Tiger Global Management, SoftBank Vision Fund and Insight Partners aren’t traditional venture capital investors, but the three growth equity firms invested in startups at an unprecedented rate in 2021, competing directly with many of Silicon Valley’s biggest names and racking up a huge number of portfolio companies in the process.

The three firms have invested rapidly in startups this year, even compared to accelerators—let alone venture firms—Crunchbase data shows.

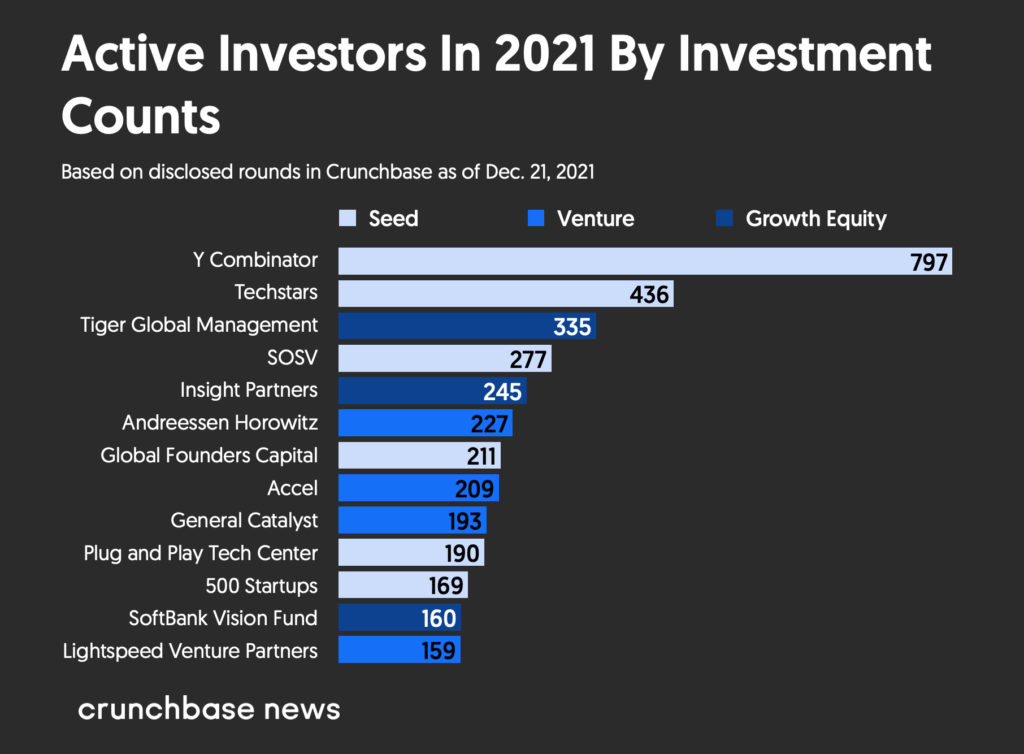

Take Tiger Global. The New York-based firm made 335 investments this year, making it the third most active investor. Only Y Combinator, the startup accelerator that runs summer and winter batches and counts upwards of 300 companies in each batch in 2021, and Techstars, an accelerator, invested at a greater pace.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Insight Partners, made 245 investments this year, followed SOSV as the fifth most active investment firm in private companies in 2021.

SoftBank Vision Fund was the 12th most active investor this year, with Andreessen Horowitz, Global Founders Capital, Accel, General Catalyst, Plug and Play Tech Center and 500 Startups each more active by investment counts compared to the growth equity fund, according to Crunchbase data.

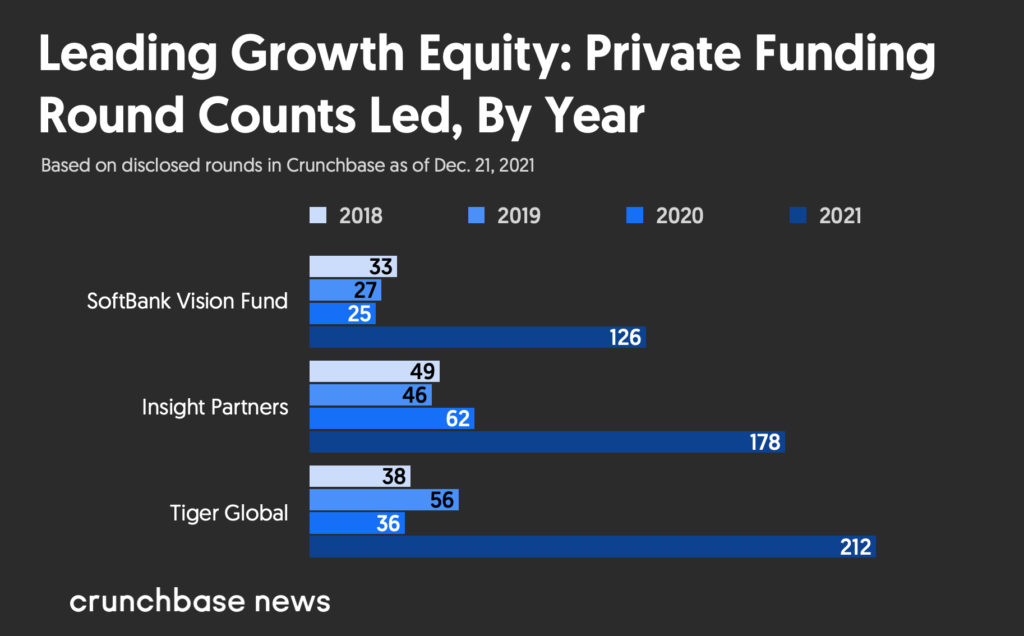

Our data also shows these three growth equity firms have increased their investment pace significantly year over year.

For every week in 2021, Tiger led a funding on average every four working days out of five. Insight Partners was not too far behind, leading on average a round more than three working days in a week. And SoftBank led on average more than two investments per week, on par with Andreessen Horowitz, the most active venture firm in 2021.

Tiger and the SoftBank Vision Fund have increased their pace of fundings led–by more than 400 percent–Crunchbase data shows, while Insight Partners has increased its pace by more than 190 percent.

Despite the increased activity and record funds raised, the investment approach for each of these firms is quite different.

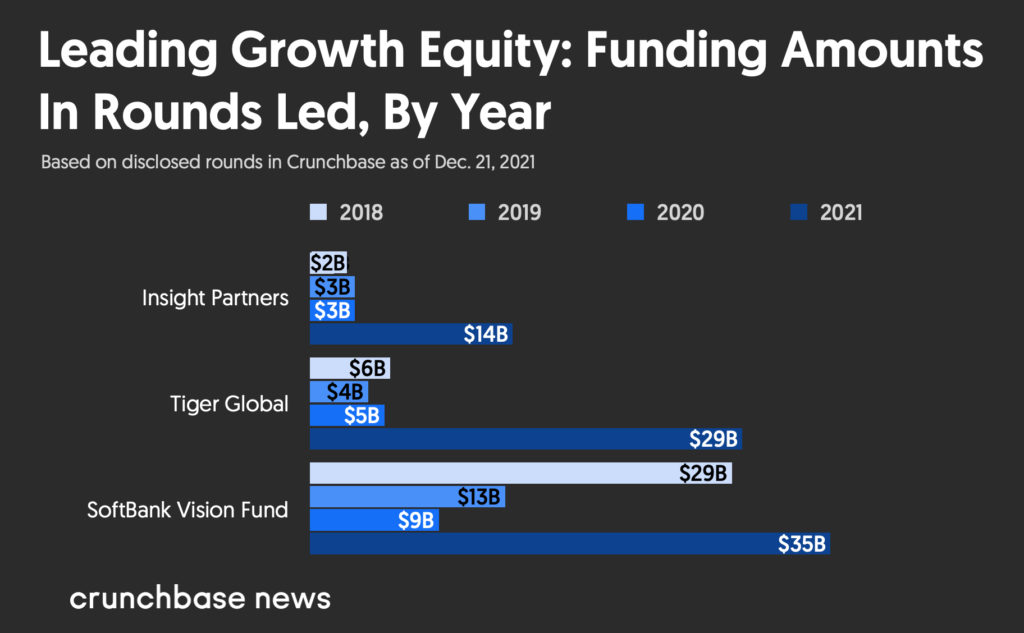

The SoftBank Vision Fund led larger and more highly valued rounds, Crunchbase data shows, leading rounds that tallied up to $35 billion.

Tiger Global, meanwhile, led almost double the number of fundings compared to SoftBank: It led funding rounds in companies that raised a total of $29 billion in 2021.

Insight Partners led rounds totaling $14 billion—still a large number, but less than half of the amount of the other two leading growth equity firms.

For context, Andreessen Horowitz and Sequoia Capital—two of Silicon Valley’s best-known and most deep-pocketed venture firms—led rounds adding up to $6.9 billion and $7.6 billion in 2021, respectively, per Crunchbase data.

Late vs. early-stage-led investments

Of the three growth equity firms, the SoftBank Vision Fund tends to lean most toward later-stage investments, our data shows, with 83 percent of the investments it led this year at Series C or later.

For Tiger Global, 52 percent of its fundings were at late stage. Under half, or 43 percent, of the fundings Insight Partners led were at late stage, Crunchbase data shows.

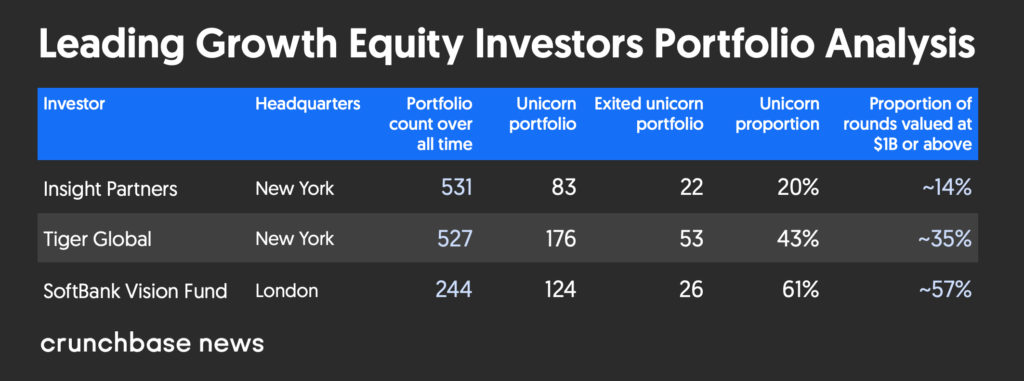

The SoftBank Vision Fund’s portfolio also has the highest proportion—61 percent—of its portfolio are unicorns. It doesn’t have the highest count of unicorns though. That distinction goes to Tiger Global, which counts 176 current unicorns in its portfolio.

Insight Partners has the lowest count amongst these firms, but also typically invests earlier in a company’s lifecycle.

Record funds

Insight Partners is said to be in the process of closing on fund 12, its largest fund to date. It raised a prior fund of $9.5 billion with a final close in April 2020.

SoftBank, meanwhile, expanded the size of its Vision Fund 2 to $40 billion, all self-funded. And Tiger Global announced the first close of fund 15 at $8.8 billion in October, fast on the heels of its $6.65 billion fund 14 announced in January.

This increased investing impact from private equity and hedge funds creates a very different private market investing ecosystem.

“If the private market starts to look a lot more like the public markets and the public markets start to take on some aspects of the private markets all as a function of essentially increased liquidity, which is then a virtuous cycle of adding liquidity to these markets, it does change a little bit what it means to be a venture capitalist,” Ben Savage of Clocktower Technology Ventures said in an interview earlier this month, speaking about the impact of crossover hedge fund investors investing into private companies.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Savage predicts venture as an asset class will not only be in long illiquid assets, but a mix of liquid assets as well over the next five to 10 years.

“It wouldn’t shock me if you saw folks that traditionally would have characterized themselves as VC firms start to move upwards and look more like crossover firms,” he said. “It’s likely that the big picture trend will continue for several years and into next year.”

Collectively, Tiger Global, SoftBank and Insight Partners alone led or co-led $73 billion in funding round totals in 2021, representing 12 percent of all venture and private equity into venture-backed startups, Crunchbase data shows.

The three firms collectively had 41 portfolio companies that each went public valued at or above $1 billion at the public debut, compared to 11 in 2020 and five in 2019. With a further 274 portfolio unicorn companies still private, and an expected active IPO market in 2022, don’t be surprised if that pace continues.

Crunchbase Pro queries relevant to this article

- Tiger Global’s Unicorn Portfolio

- 2021 Funding Rounds Led by Tiger Global Management

- SoftBank Vision Fund: Unicorn Portfolio

- SoftBank Vision Fund investments in 2021

- Insight Partners Unicorn Portfolio

- Insight Partners investments in 2021

Related stories

- Under The Hood: How Tiger Global Earned Its Stripes As The World’s Biggest Unicorn Hunter

- No More Money Moat: SoftBank CFO On Vision Fund Turnaround And How It’s Investing Its $40B Second Fund

- PE Firm Insight Partners Shares Advice On Scaling Startups Even During A Pandemic

- Bigger Checks, Days To Close: How 2021’s Red-Hot Venture Funding Landscape Is Shaking Up Early-Stage Investing

- Tiger Global And SoftBank Vision Fund Vie For Top Slot As Q3’s Biggest Startup Investor

Methodology

The data contained in this report comes directly from Crunchbase, and is based on reported data. Data reported is as of Dec. 21, 2021.

We include seed, venture and private-equity into venture-backed private companies for this analysis. We exclude secondary financings.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

![Illustration of stopwatch - AI [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/Halftime-AI-1-300x168.jpg)

67.1K Followers