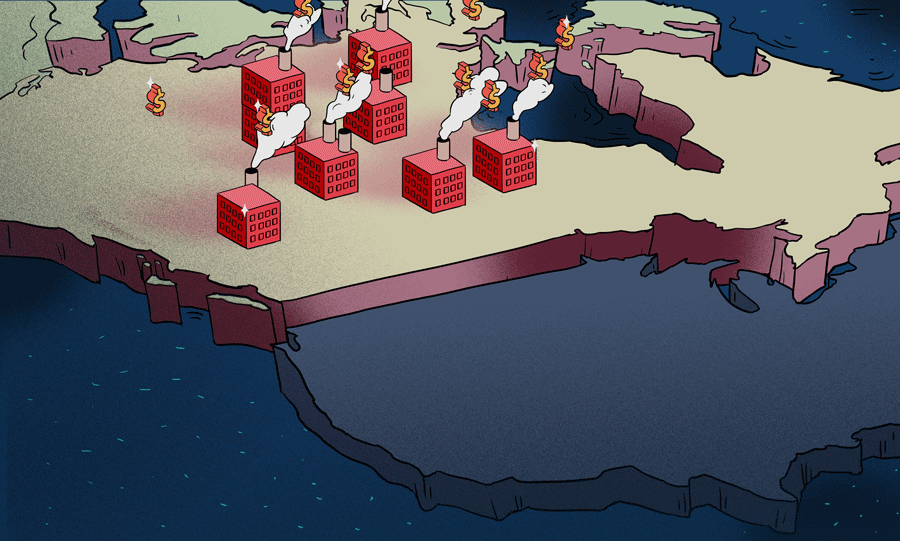

Venture capital investment in Canada is way up compared to years prior, and a lot of that funding comes from U.S.-based firms. Last week, we drilled into what’s driving the increases in funding and how the country’s tech ecosystem is growing.

Follow Crunchbase News on Twitter & Facebook

This week, we’re looking at which regions and sectors in Canada are hot and why.

The Great (Green) North

The country’s three big entrepreneurial ecosystems are in Toronto, Ontario, Montreal, Quebec, and Vancouver, British Columbia, according to Mike Woollatt, CEO of the Toronto-based Canadian Venture Capital and Private Equity Association (CVCA).

But it’s Toronto – which is one of North America’s largest cities – that is by far and away the biggest Canadian market in terms of startups and amount invested. As seen in the chart below, Ontario was home to 48 percent, or nearly half, of the venture capital dollars invested in Canada since 2012.

The Toronto/Waterloo corridor is also home to most of Canada’s finance sector. Woollatt likens its startup scene to that of New York. Then there’s Vancouver, which he said has a very similar feel to the San Francisco Bay Area with a more laid-back, West Coast style.

“You won’t find a suit in Vancouver,” he joked. That city is home to Hootsuite, a widely used platform for managing social media. Woollatt believes it’s one of the country’s roughly dozen or so unicorns.

“There’s huge companies operating in the fintech and AI spaces right now,” he said. “In general, the ecosystem is growing rapidly, and we’re seeing more VCs focused on niches.” (This is happening across the border as well: America has seen a dramatic rise in VC interest in AI for example.)

Chris Erickson, general partner of Vancouver-based Pangaea Ventures, believes there has been an increase in venture capital investments mainly in three Canadian provinces: Quebec, Ontario, and British Columbia.

“They are all excellent innovation hubs and home to some of the world’s top universities,” he said. “And there are several AI centers at universities in Canada that are creating good spinoffs.”

Another burgeoning sector is information and communication technologies (ICT). In 2016, the CVCA estimates $1.6 billion (CA$2 billion) was invested in ICT startups across 330 deals. Life sciences was second with investments of $585.9 million (CA$730 million) over 103 deals.

One challenge for Canada has been keeping its talent from migrating south. Many of them go back and forth between the valley and Canada, according to Woollatt. Some of the higher-profile members include Garrett Camp, co-founder and chairman of Uber, and Slack Technologies’ co-founder and CEO Stewart Butterfield.

“Unfortunately, we lose a lot of Canadians to the Valley,” Woollatt said. “It’s a big problem.”

Success Begets Success

Pangaea’s Erickson has seen his country’s tech ecosystem mature since his firm was founded in 2000.

“It’s just a great environment for startup companies,” said the investor of advanced materials startups. “Generally employees are very loyal – people don’t jump ship quite so often. Plus, it’s not as expensive to hire software people or scientists here.”

Erickson believes as more Canadian companies have proven successful, the more VC interest there has been.

“More VCs have been getting good returns, raising more money and investing it in Canadian companies,” he said. “We’d like to see that improve and grow.”

As evidence of such success, the CVCA reports that in the first half of 2017, the country saw 21 exits compared with 32 in all of 2016. So far the largest exit this year was San Francisco-based Airbnb’s $315 million (CA$393 million) purchase of Montreal’s Luxury Retreats International. There were also two venture-backed initial public offerings: Ontario’s Real Matters Inc. and Zymeworks Inc.

Erickson also points to the country’s research institutions as an excellent source of startups.

“Universities are different here. There’s more public support, and it’s less expensive for students to attend,” he said. “That’s being recognized, and we’re seeing more university spinoff companies getting venture funding.”

For its part, Pangaea recently led an undisclosed round in Vancouver-based Aspect Biosystems, a four-year-old biotech company focused on the 3D printing of human tissue. The startup was spun out of the University of British Columbia. Palo Alto-based Endure Capital also participated in the round.

A Founder’s Perspective

Tamer Mohamed, president and CEO of Aspect Biosystems, said the company was built on almost a decade of research. It’s currently focused on commercializing its 3D printing of tissues for a variety of applications in life sciences. Its technology could be used to predict how drugs are going to respond in our bodies before going through clinical trials.

It is also seeking to replace damaged or malfunctioning parts inside the body. To jumpstart this process, Aspect has inked a partnership with Johnson & Johnson to develop personalized 3D printed meniscus tissue.

While Mohamed concedes raising money “is never easy,” he believes his company has all the right features to make it attractive to investors.

“I’ve always believed the innovation we have in Canada is world class – from our research institutions, talent, and innovation,” he said. “Our company is an example of that. It’s just about getting the visibility on the global stage.”

In general, it’s harder to get the visibility you need and to build a strong network in Canada, Mohamed admits.

“The VC community is not as strong or as big as in the U.S.,” he said. “But we believe we are on a growth trajectory. And that helped make it easier.”

While Canada still trails far behind the U.S. when it comes to raising venture capital funds, there’s no question that the jump in financing has been impressive. But for the country to continue on its path of increased fundraising, it will need to focus on keeping more of its top talent at home and growing its companies’ exposure to outside investors.

Illustration: Li-Anne Dias

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of 50+ woman on smartphone. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/01/Femtech_-300x168.jpg)

![Illustration of pandemic pet pampering. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/03/Pets-2-300x168.jpg)

67.1K Followers