Morning Report: Bitcoin is nearly across a key price threshold. What happens next will be incredibly interesting.

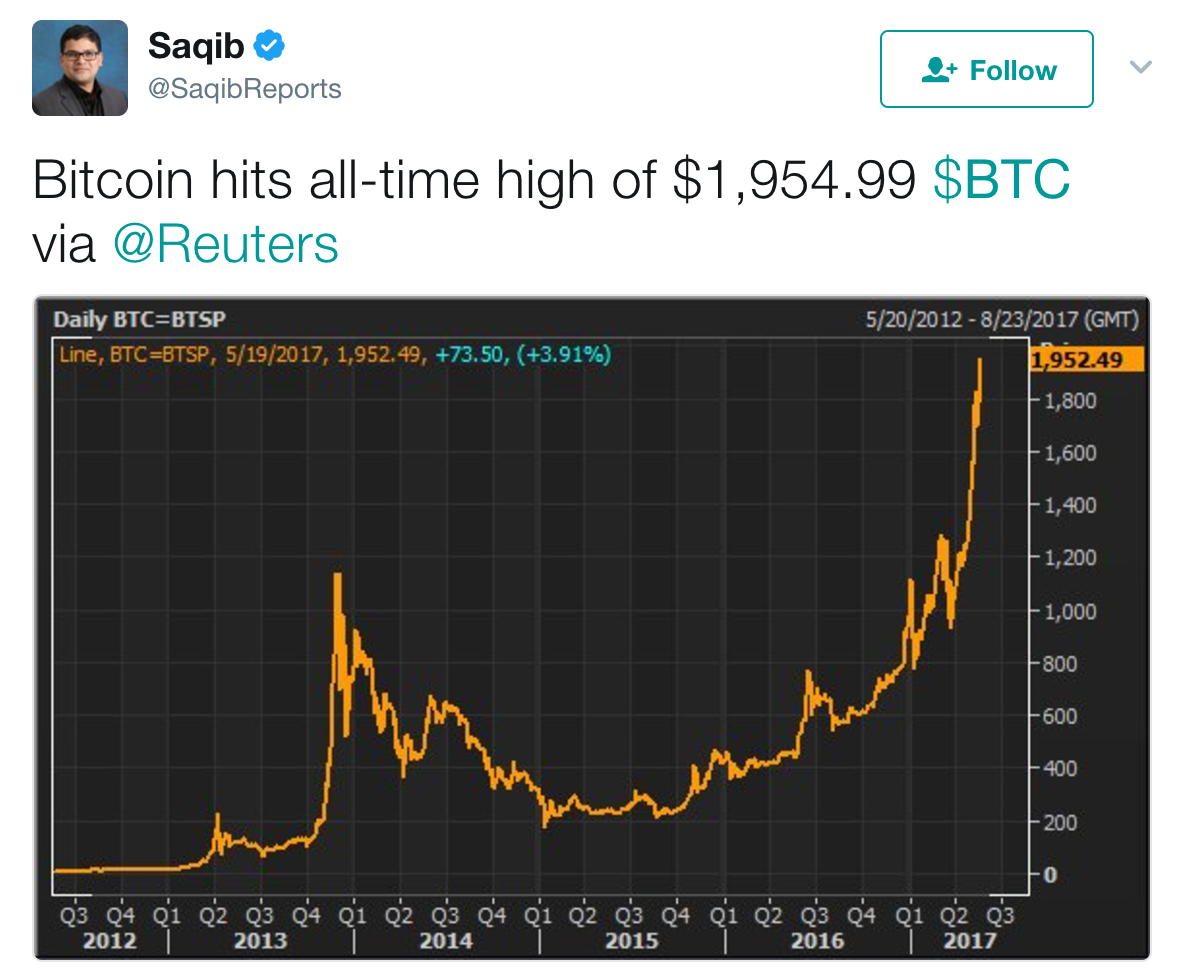

This morning, the price of bitcoin set a new record high by trading right under the $2,000 mark. The moment, and chart, looked like this:

The price growth of bitcoin, as we can see in the chart, moves forward in a repeating boom and retreat cycle. The early 2013 boom led to a mid-2013 stagnation, setting the stage for the late 2013 boom. Which led to the falling days of 2014. Which led to a slow rise from 2015 through 2016. All leading up to the newest, and seemingly steepest boom.

Whatever public square interest that bitcoin lost from 2014 through 2016 appears to be back.

And viewing CoinDesk’s meticulous tracking of investments into bitcoin and blockchain-related companies, we can see four rounds into the space of at least $10 million apiece during the first quarter of the year. Those are among a host of smaller investments.

The price signal can be used as an indicator of public investor interest in bitcoin. Meanwhile, venture capital activity serves as a proxy for private appetite. At the moment, both seem healthy.

That adds up to big value. According to CoinMarketCap, all bitcoin in circulation today are worth just under $32 billion. While that figure still feels unreasonably high today, it has been a multi-billion figure over enough time that we cannot say that the market is completely wrong in assigning value.

Now we have to ask ourselves if the rapid appreciation of the price of bitcoin is reasonable. That’s your call.

A small question: If the Nasdaq falls by 1,000 points tomorrow, does the price of bitcoin rise, or does it fall? Is it more a safe-harbor investment, contra the tech industry in its movements, or is its value tied to the upward arc of aggregate tech investment and profit?

From the Crunchbase Daily:

Menlo Ventures closes $450M fund

- Silicon Valley VC Menlo Ventures has raised $450 million for a new fund that will focus on early-stage technology companies. Menlo plans to invest roughly half in consumer technology and half in enterprise infrastructure startups.

AI and bad spelling top naming trends

- Startups often think along the same lines when it comes to choosing a name. Lately, they’ve been making reference to hot technologies like AI and robotics, engaging in creative misspelling, and cruising the grocery store for inspiration, according to a Crunchbase News analysis of startup naming trends.

Eat Club chows down on $30M

- Eat Club, a lunch delivery service focused on office workers, closed on $30 million in fresh funding, Bloomberg reports. The Silicon Valley-based company is reportedly on track to collect $50 million in revenue this year.

Regulators vote to advance net neutrality repeal

- The U.S. Federal Communications Commission voted 2-1 to advance a Republican plan to reverse the Obama administration net neutrality policy that required internet service providers to treat all web traffic equally. Broadband service providers viewed the vote as a victory, while Internet content companies were broadly opposed.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-300x168.jpg)

67.1K Followers