Venture capital firms still dominate as investors in Series B rounds, with growth equity taking on a larger presence as rounds get bigger and bigger at this stage.

In a recent Crunchbase News analysis of the 2021 U.S. market, we found some big changes in Series B funding. Specifically, the data revealed that 1,200 unique startups raised funding at Series B this past year—about a third more than in each prior year since 2017. The amounts were also larger, more than doubling from $25.4 billion in 2020 to $55.9 billion in 2021.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Here’s what else we found when we dug deeper into the investor group most active during Series B, which is sometimes viewed as a proxy for the broader venture market overall since it’s at this stage that a startup often has proven technology or market traction and is poised to scale.

Growth equity plays a more important role

Venture capital firms still dominate. They make up 60 percent of the 85 firms that led more than three Series B rounds in U.S.-based startups in 2021, per a Crunchbase News analysis.

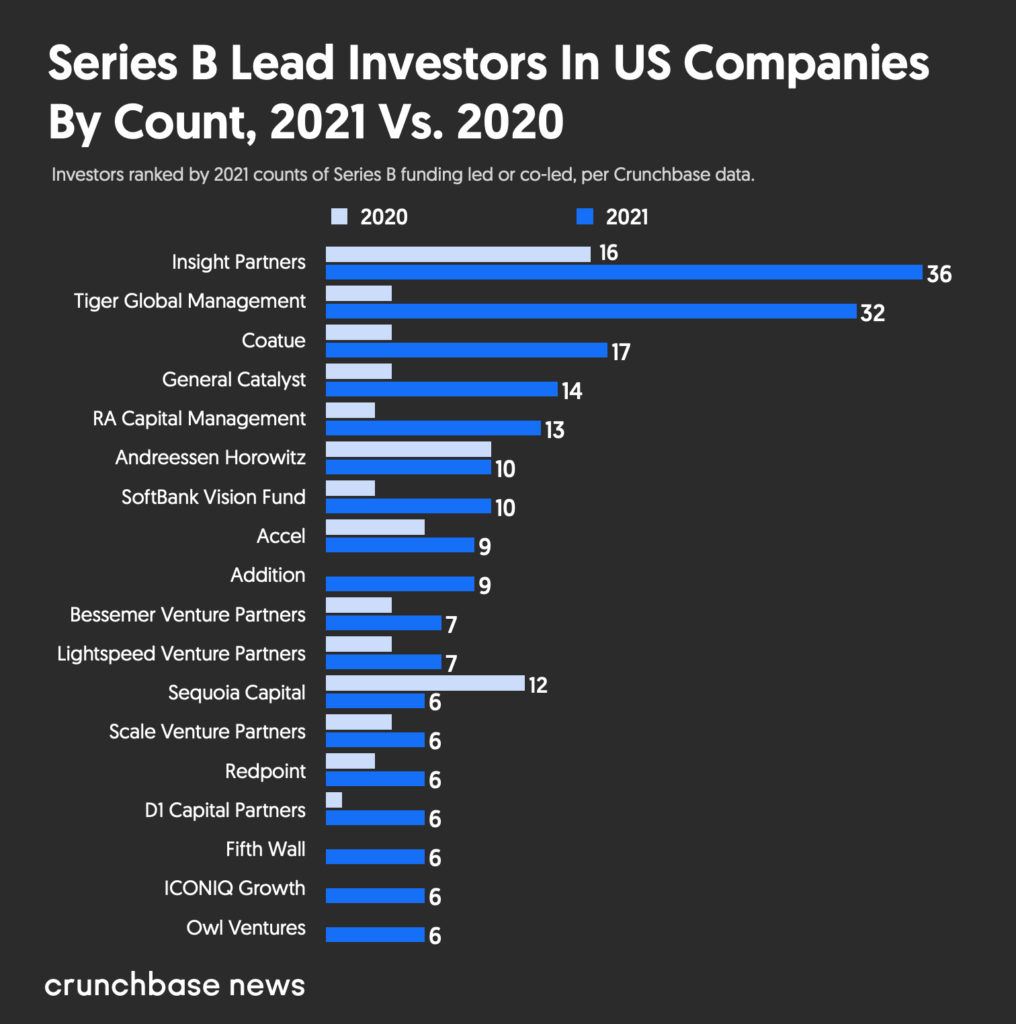

But growth equity has played a more significant role by leading the highest count of rounds at Series B, with Insight Partners leading since 2019.

Tiger Global’s runner-up spot in 2021 is a much more recent phenomenon. In 2019 and 2020, Tiger led four Series B fundings each year, and in 2018 only one funding at Series B in the U.S.

Coatue, the third most active, was also up significantly in 2021, with 17 Series B investments led, compared to four in 2020.

Series A still king

Of the more active firms to lead at Series B, Sequoia Capital is the single firm in the top 18 in 2021 that led fewer Series B rounds in 2021 compared to 2020. Sequoia increased its count of fundings led at Series A last year, as did Andreessen Horowitz, which stayed flat at Series B led fundings year over year at 10 investments.

Some of the venture firms listed do focus on investing at Series B, showing greater counts at this stage compared to leading at Series A. These include Scale Venture Partners, Owl Ventures and Fifth Wall.

And Tiger Global has signaled that it seeks to invest earlier. Already in 2022, Tiger Global and Insight Partners have led more rounds in the U.S. at Series A than Series B.

Firms invested more

All 18 firms listed—except Sequoia Capital—led or co-led higher amounts in funding in 2021 versus 2020 in U.S. headquartered startups. Tiger Global upped the investments it led or co-led in Series B fundings by more than 1,900 percent year over year from $0.2 billion to $3.4 billion.

Insight Partners was the second “spendiest” with 172 percent growth. The SoftBank Vision Fund, Coatue and RA Capital Management also all grew commitments significantly and led or co-led Series B fundings north of $1 billion in 2021.

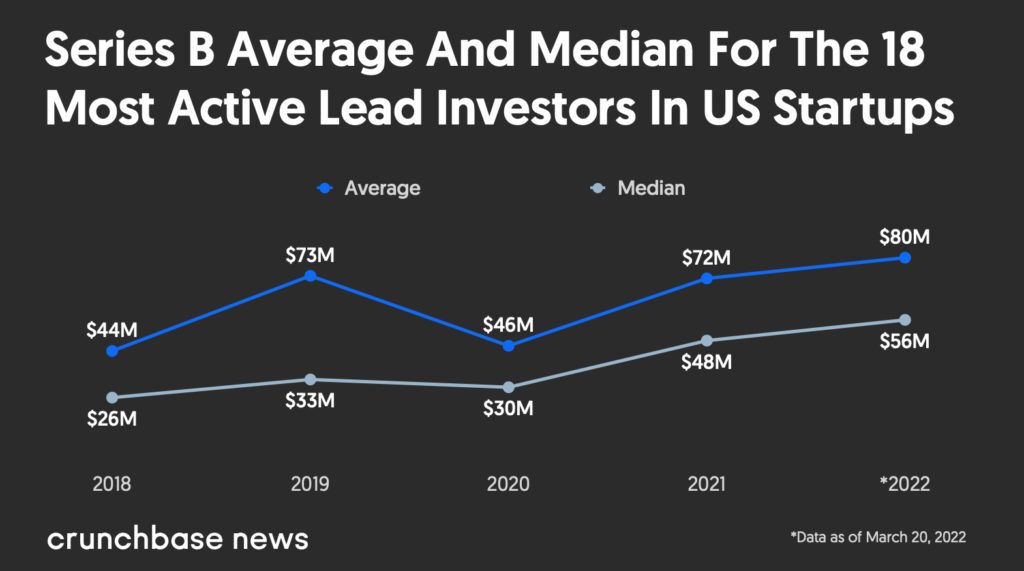

Median and average is up in 2022

The median Series B for these 18 active investors grew in 2021. The same can be said for averages—outside of some very large Series B fundings to self-driving technology companies Nuro and Aurora in 2019.

Average and median Series B continued to rise in the first months of 2022, somewhat surprisingly given the war in Ukraine and the downward trend in the public market performance of technology stocks since December 2021.

2021 (and 2008)

Last year’s activity was a significant break from prior years’ funding trends in terms of the pace and the amounts invested at Series B. Who leads has also shifted toward growth equity increasing its commitments to private investments.

A Crunchbase News analysis of the financial crisis of 2008 showed growth investors stepping away—as did other cohorts—and taking longer to invest at the 2007 pace in private companies.

As of March 17, 2022, of these 18 active firms, eight have increased their lead investment pace at Series A through C when compared to 2021.

Methodology

Data is as of March 2022. This analysis is based on announced investments for investors into U.S.-headquartered companies.

Crunchbase, like all databases of private-market transactions, has a documented pattern of reporting delays. It can sometimes take between weeks and months for some rounds to be announced publicly and subsequently get added to Crunchbase. As data is added to Crunchbase over time, some of the numbers in this report may shift slightly.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers