Investment into biotech and health care boomed during the pandemic as thousands of venture capital firms turned their attention to breakthrough artificial intelligence, cancer-detection technology, mental health treatments, digital doctor visits, diagnostics and more.

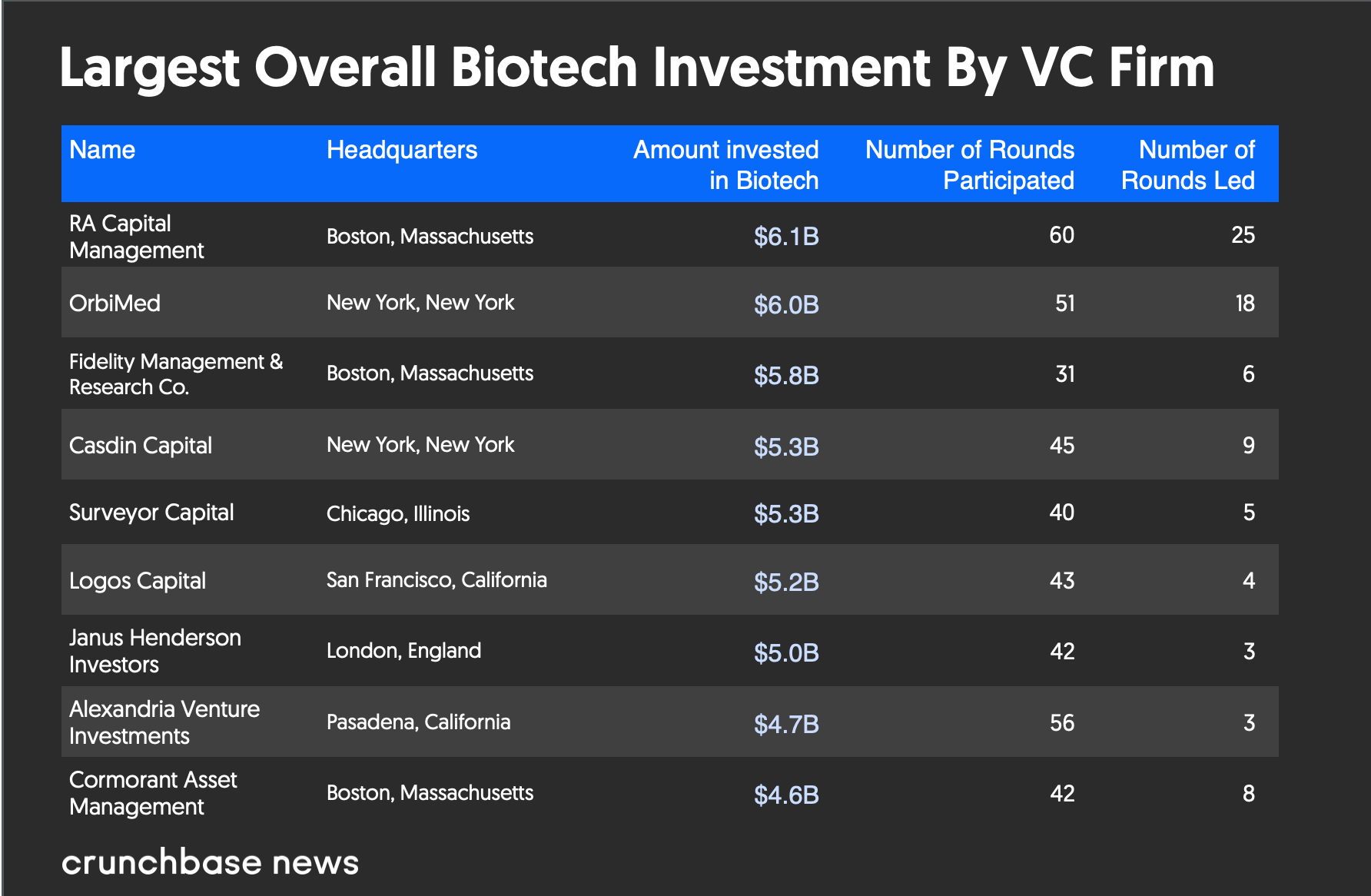

But two of those investment firms have emerged as major leaders, not only in the number of biotech funding rounds led, but also in overall dollars invested into the industry. Boston-based RA Capital Management and New York-based OrbiMed ranked first and second, respectively, on the two lists compiled using Crunchbase data.

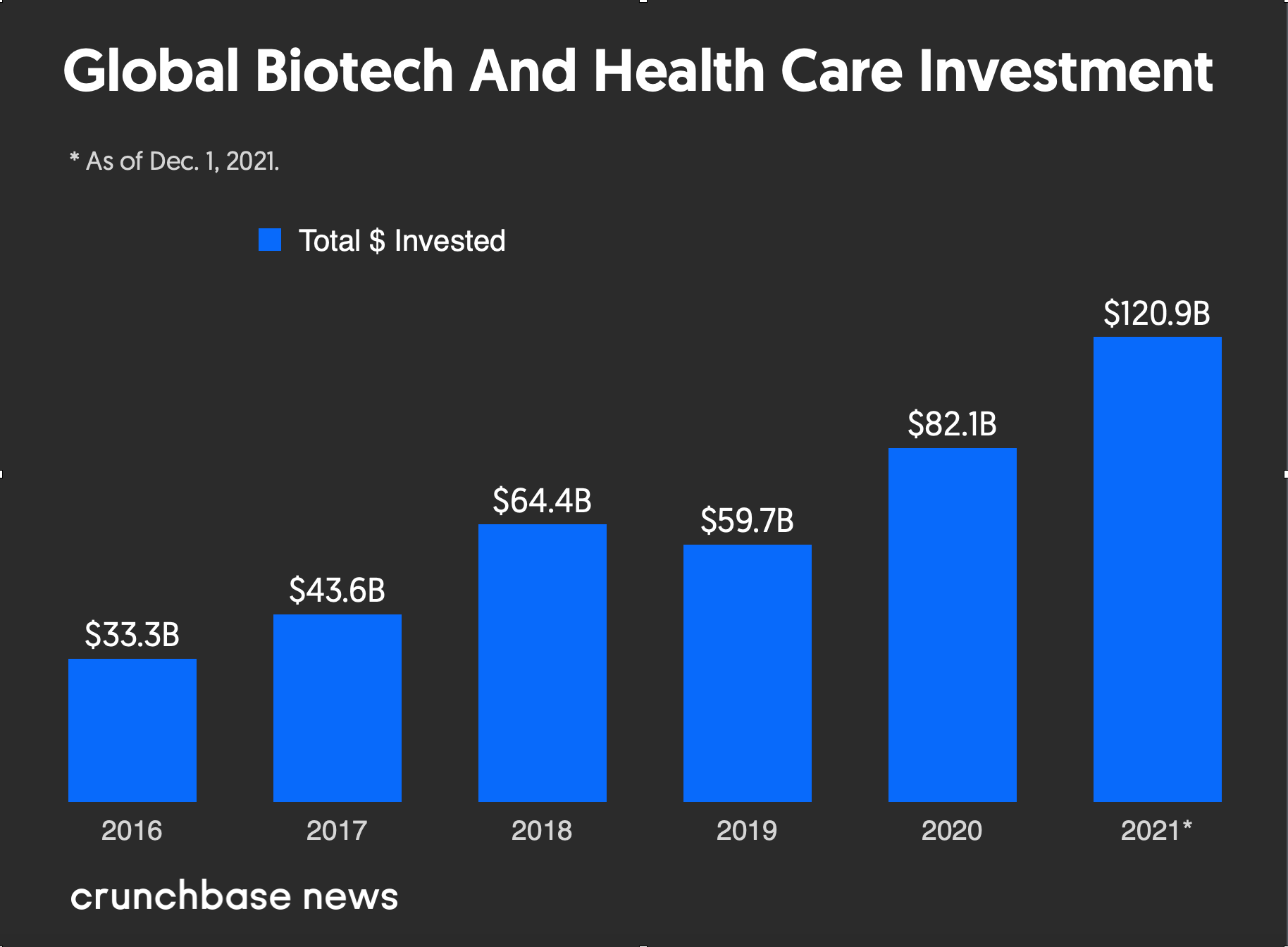

Although the two firms emerged as leaders in the data, they still make up a small part of the more than $120 billion in venture capital funds globally that poured into health and biotech startups as of Dec. 1 this year, Crunchbase data shows.

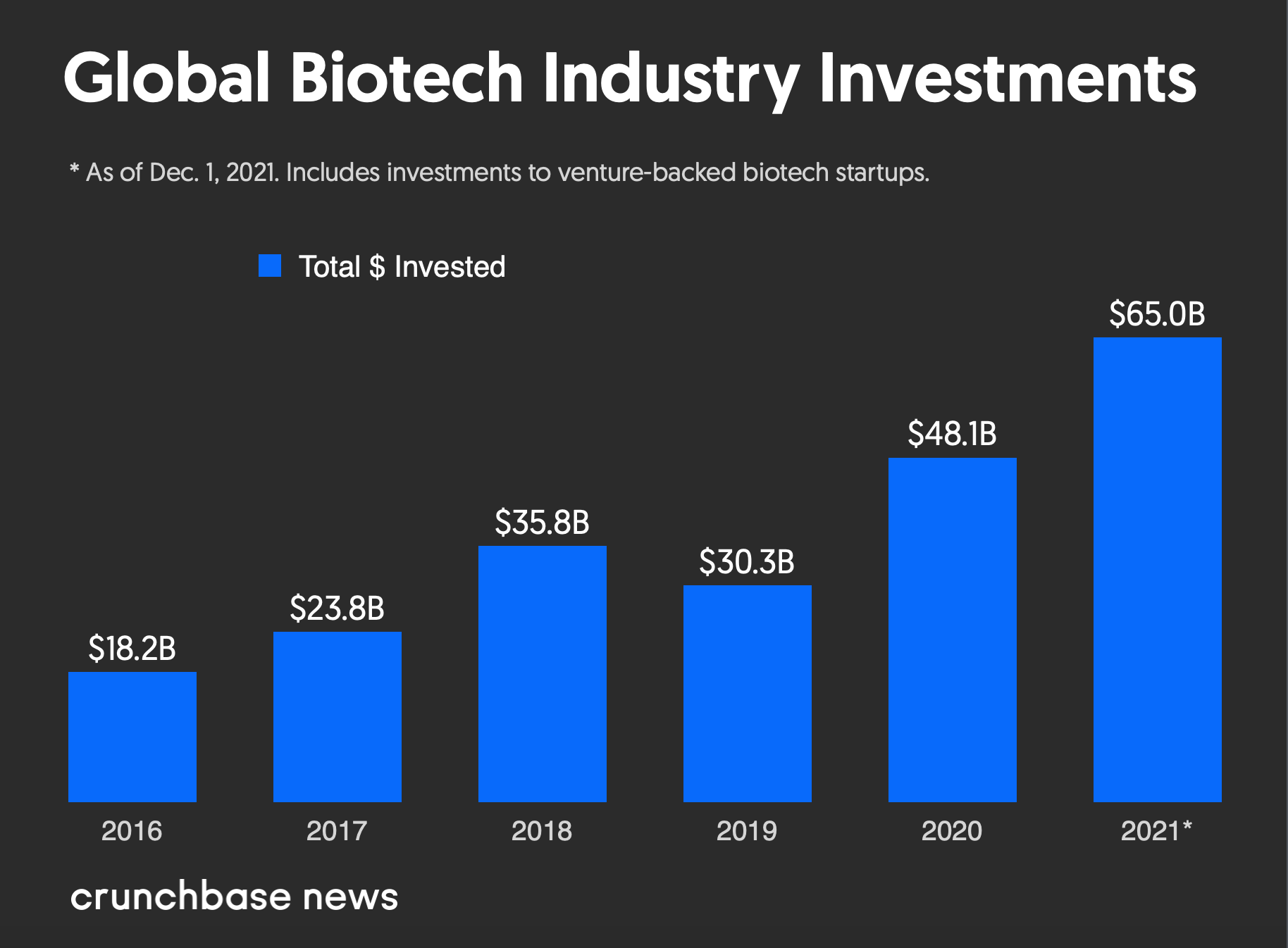

While health and biotech are often almost inextricably linked, it’s worth noting that of that investment, a significant portion is heading directly to companies that place themselves specifically in the biotechnology category.

Here is a breakdown of some of those leaders, based on Crunchbase data.

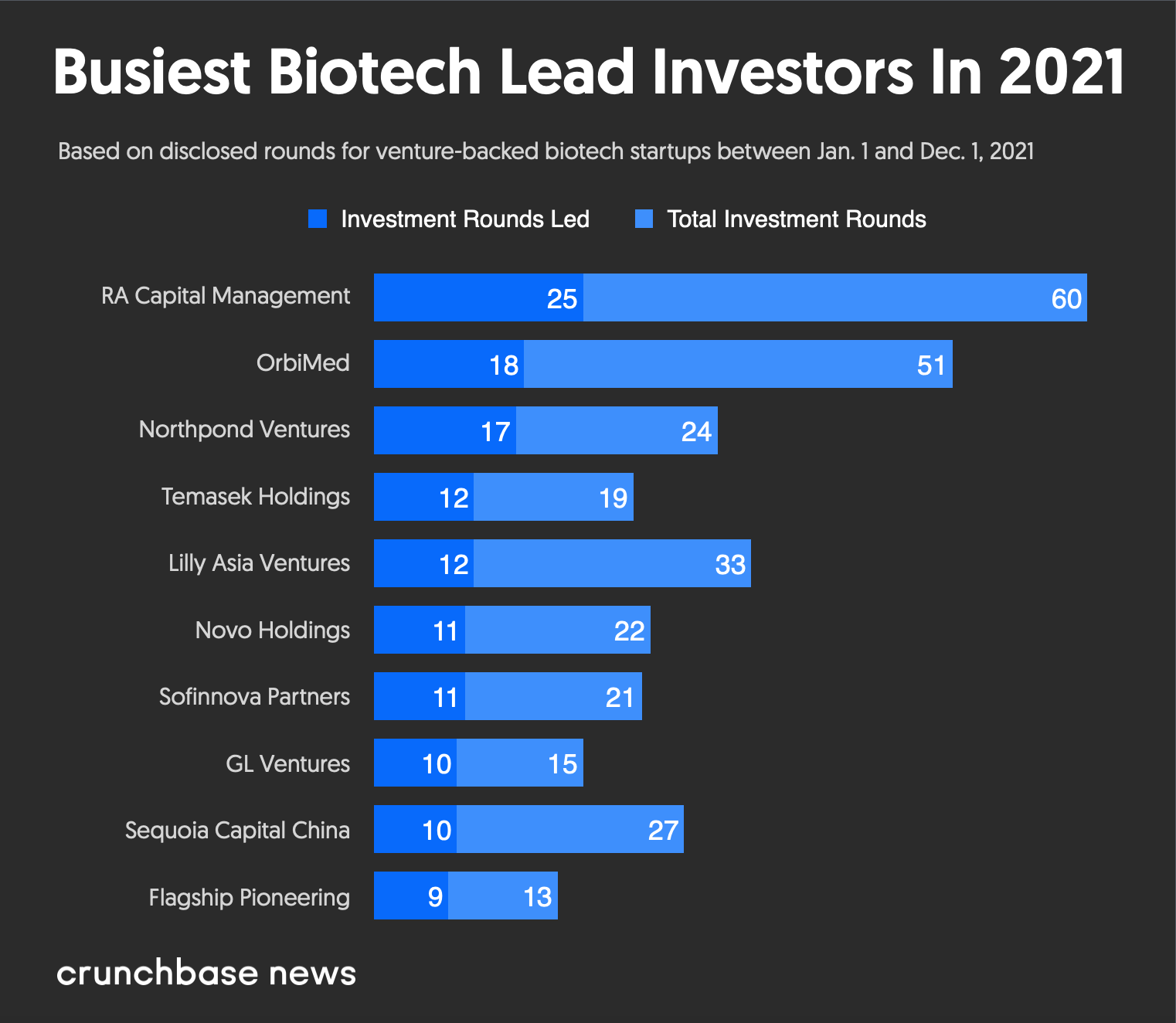

Most investment rounds led in biotech

Leading a funding round is a big undertaking. The lead investor often acts as the liaison between the startup’s founder(s) and the other participating investors, or is implicitly trusted by other investors to find the best terms for everyone.

These VC firms led the most funding rounds for biotech startups this year between Jan. 1 and Dec. 1, according to Crunchbase data. This data also illustrates the total number of biotech industry investment rounds each lead investor participated in during that time, including those rounds the firm led and those it let others lead.

Most money invested in biotech startups

RA Capital Management and OrbiMed led the way in both total dollars invested and the number of venture capital funding rounds led in the biotech industry last year—the only two firms to make it onto both lists.

Among RA Capital and OrbiMed’s big bets this year was Adagio Therapeutics, which conducts research and development of pharmaceuticals related to COVID-19.

RA Capital led the company’s $336 million Series C ahead of the company’s August IPO, though the firm hadn’t participated in the company’s earlier funding rounds. OrbiMed and Fidelity Management and Research Co., however, participated in Adagio’s Series A, B and C rounds.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

To learn more about these VC firms and their 2021 investments take a look at their Crunchbase profiles:

- RA Capital Management

- OrbiMed

- Northpond Ventures

- Temasek Holdings

- Lilly Asia Ventures

- Novo Holdings

- Sofinnova Partners

- GL Ventures

- Sequoia Capital China

- Flagship Pioneering

- Fidelity Management and Research Company

- Casdin Capital

- Surveyor Capital

- Logos Capital

- Janus Henderson Investors

- Alexandria Venture Investments

- Cormorant Asset Management

Illustration: Li-Anne Dias

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers