Today it was announced that Stripe, a well-known payment processing unicorn, led a $22.5 million investment into Step, a banking startup aimed at youths.

Subscribe to the Crunchbase Daily

Quickly, Step wants to help teens get into banking, and learn something along the way. According to a TechCrunch story on the deal, Step intends to use its new capital “to bring [its] first product — banking accounts with payment cards attached — to market.”

So, a ways off yet. But in the era of neo-banking — think Chime, Acorns, SoFi, and so forth — the company makes good sense. Who doesn’t have banking? Teens! What do teens love? Smartphones! Viola. That in mind, it’s fitting that this funding news landed the same day that JPMorgan scrapped its own banking service aimed at youths, a year after its nationwide launch.

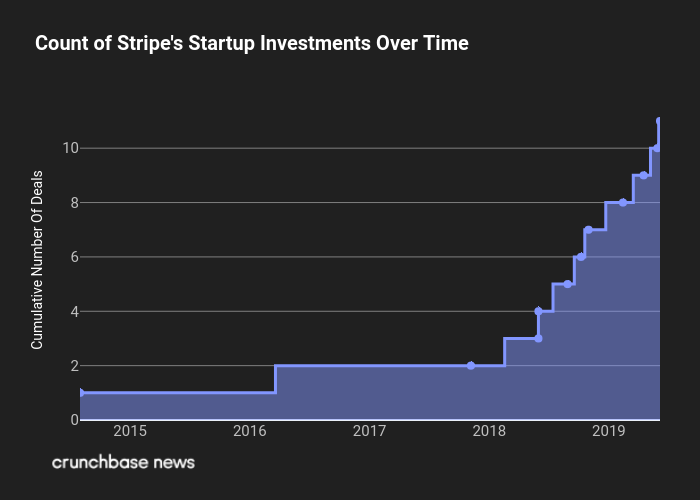

What caught our eye about the deal wasn’t Step itself. Instead, two other things stood out. First, the deal marks one of Stripe’s first lead investments in the United States (per the company), and it continues a trend of the unicorn doing more deals. Underscoring that point, here’s a chart of Stripe’s known investments over time, according to Crunchbase data.

If it feels a bit odd that Stripe, a private company and erstwhile startup, is investing in smaller companies, it shouldn’t. Wealthy unicorns pushing capital into smaller firms is somewhat common these days. Back in April, we wrote about how unicorns often play both sides of the investment table.

We saw that about 33 percent of unicorns invest in other startups (chart here). It tells us that risky startups are willing to bet on other risky startups, so long as they’re valued at a billion or more and can afford to take that jump.

WeWork does it, for example. (You can check out its investments here.) Slack set up its own fund to do so, and so forth.

But as you can see in the above chart, the pace of Stripe’s deals (that we know about, at least), is increasing. And when we consider that its most recent deal was also its first lead check, the trend feels doubly interesting. I presume that Stripe isn’t hurting for operating cash, given its investment cadence.

To-date, Stripe has raised nearly $800 million from investors across a host of rounds. Most recently the company raised another tranche of its Series E, a $100 million infusion that valued the firm at $22.5 billion. For reference, that’s far greater than the value of Lyft. Stripe has raised larger rounds in the past, including its Series D and the first part of its Series E.

Illustration: Li-Anne Dias.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a suitcase stuffed with money. Megafunds [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Megafunds-470x352.jpg)

![Illustration of a man sitting on a huge pile o' money. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Giant_Funding-470x352.jpg)

![Illustration of agentive AI brain - Europe - Quarterly. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Agentive_AI_europe-470x352.jpg)

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers