Advertising tech has seen its ups and downs in the past decade, but last month again shined a bright spotlight on the space with Meta announcing disappointing earnings due to Apple’s privacy changes and Google announcing plans for similar tracking modifications.

While such news can rattle an industry, it also can provide an opportunity for innovation—and that may be what some investors are betting on as 2021 was a banner year for those that power the technology of advertising.

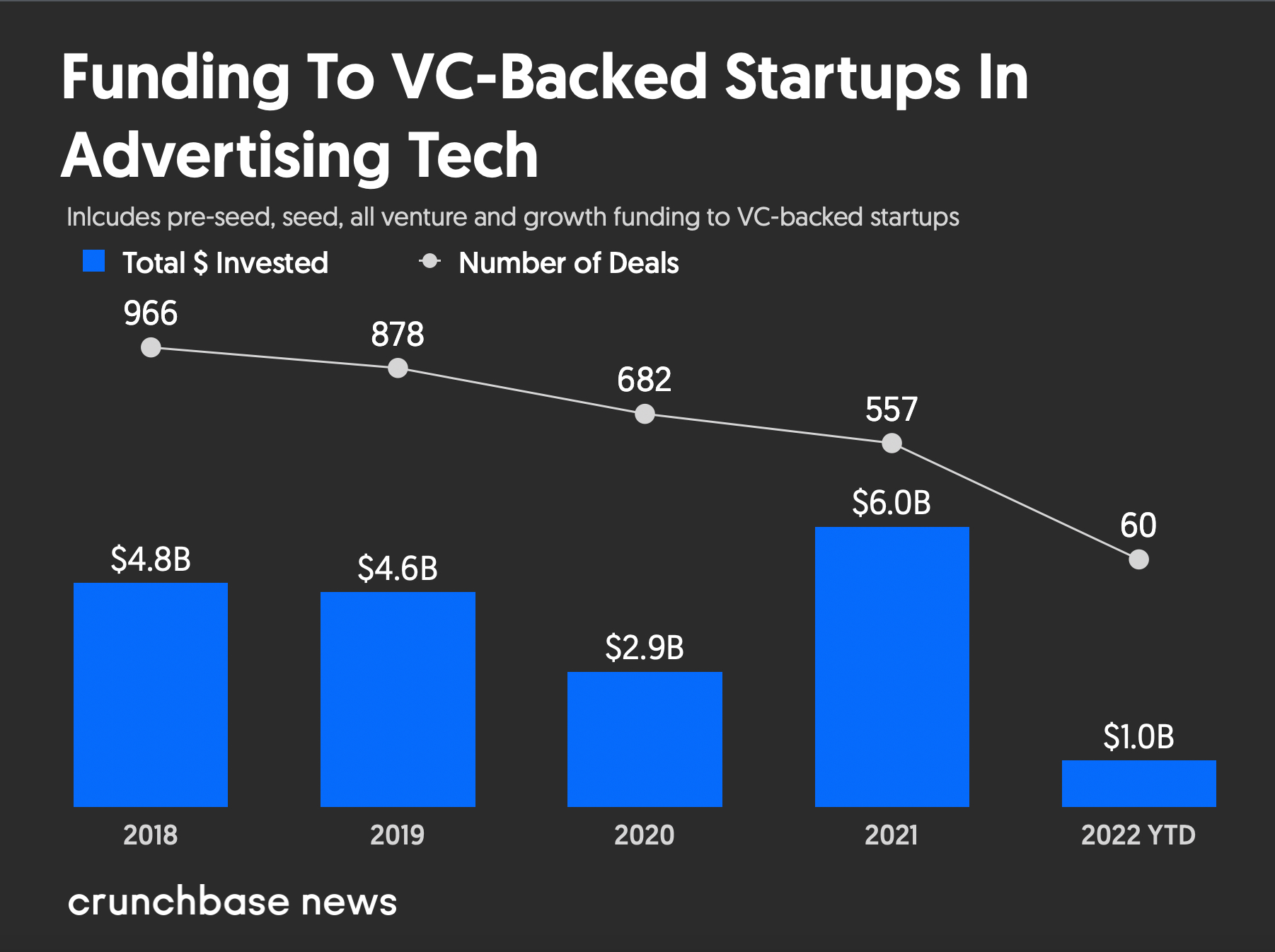

Adtech (we’ll use the term sparingly since some hate it) actually has been a pretty robust industry among venture and growth investors for several years. Between 2015 and 2019, the sector saw pretty consistent investment—with an average of about $4.5 billion per year—even as deal flow fell, according to Crunchbase data.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

However, 2020 brought change—there was a pandemic after all—as investment in the space fell through, with less than $3 billion going into the sector, according to Crunchabse. Last year though, like many other sectors, saw a huge rebound with more than $6 billion in funding going to startups in advertising and this year is on a similar pace.

The largest rounds of this calendar year all occurred last month:

- Redwood City, California-based Branch, which helps advertisers model the effectiveness of advertising campaigns, closed a $300 million Series F led by New Enterprise Associates.

- London-based GWI, a supplier of target audience insights, raised a Series B worth approximately $178 million led by Permira.

- Culver City, California-based advertising software developer MNTN closed a $119 million Series D led by Fidelity Management and Research Co. and BlackRock.

Fall and rise

Even as periods of consolidation and change have affected the sector, nothing quite had the impact on it as the double whammy in 2020.

The space, like many, saw a pullback in funding when COVID hit most of the U.S. in March of that year. Just as funding in most sectors was picking up in June, Apple announced something that would shake the industry again.

The Cupertino, California-based tech giant announced privacy changes that allows users to opt out of ID for Advertisers, or IDFA as they are commonly called. Those IDFAs allow advertisers to track iOS users’ activity across apps to better target ads and measure the effectiveness of their campaigns.

That data was important to many in the industry to track and manage advertising campaigns. To others it also presented an opportunity to build new ways to look at advertising.

A changing sector

Alex Austin—CEO at Branch and one of the people who prefers to stay away from the word “adtech”—said times in the space have changed from when many startups tried to squeeze themselves into an elongated advertising tech stack with dozens of supply- and demand-side platform providers and multiple ad networks.

“There is no margin there,” he said. “You need another angle.”

Austin sees the market breaking into two main areas. One is where companies—notably such as AppLovin— look at ways to create audiences and build relationships. The other is to have a more focused pure service and enterprise SaaS tool offerings—similar to what Branch or large programmatic marketing automation company The Trade Desk offers.

One of the things Branch—which Austin said he describes as a SaaS company, not “adtech”—does is help advertisers model the effectiveness of advertising campaigns. Software and other tooling has become an increasing part of advertising spend for companies as they try to analyze the effectiveness of campaigns—something that has become even harder with the new privacy restrictions from companies like Apple.

Before Apple’s changes came about, companies were able to get very granular in their advertising to consumers. Now those measurements are not as easy and new software and modeling can help advertisers see how campaigns are working even without that granular data they once had.

“The data is a little more clouded,” he said. “Now companies need modeling because it’s become a lot more complicated.”

The change in privacy has also clouded the outlook for large platforms that get a good chunk of their revenue from advertising. During last month’s earnings call that helped slice a healthy bit off of Meta’s value, the social media giant said the changes could cost them $10 billion in ad revenue this year. Google’s changes are set to take place in the next few years—although they promised to work more closely with developers.

Nevertheless, just looking at Meta’s plight one can imagine how the privacy changes have driven demand in the advertising space for companies with services like Branch, which introduced its tool around 2018.

“I want to solve problems that will exist regardless of the platform,” Austin said. ‘“In Branch’s case, we’re helping app companies connect the dots across the customer journey, a problem that will exist no matter the platform or its policies.”

Eying change carefully

Although dollars are up in the space, some in the industry still fear that there has been a lack of funding in new, innovative startups, at least due to the privacy changes that have taken place or soon will.

Deal flow for funding has consistently decreased in the past eight years, from a high of nearly 1,300 announced deals in 2014 and 2015 to just 557 last year, according to Crunchbase data.

The changes Apple has already implemented and Google being in the process of doing so, is having a ripple effect on the industry leading to less investments in new “adtech” startups, said Paige Leidig, chief marketing officer at Santa Clara, California-based NetBase Quid, a consumer and market intelligence platform.

Leidig said on the other hand, VCs are having to invest more in existing startups as valuations have exploded from the depths of COVID.

“When analyzing the industry, the lack of new startup funding is reflective that there has not been much innovation or innovative technology in recent years,” he said.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers