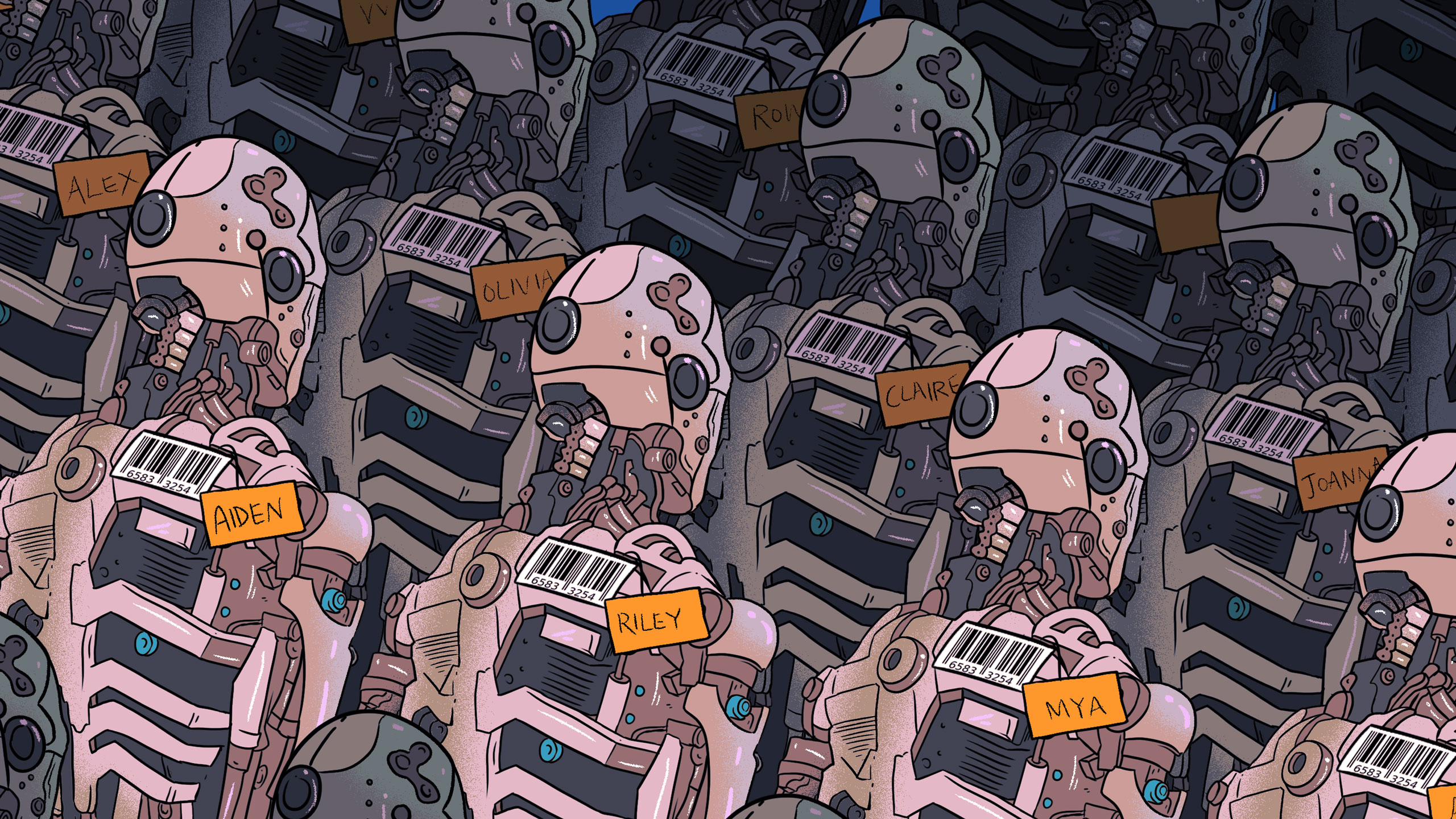

In the future, artificially intelligent machines will do more of the work we do today. We humans, meanwhile, will spend more time sipping cannabis-derived beverages and moving money around on our mobile phones.

Subscribe to the Crunchbase Daily

That’s not exactly the plotline of a great science fiction movie. However, if you spend a lot of time reading seed funding data, it is the vision startups seem to be collectively bringing to fruition.

At least that’s where the money is going. A Crunchbase News analysis of North American startups 1 that have raised disclosed seed rounds of $200,000 or more in 2019 shows that certain sectors are getting a lot more investor love than others.

Fintech, in particular, is collecting an outsize share of seed dollars, an amalgamation of the rise of neobanks, crypto and AI. Other areas, including cannabis, agtech, real estate and security, are also big investment recipients.

Below, we look at the spaces that are generating the most enthusiasm from seed-stage investors, complete with lists and speculation as to what this all might mean, futuristically speaking.

Seed Investors Really Like Fintech

By far the biggest chunk of sector-focused seed investor money this year is going to, well, money. Startups offering tools for managing and moving money are attracting some of the largest rounds this year.

Altogether, startups tied to fintech and financial services pulled in a total of over $340 million. That’s roughly one-fourth of total U.S. and Canadian seed funding for 2019, per Crunchbase.

Finance-focused rounds are also the most numerous. At least 137 known seed rounds in 2019 were in some form of fintech or financial services, per Crunchbase data (see list). That’s roughly 20 percent of all recorded North American seed rounds for the year. Funds are going to a broad array of startups, with some of the larger rounds running the gamut from an app for managing student loans, to a simplified futures trading platform, to upgraded cash management tools.

What’s the draw? Pete Flint, managing partner at seed firm NFX, posited in a blog post that there are a lot of factors at work. In particular, models for underwriting debt, insurance, and loans are becoming increasingly powerful thanks to AI and increased data availability. Startups can also compete with legacy companies with online tools that outperform in speed and ease of use.

Much of the enthusiasm can also likely be attributed to “spray and pray.” This is the popular but publicly disavowed seed investment strategy of making lots of bets destined for failure in the hopes that a tiny number of successes will pay back huge multiples.

In fintech and financial services, industry leaders generate huge valuations, both privately and on public markets, so the payoff for big wins can be enormous. For the S&P 500, about 13 percent of the famed large-cap index is financial services, trailing only behind healthcare and IT.

Moreover, given the size of late-stage funding rounds, seed is still looking pretty cheap. All the 2019 seed rounds for fintech, for instance, aren’t too much more than funding to date for a single, hot, money-losing startup – Brex – founded less than three years ago.

Here’s What Else Is Hot

So, enough about fintech. What other areas are hot for seed investors? Let’s look at some more standout sectors:

Cannabis: Startups in the legal marijuana space are still hot — but we’ll avoid calling them smoking hot, as many are veering into drinkable forms of their favored plant. Crunchbase counts at least 17 North American cannabis companies founded in the past three years that raised seed rounds this year. (See list.) They include Fyllo, a marijuana marketing and compliance platform, K-Zen Beverage, a cannabis beverage maker, and A Pot for Pot, a kit for growing plants at home.

Agtech: Agriculture is also proving fertile ground for seed investment this year. Crunchbase counts at least 25 companies in the space that made our seed funding list. (See list.) Top funding recipients include OnePointOne, an automated indoor farming platform, BeeFlow, a self-described developer of “strong and intelligent bees” for pollination, and Augean Robotics, developer of a robotic platform for agricultural work.

Real Estate: Real estate has been a hot sector for seed deals for a few years now, and investors continue to favor the space. So far in 2019, we counted more than 50 real estate-related seed rounds meeting our criteria, pulling in more than $100 million altogether (see list.) Large funding recipients include UpTop, a developer of software for property managers, PadSplit, a co-living startup, and Haus, a platform for co-investing with wanna-be homeowners.

Security: Everyone could use a little more security, and seed investors intend to help us get it. So far this year, they’ve poured over $130 million into more than 50 known seed rounds for companies in the digital security and identity management sectors (see list.) Recipients of some of the largest seed rounds include Curv, a cryptographically protected digital wallet, K2 Cyber Security, a provider of real-time attack prevention, and Athena Security, a developer of software to detect gun threats using camera images.

What Does All This Say About The Future?

It’s probably not advisable to spend too much time forming opinions about the future based purely on seed funding data. Nonetheless, here are a few trendlines.

Machines are getting smarter, and so are bees. People are getting more convenient options to enjoy a chemically altered mental state. And there are a lot more ways to move around our money and assets, even if we’re not actually getting wealthier.

It doesn’t look like the utopia that technophile futurists talk about. But on the bright side, there are worse things than cannabis and quick loan approvals.

Illustration: Li-Anne Dias.

We limited the dataset to startups founded no more than three years ago.↩

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-300x168.jpg)

67.1K Followers