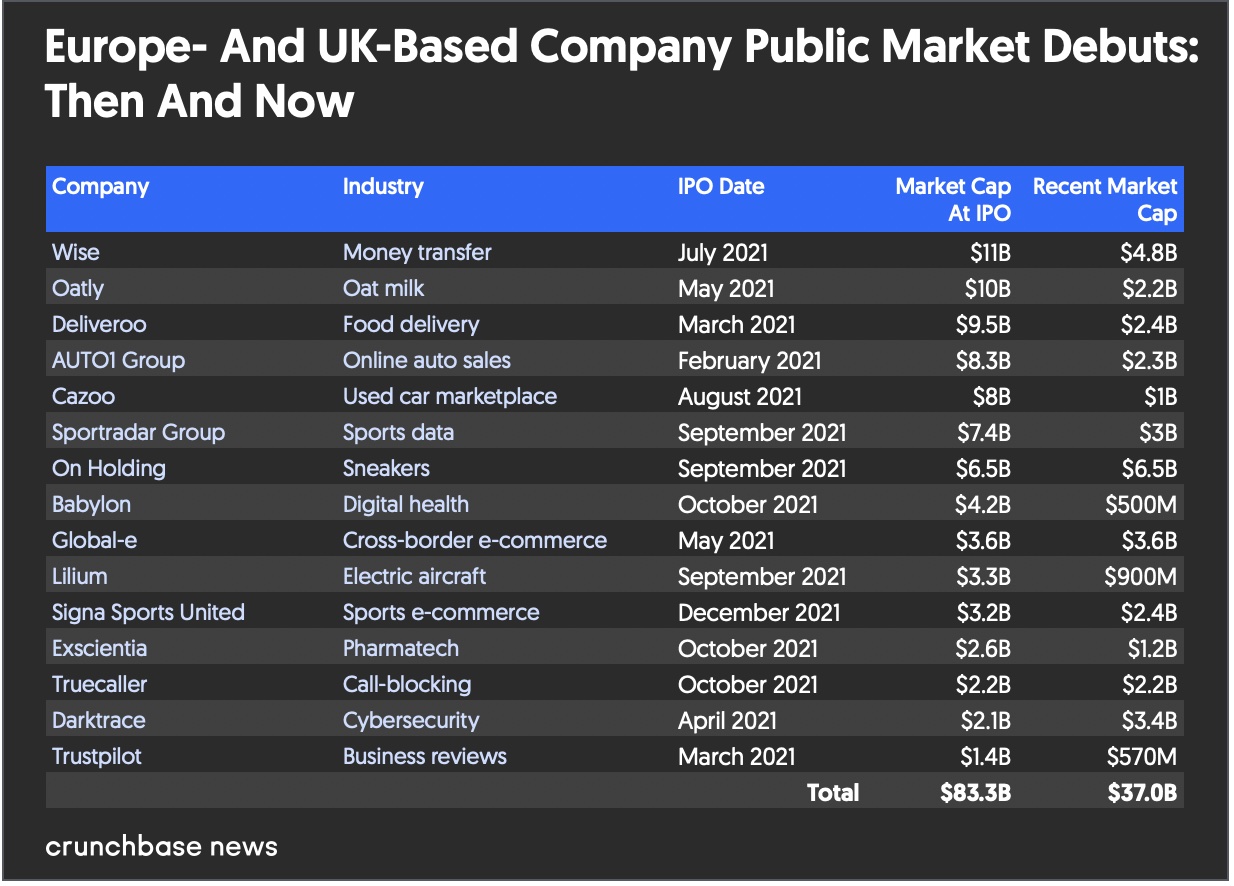

When the IPO window was wide open last year, venture-backed companies in Europe and the U.K. used the opportunity to launch a spree of big public offerings. At least 15 made market debuts with initial public valuations of over $1 billion and as much as $11 billion.

Now, the overwhelming majority of these deals are trading far below their initial offer prices. A sample of the largest have collectively seen market capitalizations fall by over 55 percent.

Some of the worst performers are prominent names. This includes food delivery service Deliveroo (down 75 percent from initial offer price), used car marketplace Cazoo (down 87 percent) and digital health provider Babylon (down 88 percent).

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

However, established brands aren’t the only ones who’ve seen sharp declines. The chart below compares valuations for 15 companies with 2021 IPOs at the initial offer price and current levels. As you can see, all but one—cybersecurity provider Darktrace—are flat or down.

Companies that took the SPAC route to market are some of the worst performers. This is by no means a European or U.K. phenomenon, as venture-backed companies that went public via mergers with special-purpose acquisition companies have broadly posted big drops.

But U.K. and European companies haven’t been immune. SPAC merger companies that have posted poor post-debut performance include Cazoo, Babylon, and electric aircraft maker Lilium.

Dismal aftermarket performance of 2021 IPOs has contributed to a paucity of companies in the region hitting the market this year. The pace of new IPO filings, SPAC deals and market debuts has slowed to a crawl in recent months.

This year’s slowdown follows a period of record venture funding to U.K. and European startups. Funding to European startups showed unprecedented growth in 2021, Crunchbase numbers show, with $116 billion invested, up 159 percent from 2020.

Late stage led 2021 investments

Two-thirds, or $76 billion, of funding last year was invested at late-stage, up more than 230 percent year over year, according to Crunchbase data. Last year 84 new unicorn startups from Europe joined The Crunchbase Unicorn Board, compared to 11 in 2020. The board currently counts over 150 European private unicorn companies.

Some of those companies will likely see markdowns in coming months, based on public market comps. Meanwhile, for those who had been eyeing a public market exit this year, it looks like those plans will have to be pushed further out.

Illustration: Li-Anne Dias

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers