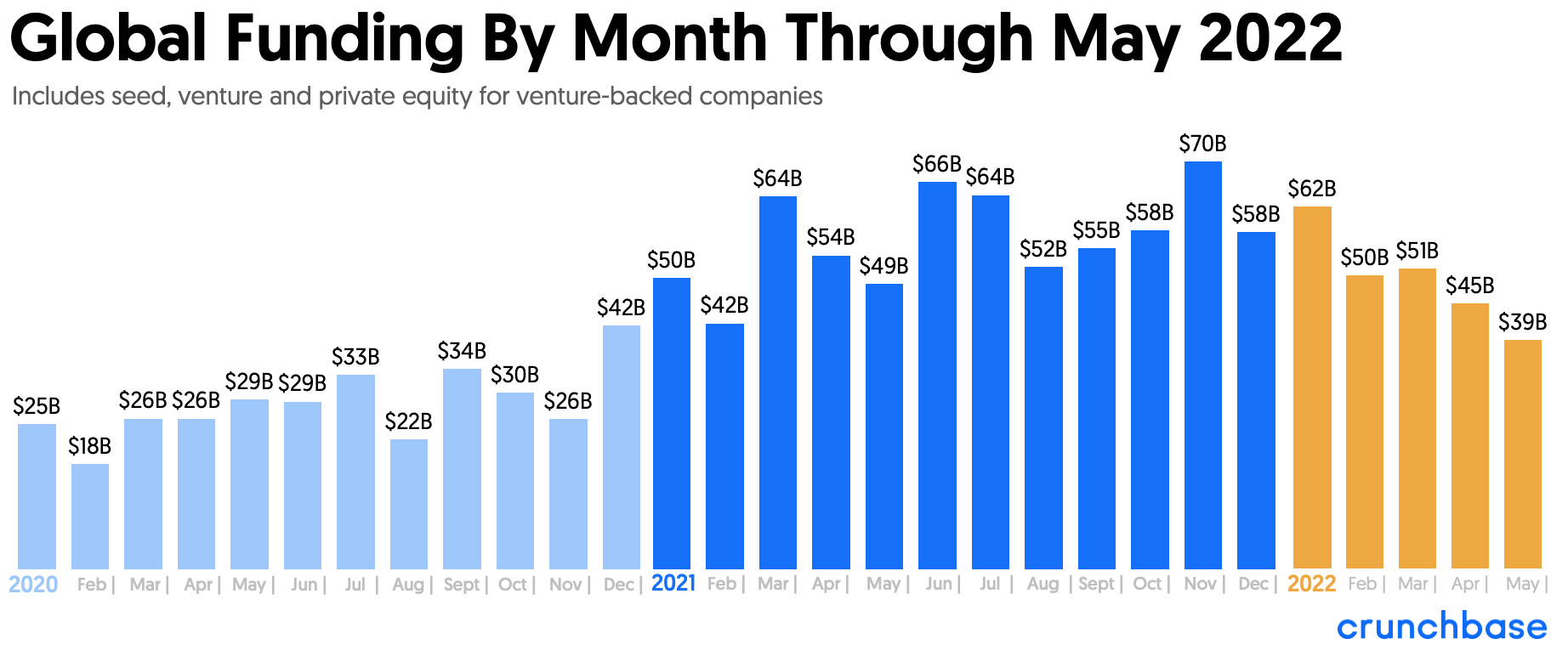

Global venture funding in May 2022 reached $39 billion, Crunchbase data shows, marking the first month in more than a year when it dropped below $40 billion. The May figure is also well below the $70 billion peak VC funding reached in November 2021.

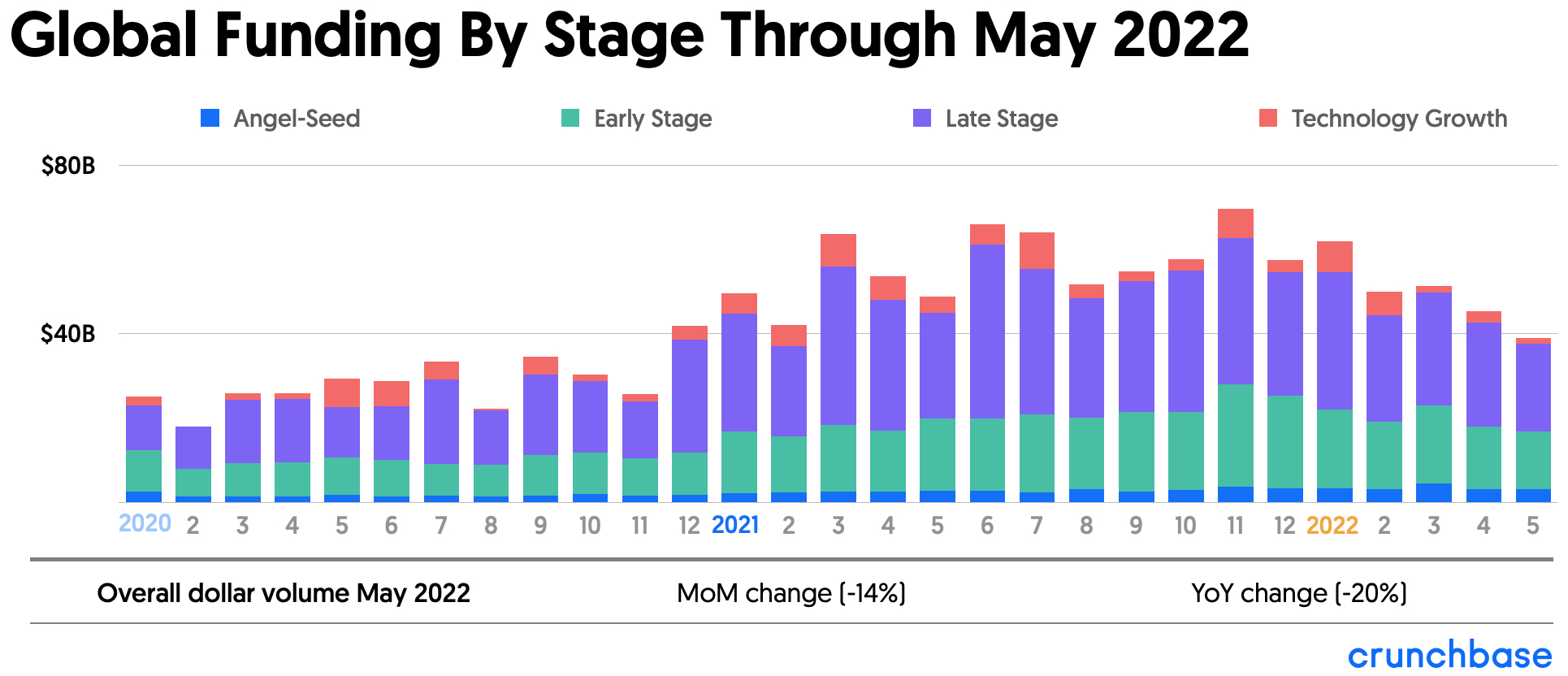

But while late-stage and technology-growth investing have been most severely impacted, seed funding remains surprisingly robust.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

All in all, VC funding in May fell 14% month over month from $45 billion in April. It’s down 20% from $49 billion a year earlier in May 2021. The largest pullback was in late-stage venture capital, which fell from 2021 monthly averages by close to 40%.

Seed stage proves more resilient

Late-stage and technology growth investing has been the most impacted by this year’s venture pullback. Last month, venture investors globally spent $22.3 billion in the late- and growth-stage sectors—down 38% from the 2021 monthly average of $36.2 billion.

But early-stage funding is not immune to the withdrawal, either. While growth equity investors last year invested record dollars in high-growth earlier-stage companies, they’ve pulled back this year. All in all, early-stage funding reached $13.7 billion last month, down 22% from the average monthly funding in 2021 at $17.6 billion.

Seed funding was the most robust funding stage last month, with $3.1 billion invested in seed-stage companies last month. Seed funding, in fact, increased 11% from the average $2.8 billion invested monthly at seed in 2021.

Growth investors pull back amid market turmoil

In line with these trends, the most active global investors either invested at earlier stages or slowed down the deals they led.

Tiger Global, for example, led more rounds at Series A last month, while Andreessen Horowitz invested more at seed and Series A compared to previous months.

Insight Partners—the third most active lead investor in May 2022, per Crunchbase data—cut back on the number of rounds it led last month.

Tiger Global, which includes both a hedge fund business and a private equity arm that invests in startups, has warned that it plans to pull back from illiquid assets, which could impact its startup investing: As the value of Tiger’s public holding has declined significantly, the firm has found its portfolio too heavily weighted towards private companies.

Other growth equity investors have already pulled back their startup investing this year, per a Crunchbase News analysis.

IPO markets and unicorn creation also slows

The IPO markets slowed significantly with just one unicorn, India-based supply chain services company Delhivery, going public in May 2022.

At the same time, some 34 companies joined The Crunchbase Unicorn Board in May, alongside a few new decacorns, some with valuations still in the 100x annual revenue rate, according to our analysis. Last month’s count is down from the 54 new unicorns minted in May 2021, but still high compared to most months in prior years.

What’s next for VC investing?

As late-stage investors pull back on investing in private companies, valuations will most likely come down and the pace of investing will continue to slow. But that also means for many venture investors who have raised record funds in recent years, there’s an opportunity to compete to invest in the best companies and at lower prices.

Crunchbase Pro queries listed for this article

All Crunchbase Pro queries are dynamic, with results updating over time. They can be adapted by location and/or timeframe for analysis.

Related reading

- Tiger Global Declawed By Market Woes

- Andreessen Horowitz And Tiger Global Most Active Investors In US Market Even As Slowdown Persists

- The Crunchbase Unicorn Board: Stable Of Unicorns Grows To More Than 1,300 As IPO Pipeline Remains Stalled

Methodology

Funding rounds included in this report are seed, angel, venture, corporate-venture and private-equity rounds in venture-backed companies. This reflects data in Crunchbase as of June 2, 2022.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-300x168.jpg)

67.1K Followers