Funding to venture-backed travel and tourism startups fell to a five-year low in 2020, a year defined by the COVID-19 pandemic and the stay-at-home mandates that came with it. But that trend may be turning around, if early funding data and investor enthusiasm are any indication.

Subscribe to the Crunchbase Daily

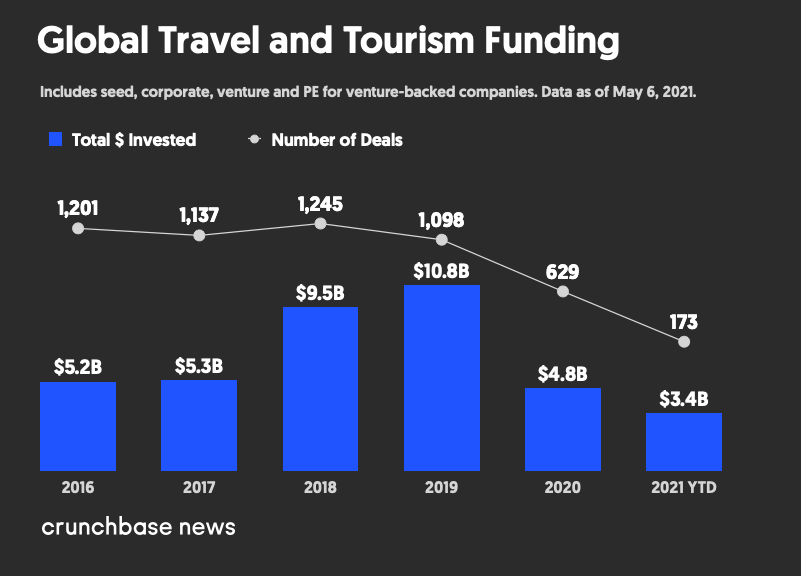

Funding to venture-backed startups in the travel and tourism sector amounted to around $4.8 billion across 629 deals in 2020, Crunchbase data shows. Both the dollar amount and deal count hit a five-year low. And that followed a record in 2019, when funding to travel and tourism startups in the past five years hit a record $10.8 billion.

So far this year, companies in the sector have raised about $3.4 billion across 173 deals, according to Crunchbase data.

“It’s a really exciting time to be investing in the space,” said Kristi Choi, an investor at Plug and Play Ventures. “And we talk a lot about this because I really feel like travel is at an inflection point for a couple different reasons.”

Companies that have survived the pandemic have learned how to stay resilient and have used the time to tailor their value proposition, Choi said, pointing to how travel startup Sherpa added travel restriction monitoring and guidelines on top of its visa application offerings. And with the crisis, new travel habits have emerged and evolved.

“I think history is a really good indicator,” Choi said. “We talk a lot about the financial crisis in 2008, and we’re seeing there are similar patterns with the pandemic.”

Choi noted that some of the best fintech companies were born during the financial crisis. Stripe and Square, for example, were founded around the time of the Great Recession.

Travel and tourism has been one of the hardest-hit industries during the pandemic, as social distancing guidelines and travel restrictions have kept people at home. But that could mean the travel companies that survived the past year could emerge stronger.

“We’re firm believers that when crisis hits an industry, you can rebuild and invest,” Choi said, noting that she’s seeing the strongest pipeline in travel investments that they’ve had in a while.

Alternative accommodations, such as short-term rentals, and the tech that could make alternative accommodations a more attractive option, is one area Choi pointed to as promising. Another popular feature to pop up is travel companies that also have a fintech component to them, such as a “buy now, pay later” option.

There are already some signs that travel is picking back up and the industry is rebounding. Flight bookings and the number of travelers being screened by the Transportation Security Administration are up, according to Michael Coletta, manager of research and innovation at travel market research firm Phocuswright.

Demand is outpacing supply for short-term rentals outside of major cities, he said. “People are definitely clamoring to get out the door and take trips, and I think investors see that and will be much less cautious putting money into the market this year,” Coletta said. “Because they really see the pent-up demand is starting to materialize.”

And for travel companies, they’ve begun to see some signs of investor interest as well. Companies in the travel and tourism space have raised $3.4 billion so far this year. Among the notable deals are Hopper’s $170 million funding round, which was announced in March, and TravelPerk’s $160 million round last month.

Business travel management platform TripActions also announced its first-ever acquisition last week, buying London-based corporate travel management company Reed & Mackay. While leisure travel is already returning, business travel is expected to rebound eventually as well, according to TripActions chief travel officer Daniel Finkel.

TripActions’ travel bookings have increased 30 percent month over month since the beginning of 2021, according to Finkel. TripActions is also seeing more corporate travel and an increase in the number of travelers per company, he said.

“In terms of future bookings, 60 percent of business travelers book their travel within the month of travel — and that is in a normal year,” Finkel said in an email. “That said, we are seeing future bookings. The average lead time for booking travel has increased from a pandemic-low of one day prior to travel to now seven days (pre-pandemic norm was about 13 days), so we do know that people are starting to feel more comfortable making advance plans.”

Reports indicate that more people are starting to feel comfortable making advance travel plans as the COVID-19 vaccine rollout accererates. According to Bloomberg, about 252 million doses of the various COVID-19 vaccines have been administered in the United States as of Thursday, May 6. Many cities across the U.S. are easing travel and lockdown restrictions, as have some other countries, such as Iceland and the European Union.

The one externality that could still scare people — and investors — off travel are new COVID-19 variants that have cropped up. That’s because if people believe the vaccine isn’t effective against them, they’re less likely to travel.

“Investors are still betting big that business travel will come back,” Coletta said. “Maybe not this year or next year, but at some point. There’s still big money going into that sector.”

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers