By Gina Gotthilf and Tomas Roggio

“Podrán cortar todas las flores, pero no podrán detener la primavera.”

— Pablo Neruda

Latin America was the fastest-growing venture capital market in the boom of 2021, dispelling historical neglect by investors. Leading up to it, the past decade showed record highs in startup creation, funding and growth.

That boom gave way to a bust, a characteristic cycle in developing economies: we’ve been facing a startup winter for two years.

But there are reasons for short- to mid-term optimism — so much so that we keep raising and investing through our Fund II.

The first reason: Founders building in these conditions need a stronger focus on unit economics, monetization, lean building and milestones. We’re bullish on this vintage, given our three years of supporting 1,250-plus entrepreneurs (who raised more than $700 million in aggregate equity) and investing in 70-plus companies.

The second reason: A relatively promising outlook on lowered interest rates in the U.S. and across Latin America. Real interest rates in Brazil, Mexico and Colombia tend to be the highest in the world, but we’re starting to see significant cuts in the region.

As rates go down, creating and betting on startups becomes more attractive, with investors searching for better returns in alternative assets. Startups in LatAm are alternative squared, even after Nubank‘s IPO and other clear signals that regional tech growth is inevitable.

The third reason: There’s dry powder to be deployed. Early- and late-stage venture capital firms worldwide and in LatAm raised funds in 2021, and since funds tend to have a 2- to 3-year deployment window, VCs are now getting close to their deadline for writing checks.

We’re already seeing interesting rounds across stages, such as Brinta ($5 million), Hyperplane AI ($6 million), Vammo ($30 million), Pomelo ($40 million), Conta Simples, ($41.5 million), Tractian ($45 million) and Nomad ($61 million).

The fourth reason: The inevitable and global increased bet on AI and AI-supported companies. We don’t predict massive core AI developments in Latin America, but startups leveraging AI as proprietary algorithms, wrappers or for efficiency should increase margins and receive VC attention.

The fifth reason: There is more qualified talent in the ecosystem than ever before. An unprecedented number of top operators and students are choosing startups over the corporate ladder and building in Latin America over finding success abroad (MercadoLibre, Nubank). Both second-time founders and employees at these success cases are looking for opportunities.

The sixth reason and Latin America’s biggest weakness: Massive problems everywhere. Just from our portfolio: Diabetes affects 40 million adults in Latin America and the Caribbean (Clivi); Latin America is one of the world’s leading food exporters in the world but SME exporters need financing (FinanEx) and to manage their data better (Agricompa); Fintech is booming but the infrastructure for getting into the billionaire credit market is lacking (Finkargo, Bamboo, Dinie, Kontempo, Vaas).

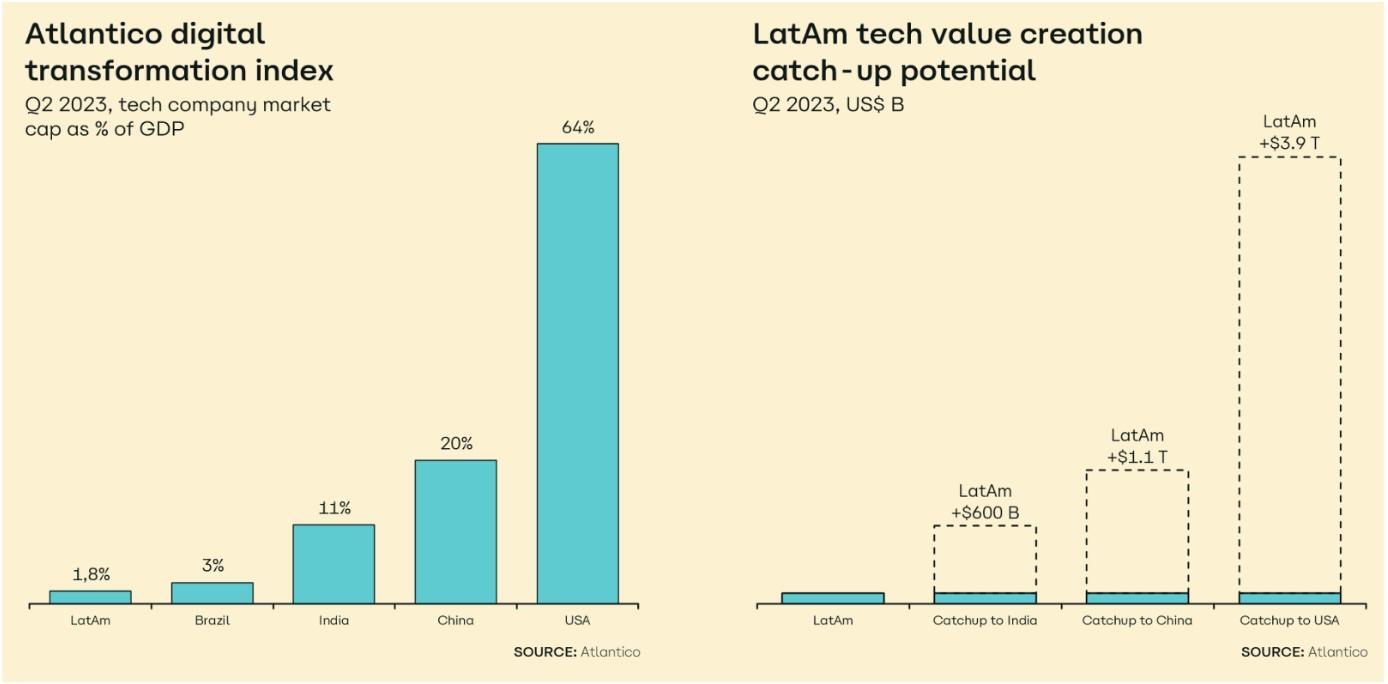

Our favorite indicator of the opportunity ahead is the delta between tech company market cap as a percentage of GDP across countries. LatAm has much to grow.

Even with these early-blooming signs, markets are still tough. While there’s always capital available for good deals, rounds will take longer, valuations will be less exciting, and investors will continue to be more selective than in 2021.

This becomes progressively common as startups advance and checks get more expensive. We encourage founders to stay default alive and assess their best moment to raise.

Tough times put entrepreneurs and investors to the test. We look forward to charging ahead alongside founders through both ups and downs — because we know there’s treasure just around the corner.

Gina Gotthilf and Tomas Roggio lead Latitud Ventures as full-time general partners. Gotthilf is Latitud’s co-founder and was previously an early employee and former vice president of growth at Duolingo, leading the company from three to 200 million users. Roggio spearheaded the 70-plus core startup investments made at Latitud Ventures.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers