By Colin McCrea

With today’s uncertain economic climate, valuing a business has definitely changed. There are lower expectations for earnings, more risk at stake, and many other unknown complexities that your business might not be prepared for.

When an economic downturn occurs, business valuations must be conducted in a way where the most optimal valuation results are achieved.

How does an economic downturn impact business valuation?

While most economic downturns happen due to traditional factors, there are some factors that are hard to predict. Business valuations can be affected by an economic downturn in two ways; it can lower the expectation of business earnings, and there could be a more conservative business risk assessment that can lead to higher discount and cap rates.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

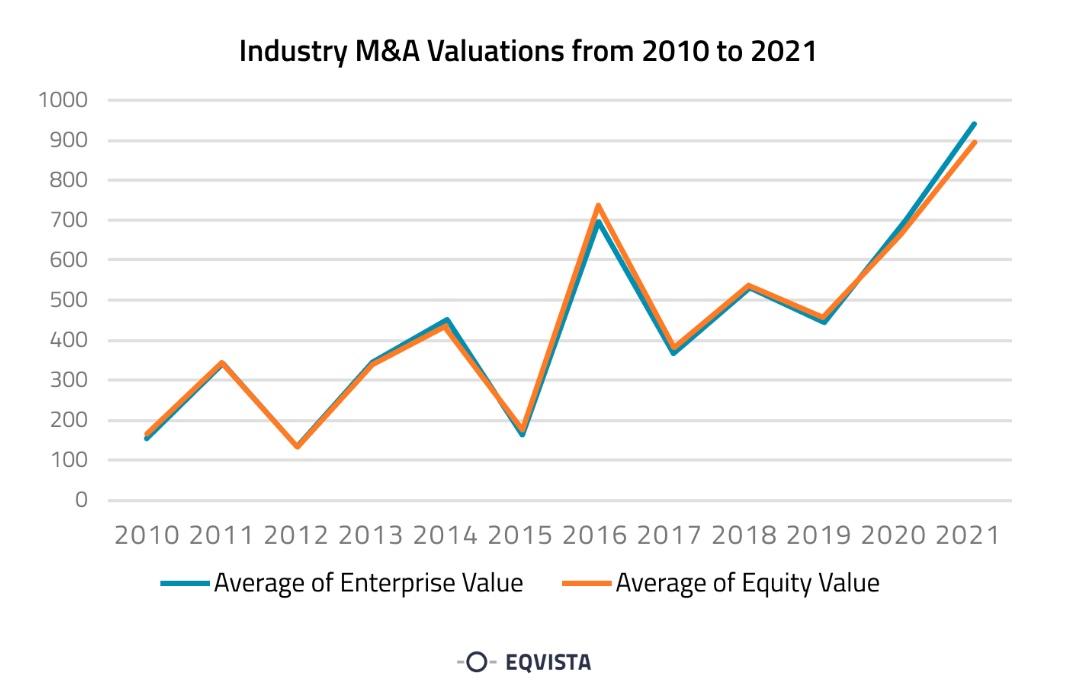

Despite the economic downturn that COVID-19 has triggered, there was a major increase in U.S. venture capital investments. From 2020 to 2021, the investments nearly doubled, which led to a major leap in startup valuation in 2021.

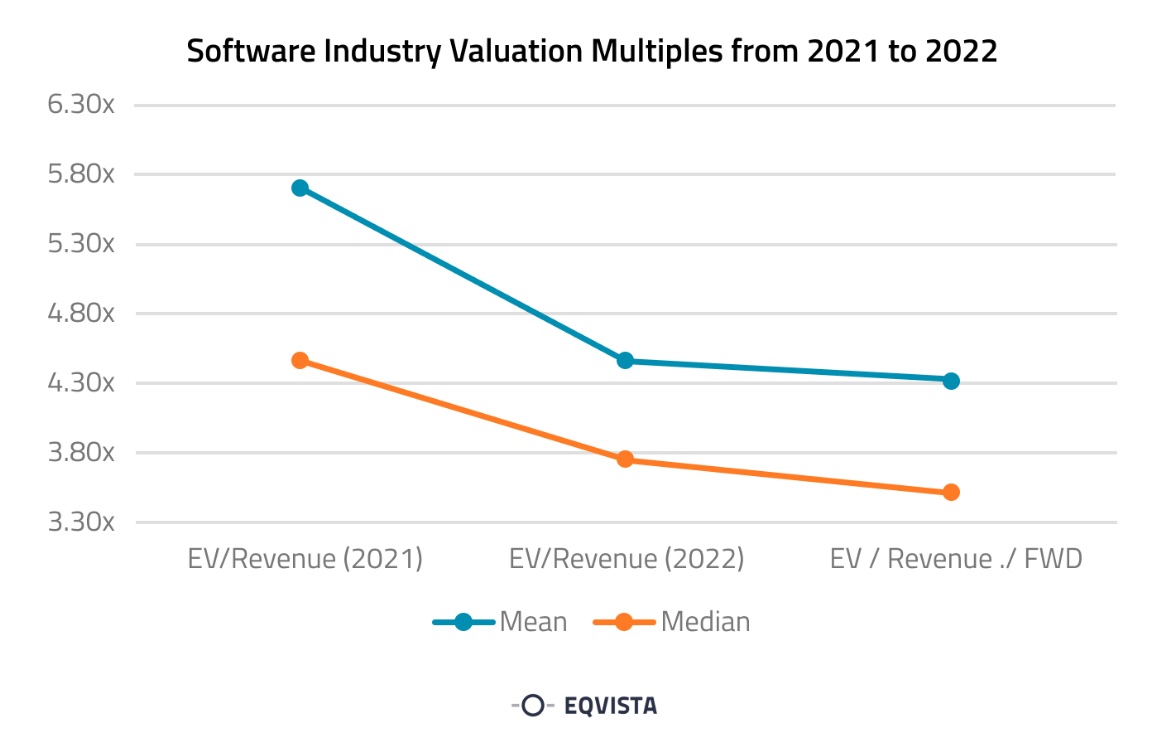

However, despite the major influx in venture capital investments, there was a dip in valuation from 2021 to 2022. For example, public software industry valuation multiples decreased in the past year as shown in the graph below:

According to venture capitalists, this dip in valuation multiples could be due to several factors. These include inflation, tensions in the geopolitical scene, expected interest rate hikes, and what seems to be a never-ending COVID-19 pandemic.

Getting value

During economic downturns, the level of uncertainty surrounding business valuations can make this process difficult. Here are some tips that can assist you in valuing a business in an economic downturn:

1. Improve cash flow: Economic downturns naturally pose a threat to cash flow, and in an effort to fuel growth and operations, companies should work to improve their cash flow and maintain steady earnings.

2. Identify which risks you are facing: A business that is vulnerable to a potentially unpredictable economic environment must be prepared for the worst-case scenario. The business valuation consultant must establish a thorough understanding of the risks faced and the level of impact on the business.

3. Budget for mid- and long-term growth: For a business in an economic downturn, the key to improving a valuation may lie in long-term planning and annual budgets. It is important to develop a financial plan for the business and allocate funds to strategic initiatives at the appropriate times.

4. Increase marketing and networking: Increased marketing and networking will drive traffic to the business, thereby improving its visibility and generating leads. In an economic downturn scenario, focusing on marketing and increasing the level of exposure is important.

- Increase organic marketing vs. ad spending: Advertising can be quite expensive, and any additional expenses will be scrutinized during an economic downturn. Thus, to make the most of your investment in marketing, it is best to increase the budget for organic marketing instead of advertising.

5. Do not demotivate employees: During an economic downturn, any negativity directed toward the employees can negatively impact morale and productivity. The business valuation consultant must strive to maintain a positive environment during an economic downturn.

Drastic economic downturns and market declines can have a major impact on business valuation. The key to ensuring you get the best result from business valuation is to establish a fundamental understanding of the industry and the economic climate.

Colin McCrea is a certified valuation analyst with years of experience in conducting business valuations for clients across many industries, both funded (Seed to Series C) and more traditional companies. He is currently with Eqvista.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers