When Tim Angelillo launched Sourced Craft Cocktails in 2015, straight-to-consumer mixed drinks and spirits was a fairly novel concept, but growth was steady as the startup navigated the rules around shipping alcohol to the doorsteps of customers around the country.

Subscribe to the Crunchbase Daily

Then COVID-19 arrived, pushing the Austin-based startup into an unprecedented era of growth. Where once its 70 percent to 100 percent growth year over year was seen as a win, suddenly the company was reaching the triple digits in growth. Revenue quickly rose to the hundreds of millions of dollars annually.

“The pandemic took what would have taken 10 years to implement in the alcohol industry and changed it in one,” Angelillo told Crunchbase News. “We all got locked in our homes because we all were protecting the safety of ourselves and our families and we weren’t going into a physical brick-and-mortar retail environment, so [online sales] really sped up.”

Indeed, sales data shows more people saw the virtues of joining an online wine club when they couldn’t visit a winery in person. Alcohol aficionados found online communities with similar tastes to talk and sip whiskeys or microbrews. Workers dialed into virtual team-building exercises meant to raise everyones’ spirits with a sampling of obscure spirits.

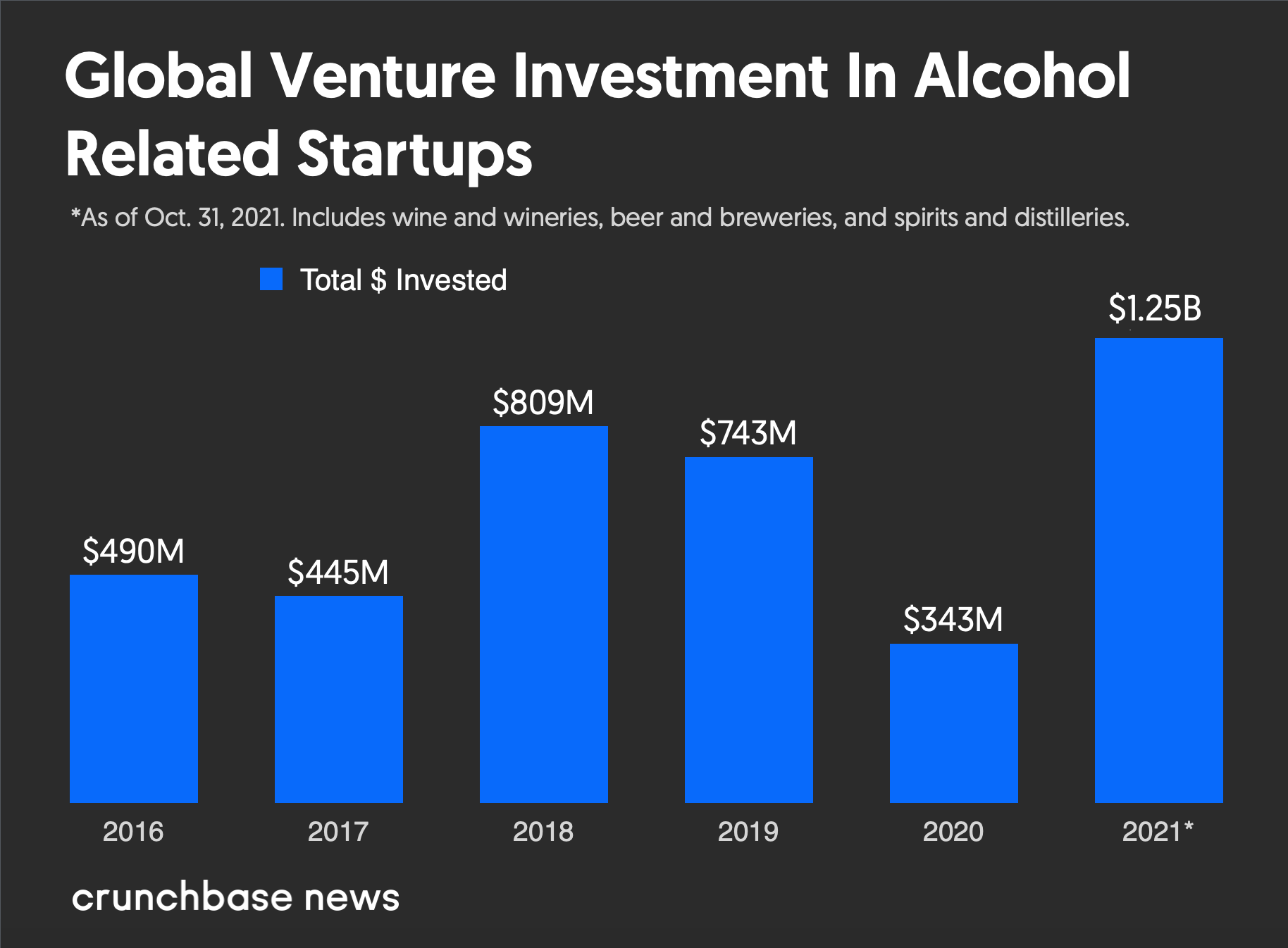

Now industry insiders wonder which of those habits have staying power post-pandemic, which will go down the drain—and what that all means for the venture-backed startups in the alcohol space that for the first time collectively raised more than $1 billion in investment this year.

Online alcohol sales jumped 234 percent year over year in the early weeks of the pandemic, global data analytics company Nielsen Corp. reported in 2020. Months later, many Americans said they were imbibing 14 percent more often during the pandemic—some much more than that—according to researchers from RAND Corp. and Indiana University. Their findings were published in September 2020 in JAMA Network Open, a medical journal from the American Medical Association.

The fast growth of direct-to-consumer products and online marketplaces like Sourced Craft Cocktails means it isn’t just the biggest names in the industry getting products in front of drinkers at a bar, or in prime real estate at a liquor store, said Taylor Foxman, founder and CEO of The Industry Collective, an advisory firm that helps grow and scale startup wine, beer and spirit brands.

In that way, although COVID-19 magnified inequalities for people and economies across the world, it may actually be an equalizer when it comes to businesses in the alcohol space.

“Everyone kind of started on the same playing field, to be quite honest,” Foxman said. “You have thousands of these little brands that are trying just to make ends meet and they thought there was no way—no way—they would ever have the visibility, money, financing, backing and resources that all of these big companies had. Then COVID happened, … production had to be halted and then everything kind of stopped.”

It was the small companies, who were agile and thirsty for success that had felt out of reach before, which adapted the fastest to getting their products to consumers in a new way, Foxman added.

Startups felt the shift in their pocketbooks. Global investment into venture-backed startups in the alcohol sector may have taken a dip in 2020, Crunchbase data shows, but it came back strong in 2021, surpassing $1 billion for the first time as of Oct. 31.

Winc misses the nod

With that in mind, it seemed digital wine club startup Winc was poised for success ahead of its IPO this year.

The Los Angeles-based company boasted that its wine case sales jumped 80 percent over the past two years, to more than 430,000 in 2020. Meanwhile, revenue soared from almost $36.5 million in 2019 to $64.7 million in 2020, largely due to the pandemic.

“Since March 2020, we have experienced a significant increase in [direct-to-consumer] demand due to changes to consumer behaviors resulting from the various stay-at-home and restaurant restriction orders and other restrictions placed on consumers throughout much of the United States in response to the COVID-19 pandemic,” company leaders said in Winc’s S-1, filed with the Securities and Exchange Commission.

Notably, the company’s marketing budget also ballooned as it unveiled a list of new wine brands, leaving the company with almost $7 million in losses last year.

Even so, Winc founders were optimistic people would keep buying wine online for the foreseeable future when they announced plans to sell 5 million shares priced between $14 and $16 in October, equating to an approximately $80 million raise.

Winc then postponed its New York Stock Exchange debut by about a month. When the company did finally go public last month, it sold about 1.7 million shares for $13 apiece, raising $22.1 million.

Values added

But, from all accounts, wine still seems to be having its moment.

Canned wine startup Maker this month announced a star-studded list of angel investors in its recently announced $2.3 million raise. Founders Sarah Hoffman, Kendra Kawala, and Zoe Victor plan to take its “Can Club,” to 45 states.

The company launched in January 2020 with 50,000 cans of wine, staring down a pandemic that threw off their plans to get their curated line of vino in peoples’ hands at events.

“It was back to the drawing board and we had to get scrappy,” Kawala said. “It was some of our initial corporate partners around the Bay Area, and the tech scene who said ‘Hey, we were going to use Maker at one of our in-person events, what do you think about doing a Zoom event at home?’”

More than 150 virtual tastings later, Maker surpassed its own expectations and sold out of wine in the fourth quarter of 2020, paving the way for more partnerships. While those virtual company tastings helped get the word out initially, about 80 percent of Makers’ sales today are directly to customers—its original target audience.

That’s the part of the business the founders plan to grow through its expansion, hoping to capture those consumers who increasingly scroll through online shops and say they want to buy based on their values. The startup’s digital platform and focus on small, woman- or minority-owned wineries has resonated with drinkers, Kawala said.

At least some of Maker’s investors say this is what attracted them to the company, including Bryan Mahoney, who is now CEO of commerce-as-a-service software company Chord Commerce, but was formerly CTO at Glossier.

“I see a lot of similarities for Maker in Glossier’s earliest days—while we pioneered the democratization of beauty, Maker’s mission is to do the same for wine,” he said in a statement. “They’re creating an amazing brand, they care deeply about the product and customer experience, and are using technology to build community and democratize an industry.”

Changing tastes

As more alcohol companies go the way of Winc and Maker with delivery for people stuck inside, InVintory, which helps collectors keep track of which bottles they have on-hand, emerged in mid-2020.

The Canada-based startup, which hasn’t sought venture backing yet but its founders say they likely will in the future, seems niche at first glance. But the application, which comes in free and paid subscriptions, blossomed over the past year as wine tasters became collectors, co-founder Joshua Daiter told Crunchbase News. That’s a sign of changing tastes the founders don’t think will reverse.

“I think this is partly due to the pandemic as well, because younger people who have more disposable income are going to buy more premium wine,” he said. “It’s like Pandora’s box, once you start buying better wine, it’s hard to go back and buy the ones you used to buy. You sort of just trend upward.”

The company has grown from the two founders—a father and son duo made up of Jeff and Joshua Daiter—to 20 employees. InVintory four months ago launched its paid version that lets users map out where each bottle of wine is located within their collection. Those customers are also increasingly taking advantage of the part of the application that allows them to track the wines they’ve ordered online, Jeff Daiter said.

Take it to-go

Alcohol is a guarded industry in America, shaped by federal and state laws that vary from border to border dictating how, where and when booze can be bought and consumed. But, as with so many industries, the last two years brought massive change.

Dozens of states began letting consumers take home pre-made cocktails and growlers from their favorite restaurants. New online alcohol marketplaces and distributors—flooded with an extremely online audience trapped inside—offered a new variety of wines and liquor that could be shipped straight to peoples’ doorsteps.

Many of those states intended their newly relaxed alcohol rules to be temporary, a gift to help business owners over the hump while dining rooms were shuttered and residents mandated to stay away from each other. But it seems many of those changes may be here to stay.

For instance, rules that allow to-go cocktails remain in place across 33 states, including in middle America, where Iowa and Ohio made the change permanent.

That’s an example of lawmakers responding to demand that Angelillo of Sourced Craft Cocktails said will only grow from here.

Alcohol, he said, has proven itself to be resilient and sustaining. The industry survived (and even flourished) during prohibition and it became a source of new tax income to help the country escape the Great Depression. Now, it’s getting people through another dark time and, Angelillo estimates, will only continue to grow.

“It’s a huge addressable market, that is recession-proof,” he said. “It’s a very attractive place to invest, because it’s a big ocean … and it’s proven very, very stable over a very long time period. Alcohol has been a part of our gatherings as human beings for centuries.”

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-300x168.jpg)

67.1K Followers