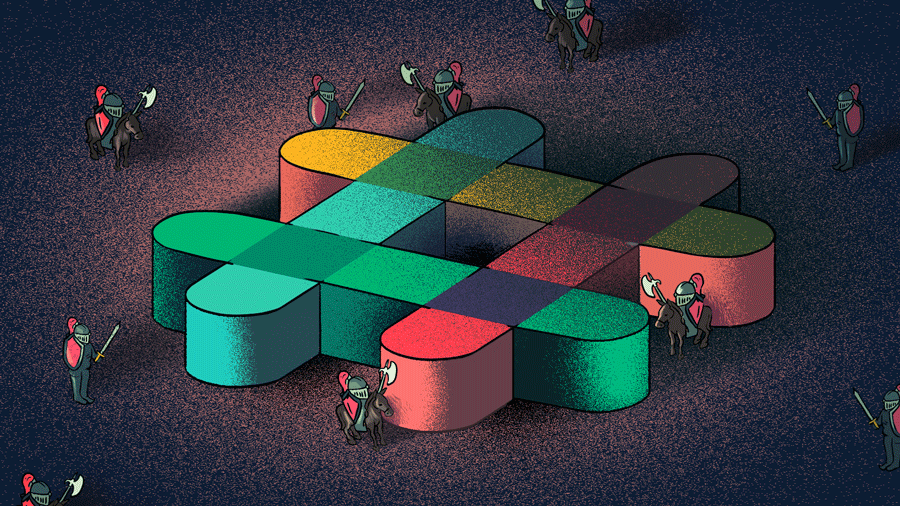

Robinhood is now worth $5.6 billion. That’s Slack territory, which gives us a game to play.

Two of tech’s most interesting late-stage players made news this week. First, team communications app Slack announced that it had reached the 3 million paid user mark. Second, the zero-fee stock trading service Robinhood raised a huge and expected Series D from a host of investors that pushed its valuation to $5.6 billion.

At surface level, those two events have nothing in common, but the latter does, in a way, outshine the former. Let me explain: Slack is worth $5.15 billion after the Series G round of capital it raised in September of 2017. Robinhood’s new valuation means that it’s worth more than Slack.

That valuation edge for the stock trading platform is notable given that Slack’s revenue ramp has been historically quick, while Robinhood is most famous in recent months for launching a low-cost crypto trading tool aimed at millennials. To see their valuations come into near contact was therefore eye-catching.

To understand what Robinhood’s new valuation means, we can’t really slap a public market comp onto the unicorn. But we can compare it to another subscription-based, self-service-powered cloud unicorn.

After all, Slack growth has been staggeringly rapid, and Robinhood is being valued as if it’s in the same situation.

Slack

Tracking Slack’s growth through time is a fun task. The company’s quick growth and early history of sharing its performance give us a good look into its expansion pace.

For this piece, I collected a few of Slack’s growth metrics (here) and did a little math. For much of its history, Slack shared a few numbers, including its number of paid seats and annual recurring revenue. From there, we could easily calculate how much revenue it generated per year and month per user.

The resulting revenue-per-paid-seat-per-month numbers gyrate a bit. This is likely due to the fact that Slack’s disclosed paid seats and ARR numbers were not temporally aligned. (A good example: In September of 2017, Slack announced 2 million paid users in “the past few months” and that it “crossed $200 million in Annual Recurring Revenue,” presumably over something close to the same timeline.)

But, our estimates of Slack’s per-seat monthly revenue tend to land around the $7 to $8 mark, reaching as high as $8.33 in our more recent calculations. Given that Slack’s lowest monthly tier is $6.67, and it presumably gives out discounts to bulk customers, our estimates seem in the ballpark, if slightly low.

Returning to the week’s news, the company announced 3 million paid seats, but not a new revenue number. Happily, with all our prior marks, we can mostly guess that Slack’s ARR is now north of the $300 million mark, assuming its prior metrics have held.

You are now blinking quite rapidly: $300 million ARR against a $5.15 billion valuation implies that Slack has some ways to go to grow into its valuation. Its paid user growth chart implies that it will grow into its calculation, of course, but using Dropbox’s current revenue multiple, the company is only worth $3.45 billion.1

Of course, Slack is growing much more quickly than the venerable Dropbox, so that’s a point in its favor. Points in Dropbox’s favor are sheer scale (proof of ability to capture TAM) and profitability (lots of free cashflow generation). You will, therefore, have to handicap a fair revenue multiple for Slack via Dropbox’s own by yourself.

However, we now have a decent idea of Slack’s revenue. Regarding its growth, Slack hit 1 million paid seats during the summer of 2016; it reached 2 million paid seats in September of 2017; Slack met the 3 million mark in May of 2018. That’s quick.

Robinhood

Now, back to Robinhood, which is now worth more than Slack. The company’s business model is faceted and incredibly interesting. Yes, Robinhood charges some users a monthly fee for access to after-hours trading. But it also gets paid by exchanges (here’s the actual document) that “also have high frequency trading arms.”

If you can’t figure out why that matters, read this.

Regardless, the setup is pretty cool from a business perspective. Robinhood makes money from some of its users directly through subscription payments and from all users in per-transaction fees from the routers of the trades it doesn’t charge for, according to coverage.

What the preceding two paragraphs do is detail why Robinhood is valuable. Not, precisely, why it is worth $5.6 billion. Indeed, with its valuation shooting from just $1.2 billion to $5.6 billion, the firm has acquired huge new shoes to fill. With Slack itself likely not fully grown into its smaller valuation, we can presume that Robinhood has even further to go to meet its own price tag.

So investors in Robinhood have laid a large wager on the company. It’s one that may very well pay off, assuming that the macro world will stay healthy. Because if Robinhood is going to keep competing for the same dollars and valuation marks as Slack, it will have to keep up its growth.

And that will prove a tall order.

- Note: Dropbox’s revenue multiple is a trailing metric, not an ARR-sourced figure. So, Dropbox’s ARR multiple would be lower than the number we are using. As such we’re being a bit unfair to Slack. But, when we are using rough numbers you can’t always do the math you want.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

67.1K Followers