Venture investors are charged up about how to power this generation—and the next one—of electric vehicles. Venture funding for EV battery-related technology surged last year, and 2022 seems ready to pick up where it left off.

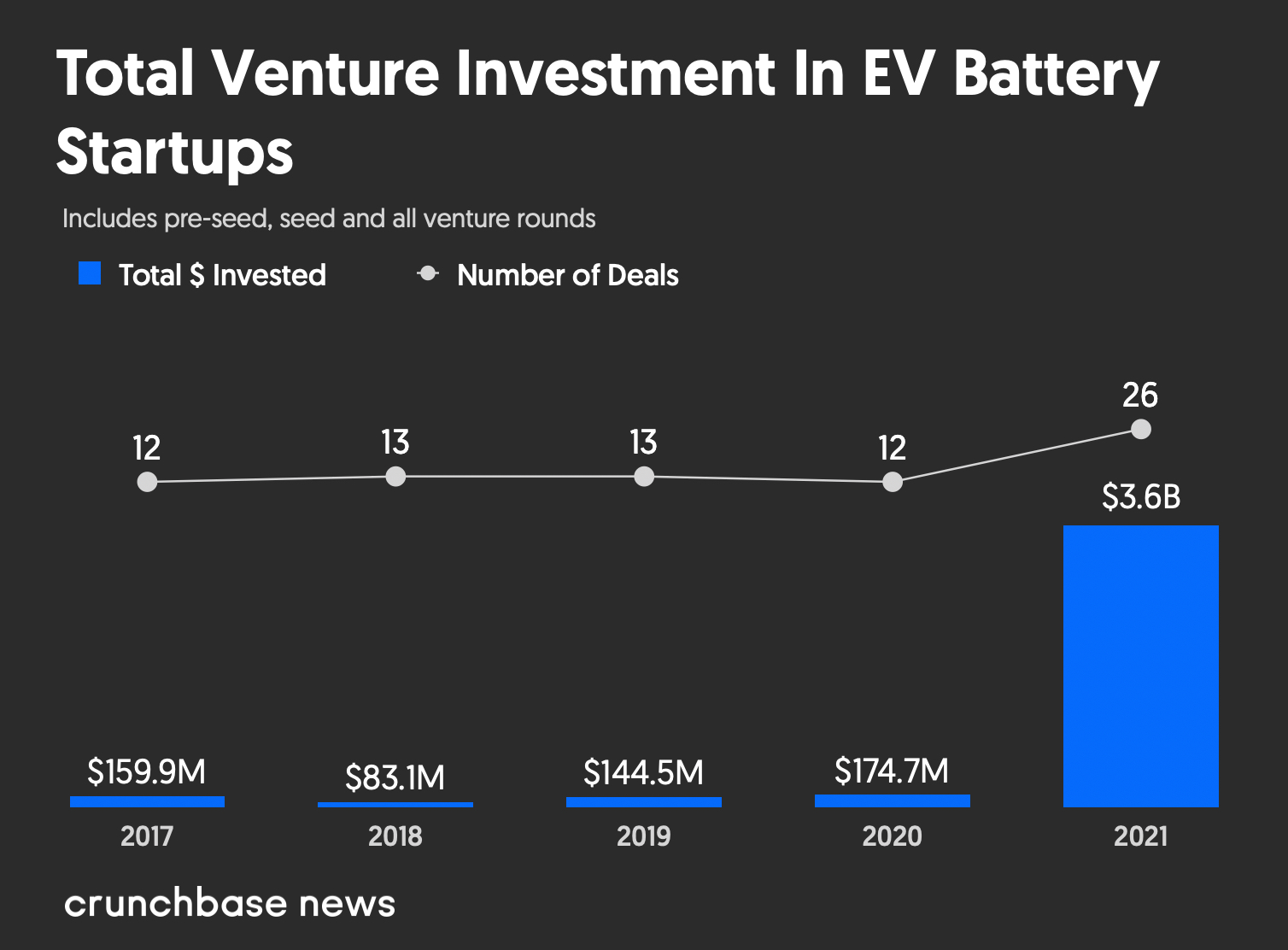

In 2021, EV battery startups—both hardware and software companies—raised more than $3.6 billion, according to Crunchbase data. Even subtracting the more than $3 billion raised by Chinese battery cell manufacturing giant Svolt, the remaining total is nearly triple the $174.7 million raised in 2020, according to Crunchbase.

What also is worth noting is how deal flow has increased, as the ecosystem around EV batteries, such as battery design and charging technologies, has grown. While previous years saw only about a dozen deals each year, 2021 more than doubled that average number.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Some of the largest deals—aside from Svolt’s rounds—in the space last year include:

- Woburn, Massachusetts-based SES, which has developed a hybrid lithium metal battery, closed a $139 million Series D led by General Motors;

- Louisville, Colorado-based solid-state battery-maker Solid Power raised a $130 million Series B led by the Ford Motor Co., BMW Group and Volta Energy Technologies. The company went public via a SPAC late last year; and

- Singapore-based charging infrastructure provider Oyika closed a $100 million venture round.

The new year also has started strong, with three deals raising almost $290 million, including Woburn-based battery-maker Factorial Energy raising $200 million as part of a Series D round led by Mercedes-Benz and Stellantis.

Big names

What is noticeable about many of those rounds mentioned are the backers: large car makers.

“Elon Musk has shown a car company is really now a battery company,” said Doron Myersdorf, CEO of Israel-based StoreDot—which is looking at using different materials in batteries to optimize charging. “All the carmakers realize that now.”

Large automakers have determined they need to be closer to—or even own—the supply chain that powers this, and the next, generation of EVs, said Myersdorf, whose own company just closed a $60 million Series D last month.

“You can’t separate the tech from the performance of the car,” he said. “A car now is really the battery and software, everything else is just off the shelf.”

Seemingly every carmaker and equipment manufacturer seems to be placing a bet in the battery game, including General Motors, Kia Motors, Hyundai Motor Co, Honda, BMW, Ford, Volkswagen, Mercedes-Benz and Stellantis.

Those players also do not seem to be slowing down. This week Bloomberg reported that Ford is planning additional investments of up to $20 billion into electric vehicles over the next five to 10 years.

“Traditional OEMs just realized this could be like the asteroid that killed the dinosaur,” said Qichao Hu, CEO and founder of SES, which is set to enter the public market tomorrow on the New York Stock Exchange after a $3.6 billion SPAC merger.

Hu said automakers realized starting around late 2019, after Tesla’s share price exploded, that changes to the EV market were needed. That was followed by the pandemic, when automakers struggled in the first half of 2020, further pushing a change in strategy and even workforce, Hu said.

“They used COVID as an opportunity to make changes,” he said.

However, which changes they are investing in can vary.

The great debate

One of the reasons more money is pouring into the space is not just the deep pockets of automakers, but the fact those companies are investing in different types of batteries.

While lithium ion batteries are currently the norm, the promise of a new solid-state battery intrigues investors. In the most simplistic terms, solid-state batteries have a solid electrolyte while lithium ion has a liquid one. The main benefit would be that solid-state batteries are considered safer, while also offering higher energy density.

“I think momentum for the industry really kicked in in late 2019 or early 2020,” said Siyu Huang, founder and CEO of Factorial, a solid-state battery developer. “The battery and vehicle market is at an inflection point.”

To illustrate the heat solid-state batteries alone is generating among investors, Huang said her company had initially planned to raise $150 million in its recent round, but eventually increased that to $200 million after receiving so much strategic interest.

The company plans to use the cash to accelerate commercial production and deployment of its solid-state battery technology, which Huang said can offer up to 50 percent greater driving range than current lithium-ion technology.

The market “has been hot,” Huang said. “I’m thrilled to see the excitement.”

The downside to solid-state batteries is that true solid-state batteries are still several years away for electric vehicles. While there have been quasi or semi solid-state batteries being developed for the markets—using substances like gels—true solid-state batteries may not be here for more than a decade.

Nevertheless, interest abounds in the solid-state space. Both Solid Power and QuantumScape, which received strategic investments form automakers like Ford and Volkswagen, respectively, both have gone public via SPACs in the past couple of years.

More batteries, more ides

While no one is complaining about the uptick in investment interest, some in the EV battery space point out much of the investment money is being poured into the hardware side of the industry—i.e. companies developing new types of batteries—while more research and money could be spent in other parts of the ecosystem.

Myersdorf said solid-state batteries are still a decade away and, even then, new processing equipment and changes to factories will be needed.

Money could be spent elsewhere to improve what is now in the market, but many investors are fixated on the next new thing, he said: “People want to know what is coming next, that’s where they want to invest.”

Shyam Srinivasan, co-founder and CEO of Oakland, California-based Zitara, which builds battery management software for enterprises, said instead of designing new batteries, more effort could be concentrated on using data to make current batteries more predictable and efficient.

His 3-year-old company has raised more than $15 million in venture funding to date and he is amazed by the interest the space is seeing, but also believes more ideas are needed.

“There’s too much money and not enough ideas that can achieve scale in time to mitigate the climate crisis,” he said.

Methodology

Electric vehicle battery startups are defined by the industries of both electric vehicle and battery, as according to Crunchbase data.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers