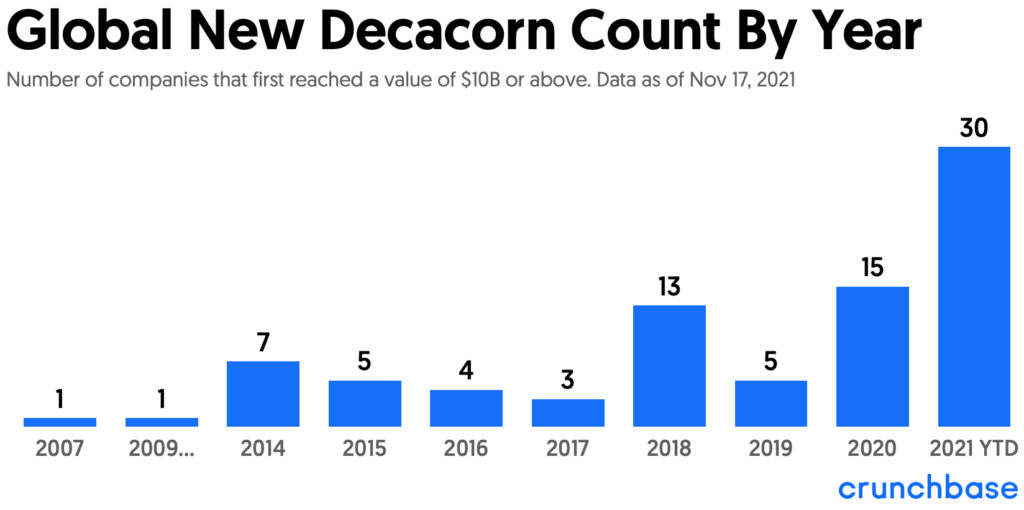

More new startups valued at $10 billion or above have been minted in 2021—far more than in any prior year, and double the number created in 2020, which set the previous record for new “decacorns,” as these highly valued companies are known.

Subscribe to the Crunchbase Daily

All told, 30 companies have been newly valued at a decacorn valuation in 2021 so far, Crunchbase data shows. This contrasts with half that count at 15 in 2020 and five new decacorns in 2019.

Grammarly, a writing tool and Faire, a marketplace for retailers and wholesalers, both based in San Francisco, were the most recent additions valued at $10 billion just this week.

The first decacorn

This year’s growth shouldn’t necessarily come as a surprise, given that 2021 has been a record-shattering year for venture funding around the globe, The Crunchbase Unicorn Board recently peaked above 1,000 companies for the first time, and private equity and hedge funds have rushed to fund high-growth startups at unprecedented rates this year.

Still, it’s worth noting that it’s only been 14 years since the first decacorn emerged. That was Facebook, now Meta, which became the first decacorn when it was valued at $15 billion in a funding round in 2007 via a strategic investment from Microsoft.

2021 decacorns

Amongst the new decacorns of 2021 are Sydney-based online-design platform Canva, which is now valued at $40 billion and jumped to the sixth most highly valued private unicorn this year. It has added $157 million in value daily since its prior funding in April 2021, which valued the company at $14.4 billion.

San Francisco-based data and AI company Databricks, valued at $38 billion in August 2021, is now listed as the eighth most highly valued private company. It received a $10 billion valuation hike in only six months, following its previous funding round in February 2021 that valued the company at $28 billion.

London-based neobank Revolut, valued at $33 billion, is another new 2021 decacorn. It is now the tenth most highly valued company in the world, per Crunchbase data. Just over a year ago, in July 2020, it was valued at $5.5 billion in a funding round—meaning it added $27.5 billion in value in short order, averaging to around a $77 million daily valuation hike in a 12-month time frame.

Other new 2021 decacorns include Bahamas-based crypto exchange platform FTX, valued at $25 billion, and Shanghai-based social e-commerce platform Xiaohongshu, valued at $20 billion. Both make the top 20 most highly valued companies as of this writing.

Liquidity

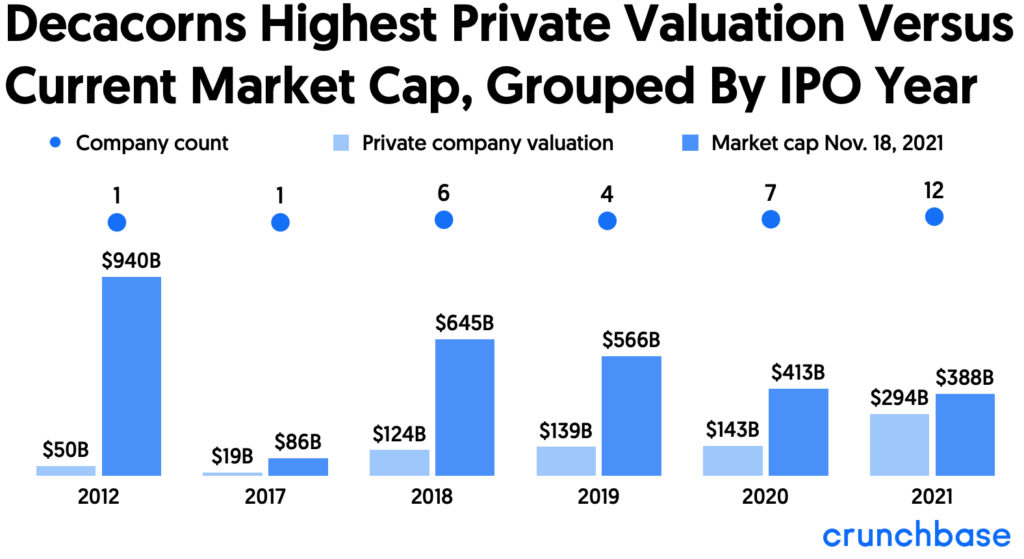

Twelve decacorns have exited in 2021. Those include three companies that became decacorns just this year, before going public: Rivian, Roblox and Squarespace.

Of the 31 decacorn-valued companies that have gone public since Facebook IPO’d in 2012, the majority are trading at market caps above their highest private valuations. Exceptions to this as of Nov. 18, 2021 are WeWork, Lu.com, Paytm, Didi, Wish, UiPath and Squarespace. Paytm is the most recent decacorn to go public.

A short history of the decacorn

When did $10 billion valuations first become a phenomenon for private companies?

After Facebook’s debut as the first decacorn in 2007, the next didn’t come along until two years later—that, by our calculation, was Alibaba, which was valued north of $10 billion in 2009 in a funding led by global growth equity investors General Atlantic. Two years later, Alibaba was valued at $32 billion in a funding round led by Silver Lake and DST Global.

Then no companies were newly valued at $10 billion until 2014, per Crunchbase data.

In 2014, seven companies were valued at $10 billion for the first time. These include now public companies Snap, Dropbox, Xiaomi, Uber, Palantir, Airbnb and Flipkart acquired by Walmart in 2018. New decacorn counts dropped each subsequent year until 2018, where newly valued decacorns first reached double digits at 13.

A total of 84 decacorns have been minted since the first private $10 billion valuation in 2007. Of these, 33 have since exited, leaving 51 decacorns still seated atop the The Crunchbase Unicorn Board.

More to come

As we head into 2022, private equity and hedge funds are looking to invest in high-growth companies pre-IPO. With more than 1,000 private unicorns and counting, and 90 of those valued between $5 billion and $10 billion, we can expect new decacorn creation to continue at a steady pace in 2022.

Next in this series, Crunchbase News will look at the most active investors in these high-growth, decacorn-valued companies.

Crunchbase Pro queries relevant to this article

Methodology

Decacorn companies are assessed based on the following criteria: A privately held, venture-backed company valued at $10 billion or more in a funding event.

Exited decacorn companies are companies with a $10 billion private round valuation that have since been acquired or had a public debut.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers