Last month, 34 new unicorn companies joined The Crunchbase Unicorn Board, collectively adding $57 billion in value and $8.3 billion in equity funding raised. For the first time, the total count of current unicorns on the Unicorn Board is above 1,300 companies.

Altogether, these startups are valued at $4.6 trillion and have raised $770 billion.

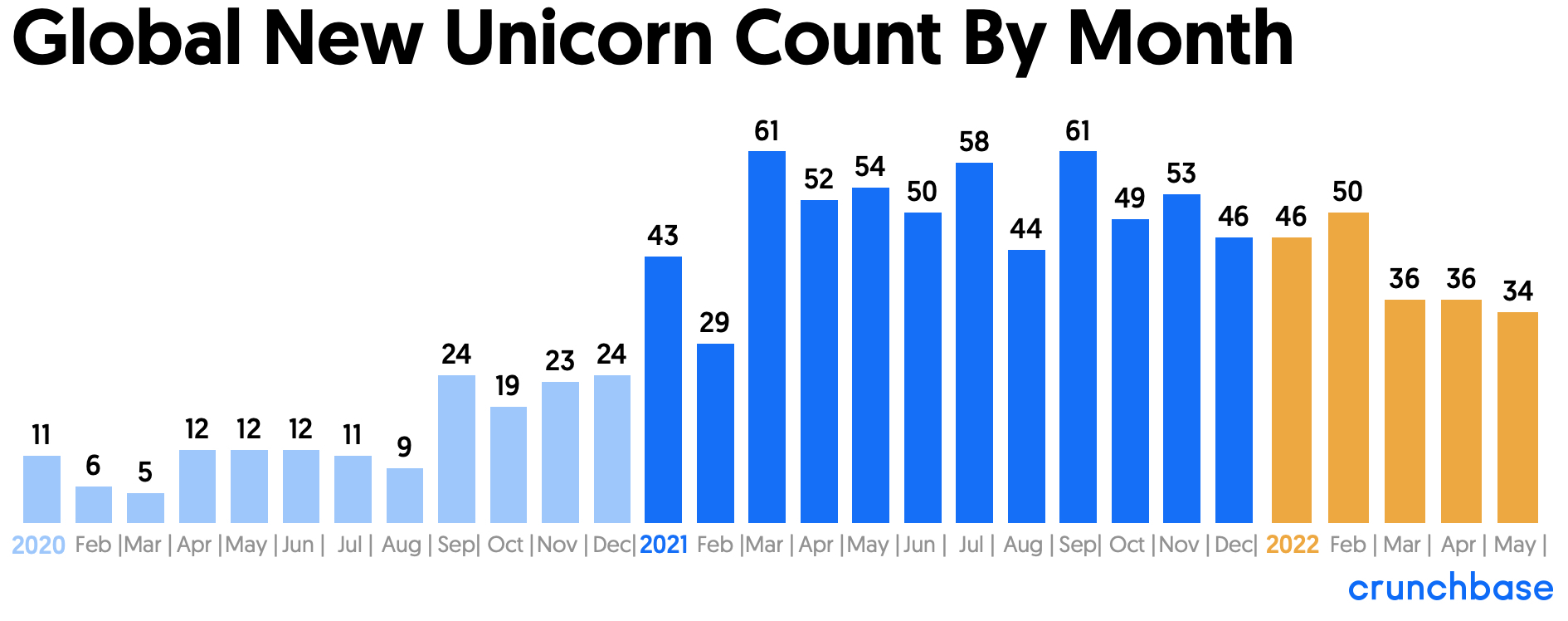

Last month’s new unicorn count is down from May 2021, when 54 companies joined the board. It’s also a few companies short of the 36 new unicorn companies minted in April 2022. But if you cast your gaze back over time, May 2022’s monthly count still exceeds any single month in 2020.

These new unicorns hail from 15 countries. Of those, 20 are headquartered in the U.S., Asia and Europe each have five, three are from Latin America, and one from Africa.

Only two companies exited the board last month.

SpaceX rockets to higher valuation

Elon Musk’s SpaceX, already a unicorn, grew its valuation by 25% compared to seven months ago. It last month raised a megaround of $1.5 billion in funding that valued the company at $125 billion, up from $100 billion in a secondary sale a year ago. The investors were not disclosed for this latest funding.

SpaceX is still the most valuable private technology company in the U.S., and is in third place for the most highly valued private company in the world.

The most valuable company on the Unicorn Board remains Shanghai-based social media company ByteDance, owner of TikTok, last valued at $180 billion in 2020. The second-most valuable is Hangzhou-based digital financial services company Ant Financial, valued at $150 billion in a 2018 funding round.

New decacorns in HR and crypto

Three companies became decacorns last month. They were:

- Rippling, a San Francisco-based HR IT platform co-founded by CEO Parker Conrad, raised a $250 million Series D that values the company at $11.25 billion. The funding was led by Kleiner Perkins and Bedrock. With disclosed annual recurring revenue north of $100 million, according to Forbes., this new valuation-multiple-to-ARR would be more than 100x.

- Seychelles-based cryptocurrency exchange KuCoin raised a pre-Series B funding of $150 million led by Jump Crypto that valued the company at $10 billion. KuCoin is new to the Unicorn Board with this funding. The company plans to dive deeper into Web3 with an NFT platform. The company raised its Series A in 2018, a $20 million round led by IDG Capital, Matrix Partners and NEO Global Capital. In its latest funding announcement, the company said it has 18 million users across 200 countries, but did not disclose its ARR.

- Deel, a remote work payroll company based in San Francisco, became a decacorn-valued company last month, according to Axios. Deel said it reached $100 million in ARR in April 2022, reportedly less than two years after reaching $1 million in ARR and just a few months after reaching $50 million in ARR in December 2021. This annual revenue run rate would mean the new valuation-multiple-compared-to-revenue would be more than 100x based on Deel’s new $12 billion valuation. It is worth noting that Deel’s latest round is a smaller funding amount—only $50 million—compared to its Series C of $156 million and Series D of $425 million, which were both announced in 2021. Emerson Collective is a new investor in the latest round.

Supply chain exiting the board

Supply chain companies are in demand.

India-based Delhivery, a supply chain services company, went public on the Bombay Stock Exchange and the National Stock Exchange in May. Delhivery was valued at $4.6 billion at its IPO. Its last known private valuation was from July 2021, when the company was valued at $3 billion in a funding led by FedEx. SoftBank owned an 18.5% stake in the company after its IPO, according to the Economic Times of India, more than doubling the value of the investment it made in 2019.

Also last month, San Francisco-based e-commerce logistics company Deliverr was acquired by Shopify for $2.1 billion, pending approval. The company was last valued at around $2 billion in a November 2021 Series E funding.

Revenue and runway

Based on a Crunchbase news analysis, more than 80% of the current unicorn crop have raised funding since the beginning of 2021. The runup in unicorn valuations came as VC firms raised record funds in recent years and growth investors committed more to this asset class.

The new metric for high-growth cloud companies, according to Bessemer Venture Partners, is to reach $100 million ARR. The firm, which invests heavily in SaaS companies, counts around 150 private companies that meet this metric, according to its most recent report on the state of the cloud computing industry. If these companies are all unicorns, this would include around 11% of all current private unicorn companies that could be thinking about going public, since the $100 million ARR threshold appears to be the typical tipping point for a company to seek an IPO.

More than 120 unicorn companies went public in 2021, the highest number on record. But so far in 2022 the IPO markets have stalled, with only nine unicorns going public.

However, one of the better known and ninth most valuable private company on the Unicorn Board, Instacart, silently filed this past month and could go public this year. It was first valued as a unicorn in 2015 in a Series C funding led by Kleiner Perkins. With Instacart filing, can we expect the markets to open up again this year?

Crunchbase Pro queries listed for this article

All Crunchbase Pro queries are dynamic, with results updating over time. Queries can be adapted by location and/or timeframe for analysis.

- Unicorn leaderboard (1,326)

- Unicorns in the U.S. (664)

- Unicorns in Asia (407)

- European unicorns (182)

- Emerging unicorn leaderboard (310)

- Exited unicorns (397)

- Unicorn fundings in 2022 ($78B)

Methodology

Funding rounds included in this report are seed, angel, venture, corporate-venture and private-equity rounds in venture-backed companies. This reflects data in Crunchbase as of June 1, 2022.

The Crunchbase Unicorn Board is a curated list that includes private unicorn companies with post-money valuations of $1 billion or more and is based on Crunchbase data. New companies are added to the Unicorn Board as they reach the $1 billion valuation mark as part of a funding round.

Funding to unicorn companies includes all private financings to companies that are tagged as unicorns, as well as those that have since graduated to The Exited Unicorn Board.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers