can scale fast.

Methodology

Population data is based on U.N. projections, as aggregated by World Population Review.

Funding totals are based on Crunchbase data and include seed through late-stage venture rounds, as well as corporate venture investments and venture deals with stage not disclosed. While Crunchbase collects funding rounds from all geographies worldwide, our ability to track financings in some countries may be more expansive than in others, due to factors including language, public availability of funding data, and other externalities.

Additionally, we are only tracking deals in our database that are tagged as venture or seed-stage. It is possible that fundings for companies that have attributes of startups are labeled as private equity or some other category, and thus not included in the tallies.

Investment totals are for the 12-month period from Oct. 28, 2020, to Oct. 28, 2021.

Related stories

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers