Eve Halimi and Anam Lakhani, the co-founders of fintech startup Alinea, briefly considered moving to San Francisco to build their company. Some of their earliest investors suggested the pair move to the Bay Area, as hiring talent could be easier in a city full of engineers and other tech workers.

The pair toured the city while in town for Y Combinator’s Demo Day last year, but opted to stay in New York City, where they both previously attended Barnard College. They raised a $2.1 million seed round for Alinea in 2021.

“Especially coming from New York where things are so dynamic, things are very fast paced, SF felt very slow, and it didn’t give us the imagination and what we expected from San Francisco,” Halimi said.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

They’re bullish on New York as a place to build a startup, as the city sees a record amount of venture funding and startup public exits.

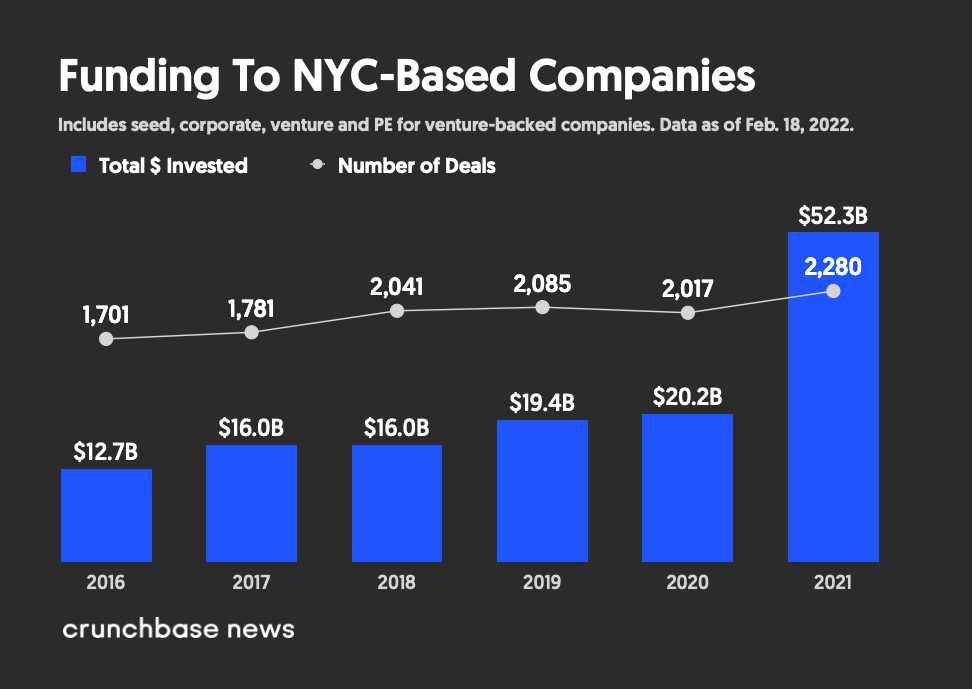

Venture-backed startups based in the greater New York City area raised more than $52 billion last year, more than double the $20.2 billion that VC-backed companies in the metro raised in 2020. And last year also included two of the largest traditional IPOs by deal size for venture-backed startups based in New York in the last decade: Oscar Health and UiPath.

“It’s just been a snowball that’s been going on for some time, and it’s hit a major inflection point, I’d say, (in) the last two to three years, particularly as we’ve seen larger-scale exits coming out of this market than we’ve seen before,” said Brian Hirsch, co-founder and managing partner of Tribeca Venture Partners, a venture capital firm that focuses on investing in companies based in the New York City metro area.

New York City has always been in the conversation in terms of places to build a startup, but it’s typically taken a back seat to the Bay Area and even Boston, which are known for attracting venture dollars for biotech companies.

But last year was a banner year for the city that never sleeps.

The story of New York’s current startup scene goes back to about 15 years ago, when venture investing started to shift from hardcore tech and research centers to applications of technology. When tech started to mature as an industry, and with the rise of the internet and mobile, the focus turned to apps, Hirsch said.

Some of the industry groups in New York that received the most funding in 2021 were software, financial services, information technology and health care, according to Crunchbase data.

“New York was going to have real built-in advantages as the center of commerce in the U.S., (and as) one of the centers of commerce in the world,” Hirsch said.

People with domain expertise began applying tech to an area to disrupt or improve it, and New York benefited in a big way as funds began to form and operate in the area. The startup circle at the time was a fairly small group, Hirsch said, but the ecosystem grew as more companies began receiving funding.

The last piece of the puzzle, according to Hirsch, is big exits. In recent years, VC-backed New York-based companies both in the enterprise and consumer spaces have seen large exits. Last year, companies including UiPath, Warby Parker, Squarespace and WeWork went public through IPOs, SPACs and direct listings.

New York state of mind

When Tribeca Venture Partners raised its first fund, some prospective limited partners were confused about why the firm would focus only on companies based in the greater New York City area. They were uncertain that there were enough early-stage companies to invest in, Hirsch said.

There was less of that sentiment around the firm’s second fund, and by the third fund, LPs were asking how the firm would have an edge over all the other VCs looking to invest in New York.

It’s true that VCs are also expanding to have more of a physical presence in New York. Andreessen Horowitz, for example, signed a lease late last year for a 34,000-square-foot office in SoHo. And to add to the crossover between Silicon Valley and New York, NYC-based growth firms including Tiger Global Management and Insight Partners frequently lead funding rounds in VC-backed companies, often competing with or investing alongside well-known Bay Area investors.

New York was one of the top destinations for people leaving San Francisco last year.

The city has also felt some momentum from people moving or returning to New York after the earliest, brutal days of the pandemic, according to Zach Schleien, founder of the video-based dating app Filter Off and the Slack community NYC TechConnect. The Slack group has grown to more than 1,200 people since it began in April 2021.

“A large percentage are people who just moved to New York City,” Schleien said. “Pre-Omicron we were running lots of events. We were running New York Tech Connect events two times a week. A lot of those people were San Francisco-based.”

While all sorts of industries have a large presence in New York, some sectors are particularly concentrated, making the area a natural place to build a company.

Part of the reason it made a lot of sense for Halimi and Lakhani to build fintech startup Alinea in New York was because they could tap into the city’s existing concentration of people who work in traditional finance, a background Halimi and Lakhani hail from as well. The pair plan to look for New York-based investors for their next round of funding.

“It feels like a very natural transition because a lot of people come to New York for traditional finance roles and the next step is fintech,” Lakhani said.

Hirsch said New York’s place on the global stage and incredible cultural diversity are assets as well.

“As the world becomes more global and more diverse, and companies need to be more globally minded and diverse, what better place to start a company and to be than the most global and diverse city in the world, and that’s what New York is,” Hirsch said.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers