Aron Schwarzkopf is the CEO of Kushki, a Latin America-based payment platform that standardizes local payments and conversion rates across borders.

Second only to China, Latin America, along with the Middle East and Africa, are tied for the world’s fastest-growing retail eCommerce markets. Consumers are putting their money where their mouth is and proving that diverse options for digital payments, cybersecurity, and positive user experiences on platforms are essential to this growing industry.

Subscribe to the Crunchbase Daily

With 649 million people living in Latin America and mobile subscribers making up 68 percent of the population, there is significant potential for growth across the region. Along with these digitally-connected consumers and Latin America being one of the fastest-growing eCommerce markets in the world, comes significant potential in the region.

In 2019, over 150 million Latin Americans are expected to buy goods and services online, while retail sales alone are expected to surpass US$84.7 billion by 2019. But more importantly, Latinos have begun to procure a great deal of primary services through their mobile phones, as well as billpay.

Here are four predictions on where eCommerce in Latin America is headed.

Increase in retail eCommerce and payment solutions

Globalization is bridging the connection between international brands and retailers to consumers worldwide. In Latin America, retail eCommerce sales are expected to grow 21.3 percent, bringing total sales to an impressive US$71.34 billion.

There is great potential to reach an expanding audience in Latin America who are showing significant interest in online purchases and, ultimately, it is essential for global online merchants to accept local payments country per country, digital cash and wire transfer payment options are surging in the region. But not limited to that, local card processing is significantly cheaper and has higher acceptance rates in comparison to handling card payments cross-border. Issuing banks in the region still reject a great majority of cross-border credit transactions, and debit cards are many times limited to transact locally.

Furthermore, two in three Internet users in Latin America said they are likely to use mobile wallets or similar payment methods during 2018 and 2019. In particular, consumers in Argentina and Mexico had the highest rates of in-store mobile payment usage among their regional peers, revealing that there is interest in expanded payment options. With this need for people to make digital transactions, a need for these new options is growing.

Expanded payment options create more inclusivity

Around 70 percent of Latin Americans do not have bank accounts and tend to be wary about making digital transactions and therefore are more comfortable making cash or wire transfer transactions. Despite the region being a predominantly cash-driven culture, the culture is changing fast, and more acceleration is coming through the exploding neobank industry, which is giving out credit and debit cards to the unbanked at a very aggressive pace, an increasing number of people are showing interest in paying from their devices. Current ways in which people are conducting transactions include paying by phone, e-checks, cash-based payments, and local card installment options that let customers sparse out payments over a fixed period.

For those who are using digital platforms for bill pay and purchasing products and services online, both startups and traditional financial institutions are offering mobile payment options throughout Latin America, which is attracting overseas investors and proving that there is monetary interest in this sector. This apparent need for more diverse payment options has motivated fintech startups in Latin America, resulting in an impressive US$600 million worth of investments in VC funding in 2017 and is expected to grow in the coming years.

As new payment options come to market, more consumers will take part. Traditional banking leaves out a significant portion of consumers, but alternative payment options can bring this group online.

Millennials continue to be influential consumers

Millennials and Generation Z are paving the way for eCommerce in Latin America as their proximity and dependability on tech is more significant than older generations. Two-thirds of all Internet users are under the age of 35, and the region is one of the fastest-growing in terms of its smartphone usage. This younger generation prefers to use debit and credit cards for purchases with 32 percent preferring to make purchases through online payment services.

In 2018, 27.5 percent of all online retail transactions were on mobile devices. Purchasing clothing and electronics online has always been popular, but now millennials are increasingly using their phones to buy everyday products. The successful payment option platforms are the ones providing a user-friendly experience that keeps consumers—and their money—coming back. This age group is very receptive to new technologies, and because they are developing even more spending power as they age, they are quickly becoming a key factor in the expanding eCommerce industry.

Improved security measures mean more trusting customers

Latin Americans traditionally have a preference to use cash over card transactions and are wary of putting their information online if it is not necessary. This is a result of a lack of robust anti-fraud technology in the past decade throughout the region. However, new payment entrants are leveraging local databases, coupled with machine-learning capabilities, in order to rapidly deploy secure technology equal to the ones used in developing nations. More security means more trust. More than six out of 10 digital consumers felt safe making digital purchases, with Argentina leading the way with 78.7 percent of their population trusting these transactions and Peru (56.4 percent) as having the lowest amount of trust.

To create a more secure platform, companies are focusing on creating secure networks, monitoring systems and networks regularly, and maintaining their security policies. The demand for multiple payment options is increasing and along with it is the need for cybersecurity measures to be taken to hold the interest of the next generation of consumers.

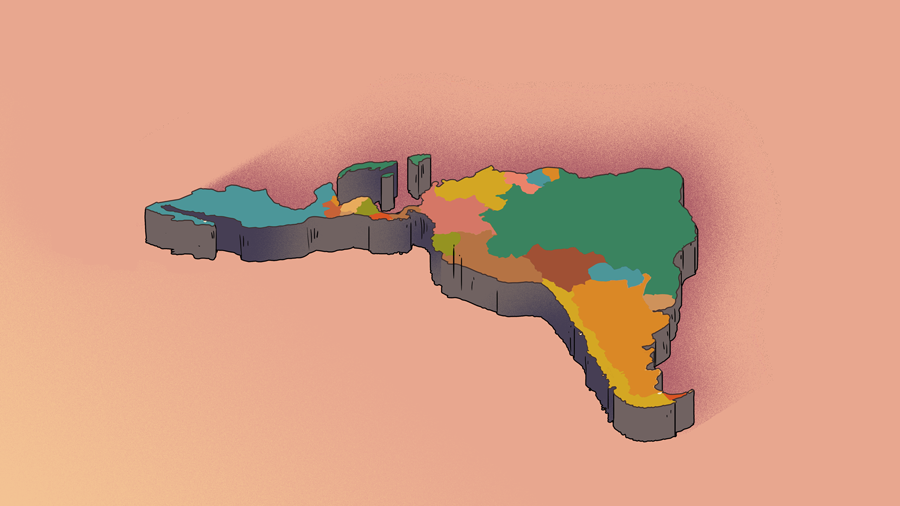

Every Latin American country has its unique market

eCommerce in Latin America cannot be treated as one entity as it encapsulates many countries with vastly different economies. Percentage of mobile users, investment in local infrastructures, social and political impacts, and Internet connectivity are unique across the region. Despite these variables, there is great potential to reach new customers and abundant opportunities for eCommerce businesses and payment solutions platforms to attract cross-border customers in the region.

Illustration: Li-Anne Dias.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers