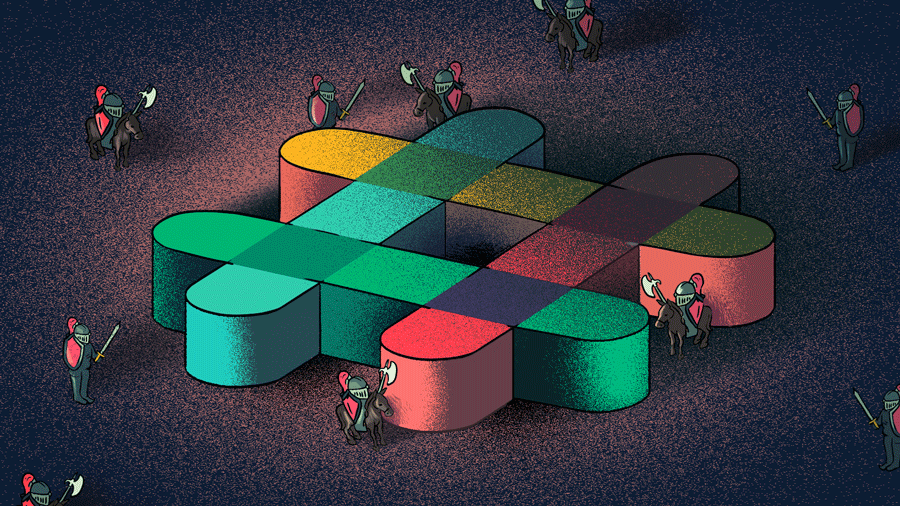

Morning Report: The fine crew at TechCrunch scooped last night that Slack is raising $400 million at a $7 billion valuation. How does that measure compared to what we know about Slack’s financial performance?

TechCrunch’s Ingrid Lunden and Josh Constine reported that workplace collaboration tool Slack is back at the funding well, this time hunting for $400 million at a $7 billion valuation. A year ago, Slack raised $250 million at a roughly $5 billion valuation, bringing its total capital raised to around $790 million at the time.

Another $400 million would put Slack over the $1 billion raised threshold. And with a valuation of $7 billion, Slack would push higher into the upper crust of global unicorns.

The possible new round raises two questions: why is Slack raising again, and is the company worth $7 billion?

Why Raise Now?

The company is likely raising now because it can access the capital. Markets are hot, mega-rounds are in vogue, and Slack is a badge that anyone would want in their portfolio. And while I doubt Slack will struggle to find $400 million, the firm will have a harder time getting the same stack of money in a year’s time if market conditions deteriorate.

Getting cash while the market is willing to charge you a minimum for it is intelligent. And with competitors far from quashed, Slack may need an infusion to build out its own service while fending off rivals hungry for its rapidly expanding recurring revenue.

On the competitive front, Slack may have neutered Atlatssian’s potential rival to its platform, but that doesn’t mean that Alibaba’s DingTalk or Microsoft’s Teams products have been dealt with. DingTalk is said to be the largest office chat app, and Microsoft is investing in Teams heavily, including releasing a free version of the product.

And while Slack is well capitalized, Alibaba and Microsoft are capital made flesh.

Finally, Microsoft recently mentioned Slack as an Office competitor in an SEC filing. From that we can presume that Redmond is hellbent on killing what it failed to buy.

Why $7 Billion?

Crunchbase News previously took a look at Slack’s paid seat count and reported ARR figures to figure out how much revenue the technology company pulls in from each of its users.

In September of 2017, Slack had 2 million paid seats and ARR of around $200 million. In May of 2018, the firm noted it had reached the 3 million paid seats, but declined to detail its then-current ARR. Using other public and reported data (here) we estimated with moderate confidence that Slack was likely around the $300 million ARR mark early this summer.

It took Slack from September to May to add 1 million paid seats. It seems unlikely that Slack has added another million between May and August. As such, Slack’s ARR is probably under the $400 million mark today.

If we presume that Slack has reached the $350 million ARR threshold, a $7 billion valuation would value Slack at 20 times its current annual recurring revenue.

That sounds high until you realize that Slack is accreting ARR at a silly clip, pushing that multiple quickly down. Investors are willing to pay for growth today, so why not park your capital in a company that only grows? It just makes sense from the current investor perspective.

Slack will need to grow into its $7 billion valuation, but that’s fine. The company will have the capital to do so.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of pandemic pet pampering. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/03/Pets-2-300x168.jpg)

67.1K Followers