Shares of work messaging and productivity company Slack shot up in the company’s first day on the public markets, topping $40 a share in midday trading. That’s a jump of more than 50 percent from the $26 a share reference price that the company set late Wednesday for its direct offering on NYSE. Shares opened at $38.50.

Subscribe to the Crunchbase Daily

The company, trading under the ticker symbol WORK, is now valued at more than $23 billion. That’s well over Slack’s reported private valuation of $7 billion, following a $427 million Series H last August led by General Atlantic and Dragoneer Investment Group. That deal valued Slack at just over $7 billion, post-money.

Shares in the San Francisco-based company had previously been trading privately in the range of $21 to $31.50, according to its most recent prospectus.

As we reported yesterday, Slack’s direct listing is an uncommon way to enter the public market.

It’s a different path from a traditional IPO process, which helps companies raise funding by selling shares on the public markets. A traditional IPO also provides additional support from investment bank underwriters to make sure you don’t tank and aren’t further diluting yourself. However, it’s a long, exhausting process with lots of fees.

Barrett Daniels, a partner and National IPO Services Leader with Deloitte, said that a company might opt for a direct listing because it doesn’t believe it’s in urgent need of cash, whether it has a lot in the bank or is just cash flow positive.

Daniels mentioned that “this used to be something bad companies did, companies that were not able to do an IPO, they’d do [direct list] as a way to go ahead and go public.” The risk with this path is volatility.

“You don’t have the underwriters, roadshows, the test-the-waters meetings which give you a real indication for what the price should be,” he said. But now, as the market stays excited for tech companies showing any growth, he said “risk is very limited.”

Based on Slack’s previous valuation, the company has been compared to high growth startups like Zoom and Pagerduty. Both are currently trading above their opening price. More when Slack closes for the day.

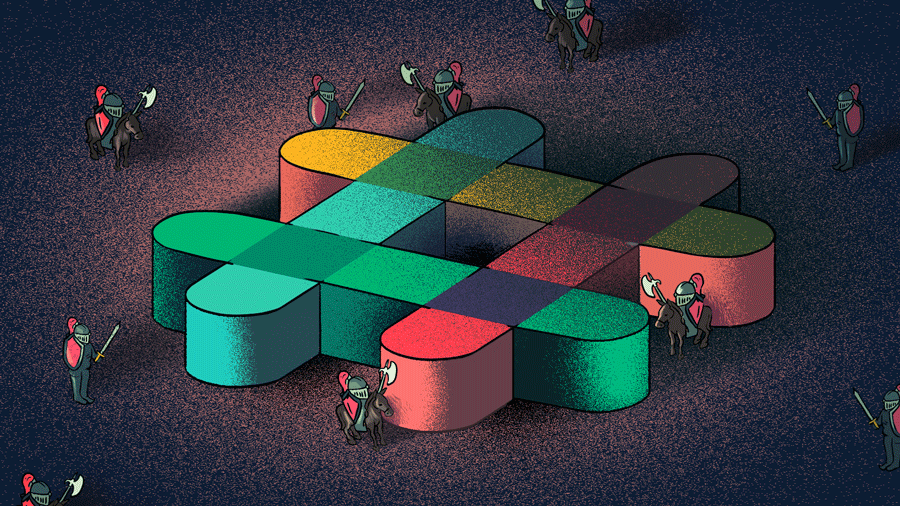

Illustration: Li-Anne Dias

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-470x352.jpg)

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-300x168.jpg)

67.1K Followers