Morning Report: Continuing our exploration of 2017’s tech IPO crop, let’s talk about Snap’s recent declines and how they are rapidly pushing it closer to Twitter-landia.

On July 11, Snap underwriter Morgan Stanley cut its view of the company, lowering its price target in the process. The scale of the downgrade was staggering. For context, here’s CNBC on the matter:

Shares of the social media company closed 8.95 percent lower at $15.47 a share after the call. A [Morgan Stanley] team lead by analyst Brian Nowak downgraded the stock to equal weight from overweight and slashed their price target to $16 from $28.

As you can see, Morgan Stanley wasn’t prescient to forecast that Snap’s shares would struggle in the market at the time, as it already was. Instead, the company was anti-prescient before by greatly overestimating where Snap’s shares would trade previously. This was correction, not prognostication.

Regardless, the change from $28 to $16 is over 42 percent. That’s steep.

But Snap has continued to dip, trading under the $15 mark today. That fact brings up two quick points that keep buzzing around the back of my head:

- Snap’s last private round looks increasingly odd. The firm was worth $19.3 billion (post-money), after raising $1.8 billion at a $17.5 billion pre-money valuation. Back then its revenue was in the generating revenue in the tens of millions per quarter. Snap, now worth $17.47 billion (so close to its prior pre-money valuation!), puts up revenue numbers north of one hundred million each quarter. Thus we see, again, the gap ‘twixt private and public valuations at play.

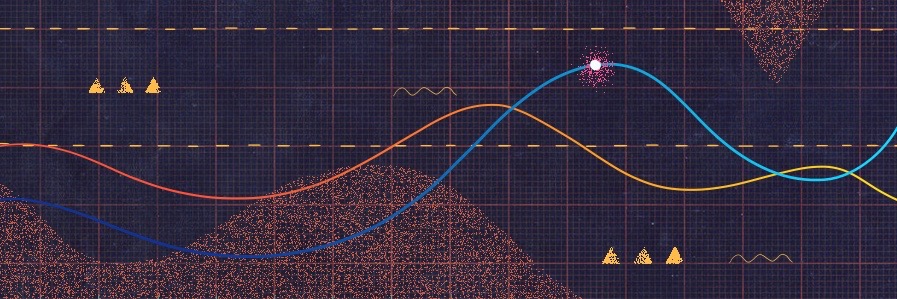

- And will Twitter’s market cap eventually surpass Snap’s? The gap looks like this over time:

That chart tracks the ∆ from Twitter’s market cap up compared to Snap’s, so at zero the firms are equally valued. The trend, I posit, isn’t hard to grok.

But now in earnings season are we. So all bets are off regarding when parity could be reached, as both Twitter and Snap both have historical precedent for wild post-earnings trading swings.

For now, what was once unthinkable, that Snap could stumble and Twitter could rise — it’s over $20 today! — is slowly working on coming to pass. What an odd year.

From The Crunchbase Daily:

Plenty harvests $200M for indoor farms

- Plenty, a developer of high-yield indoor farms, has raised $200 million in a Series B round it described as the largest agriculture technology investment in history. Softbank Vision Fund led the round for the three-year-old, South San Francisco, Calif.-based company, with participation from several existing investors.

Receipt Bank secures $50M Series B

- Bookkeeping software provider Receipt Bank closed a $50 million funding round led by Insight Venture Partners. The London-based company, founded in 2010, develops tools for collecting and extracting data from receipts and invoices.

Tech’s big five now worth $3 trillion

- Tech’s five most valuable players just crossed the $3 trillion aggregate market cap mark, according to a Crunchbase News analysis. It’s a feat that marks a new threshold for tech amidst the current boom. (For more stories, follow @crunchbasenews on Twitter and check us out on Facebook.)

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of a guy watering plants with a blocked hose - Global [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/quarterly-global-3-300x168.jpg)

67.1K Followers